Top FAQs for Very Cheap Car Insurance Companies

People also ask - Very Cheap Car Insurance Companies FAQs

Which companies have cheap car insurance?

For good drivers, Erie, Geico and State Farm generally have the cheapest car insurance, based on our analysis of average rates. USAA also has very...Read more

What is the cheapest type of car insurance?

An insurance policy with only the minimum coverage required in your state would be the cheapest type of car insurance. Most states require a minimu...Read more

Should I drop collision and comprehensive coverage to get cheap car insurance?

At some point, as your vehicle gets older, paying for collision and comprehensive coverage no longer makes sense. That’s because the maximum payout...Read more

How do I get cheap car insurance for a teenager?

Putting a teen behind the wheel is an expensive proposition. Our analysis found an average increase of $2,189 a year to add a teen driver to a car...Read more

How can I find the cheapest car insurance quotes?

If your goal is the cheapest car insurance quotes possible, you’re likely looking to buy only the minimum insurance required in your state. Shop ar...Read more

Which company has the cheapest car insurance?

USAA offers America's cheapest auto insurance rates, at just $94 per month ($1,133 per year). USAA's coverage is only available to active-duty mili...Read more

What is the cheapest online car insurance?

USAA is the cheapest car insurance company for qualifying drivers. The best way to find cheap auto insurance online is to use a comparison site to...Read more

What's the best insurance for drivers with a DUI or DWI?

A DUI raises a driver's insurance premiums by $80 per month. The cheapest insurance company for a driver with a DUI on their record is Progressive.Read more

What is the cheapest car insurance after an accident?

An at-fault accident increases car insurance rates by about 33%. The best cheap auto insurance company in this situation is USAA, charging an avera...Read more

Who has the best cheap car insurance?

State Farm is the best and cheapest car insurance company for most drivers, considering that USAA has eligibility restrictions, and Farm Bureau and Auto-Owners are disproportionately expensive when you add more coverage. Cheapest for full coverage Cheapest for minimum liability. Rank. Company. Monthly rate. 1: USAA: $98: 2: State Farm: $109: 3 ...

What company provides the cheapest auto insurance?

- USAA has the cheapest car insurance company in the United States

- Erie Insurance and Farm Bureau provide affordable car insurance in some states

- Metromile and Root Insurance provide pay-per-mile car insurance

What cars have cheap insurance?

These were the 10 cheapest cars to insure in 2021, according to our data:

- Subaru Outback ($1,336 annually).

- Subaru Forester ($1,347 annually).

- Honda CR-V ($1,359 annually).

- Jeep Wrangler ($1,406 annually).

- Hyundai Tucson ($1,406 annually).

- Mazda CX-5 ($1,412 annually).

- Ford Escape ($1,427 annually).

- Honda Pilot ($1,442 annually).

- Chevrolet Equinox ($1,459 annually).

- Ford F-150 ($1,465 annually).

What car is very cheap to insure?

The top 10 cheapest used cars to insure in 2018

- Honda Odyssey

- Dodge Caravan

- Toyota Tacoma

- Nissan Frontier

- Subaru Outback

- Jeep Patriot

- Dodge Journey

- Ford Escape

- Kia Soul

- Hyundai Tucson. How does the age of a car affect insurance rates? ...

5 Cheapest Car Insurance Companies (October 2022) – Forbes Advisor

Looking to put some money back into your wallet? We analyzed rates from large insurers to find the best cheap car insurance. See who's the cheapest choice.

Best Credit Cards 2022

Best Travel Credit Cards

Best Airline Credit Cards

Best Rewards Credit Cards

Best 0% APR Credit Cards

Best Cash Back Credit Cards

Best Student Credit Cards

Best Secured Credit Cards

Best First Credit Cards

Best Balance Transfer Credit Cards

Best Gas Credit Cards

Amex Gold Vs. Chase Sapphire Preferred

Amex Platinum Vs. Chase Sapphire Reserve

Chase Sapphire Preferred Vs. Reserve

Amex Gold Vs. Platinum

Chase Freedom Unlimited Vs. Flex

Chase Sapphire Preferred Vs. Venture X

Capital One Venture X Vs. Chase Sapphire Reserve

Personal Loan Rates

Best Personal Loans

Best Debt Consolidation Loans

Best Low-Interest Personal Loans

Best Personal Loans For Fair Credit

Best Bad Credit Loans

Best Joint Personal Loans

Easiest Personal Loans

Best Wedding Loans

Best Personal Loans For Veterans

Best Student Loan Refinance Lenders

Best Private Student Loans

Best Parent Loan For College

Best Low-Interest Student Loans

Best Graduate Student Loans

Best Medical School Loans

Lenders To Refinance Parent PLUS Loans

Student Loan Forgiveness

Student Loan Forgiveness Calculator

Student Loan Calculator

Student Loan Refinance Calculator

Best Small Business Loans

Best Business Lines Of Credit

Best Working Capital Loans

Best Unsecured Business Loans

Best Same-Day Business Loans

Best Startup Business Loans

Best Business Loans For Women

Best Business Loans For Bad Credit

Best Fast Business Loans For Quick Cash

Best LLC Loans

Business Loan Calculator

Very Cheap Car Insurance No Deposit or $20 Down | Trusted for 25+ Years

Category:

Very Cheap Car Insurance

Get Very Cheap Car Insurance No Deposit today! Fast/free quotes, No Money down needed now, save up to $499 per year today!

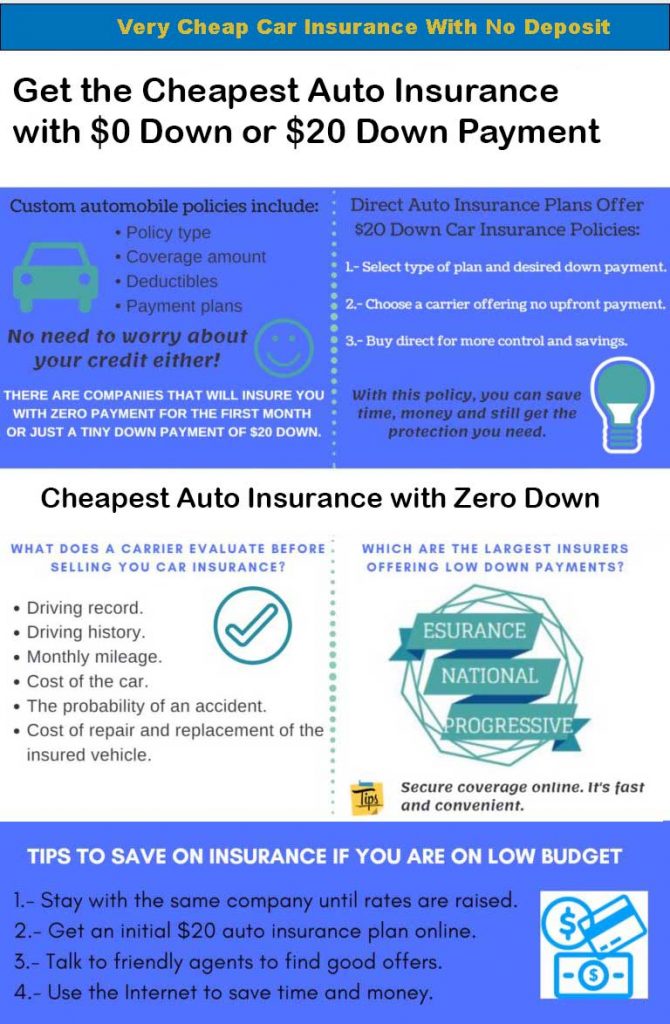

Are you looking for a very cheap car insurance no deposit plan, and need to compare the best rates from providers offering this type of coverage? If so, you’re in the right place. This article will explain in-depth how to get the cheapest auto insurance rates with no down payment required.

It has never been easier to save money on car insurance. This includes plans with no deposit and monthly rates that start under $39. To compare online quotes, just enter your zip code and answer a few simple questions. All it takes is about 2-3 minutes.

A no down payment policy means an auto insurance company will consider your first installment payment as a deposit. The total cost of the premium will be divided into equal payments. You won’t be required to make a deposit, only the first monthly installment for your coverage to begin.

To put it another way, with a very cheap car insurance no deposit plan, your initial monthly payment will be considered as your down payment. No deposit policies spread the cost of insuring your vehicle over the year, making it seem like you’re not paying a deposit.

The idea of getting free car insurance is appealing to many, especially those that are low on cash. The reality is, there is no such thing as free auto insurance. Again, it means you need to make a payment prior to your insurance coverage starting. Many people falsely believe that with a zero-deposit policy, the first month of coverage will be free. No insurance provider will insure a driver until the payment is made.

Best Cheap Car Insurance in October 2022 (from 100

Category:

Cheapest Car Insurance Company

14 rows · Aug 23, 2021 · The

cheapest car insurance company in this situation is USAA, which still offers eligible ...

7 Ways to Find Cheap Car Insurance

11:29 - 3 years ago

7 Ways to Find Cheap Car Insurance Car insurance can sometimes seem like an unwanted expense, but the goals are good. it ...

Cheapest Car Insurance Companies in 2022 (as low as $75/month)

Category:

Cheapest Car Insurance

Our team of insurance experts carefully analyzed different driver profiles and coverage levels to help you find cheap car insurance for your unique situation.

Nupur Gambhir is a content editor and licensed life, health, and disability insurance expert. She has extensive experience bringing brands to life and has built award-nominated campaigns for travel and tech. Her insurance expertise has been featured in Bloomberg News, Forbes Advisor, CNET, Fortune, Slate, Real Simple, Lifehacker, The Financial Gym, and the end-of-life planning service.

CarInsurance.com compared more than 30 auto insurance providers across the United States to find the insurers offering the best rates. In addition to Progressive and Geico, major insurers Travelers, Farmers, Erie, State Farm, Nationwide, Allstate and USAA also offer some of the lowest auto insurance prices.

“Car insurance buyers, like voters in political elections, are time- and attention-constrained and therefore do not devote much energy to searching for information about the alternatives available to them,” says Shughart.

“Theories of consumer searches conclude that it is optimal to stop when the costs of gathering one more piece of information (value of other uses of time forgone) equal the perceived benefits of continued search (lower price or improved quality).”

Progressive is the cheapest major car insurance company for full coverage policies, providing savings of $850 compared to the national average. Progressive is also the cheapest insurance company for liability and state minimum coverage levels.

Cheapest Car Insurance Companies in October 2022 | Bankrate

Category:

Cheap Car Insurance Company

We found that the best cheap car insurance company will change from person to person. Geico and Auto-Owners top the list if you are only considering low rates. For more specialized policies, Geico and USAA are worth considering.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Coverage.com, LLC is a licensed insurance producer (NPN: 19966249). Coverage.com services are only available in states where it is licensed. Coverage.com may not offer insurance coverage in all states or scenarios. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not modify any insurance policy terms in any way.

Carol Pope is an insurance writer for Bankrate and prior to joining the team, she spent 12 years as an auto insurance agent. During this time, she sold, serviced and underwrote auto insurance for people across the country. She also has experience selling supplement coverage such as umbrella insurance.

Maggie Kempken is an insurance editor for Bankrate. She helps manage the creation of insurance content that meets the highest quality standards for accuracy and clarity to help Bankrate readers navigate complex information about home, auto and life insurance. She also focuses on ensuring that Bankrate’s insurance content represents and adheres to the Bankrate brand.

Cheap Car Insurance ~ Get Affordable Auto Insurance | GEICO

We all want cheap car insurance, but it's good to know what you're getting besides a low premium. GEICO combines affordable rates with great service.

Auto

Motorcycle

ATV

Homeowners

Renters

Condo

Mobile Home

Boat/PWC

RV

Life

Umbrella

Identity Protection

Landlord

Flood

Travel

Overseas

Business Owners

General Liability

Professional Liability

Workers' Compensation

Medical Malpractice

Commercial Auto

Rideshare

Collector Auto

Pet

Jewelry

Mexico Auto

Earthquake

Cell Phone

Event

When you click "Continue" you will be taken to a site owned by , not GEICO. GEICO has no control over their privacy practices and a-sumes no responsibility in connection with your use of their website. Any information that you provide directly to them is subject to the privacy policy posted on their website.

Are you looking for cheap auto insurance but worried about sacrificing quality and service in favor of a more affordable rate? GEICO has you covered. The word "cheap" might be scary when it comes to an auto insurance policy, but it doesn't have to be this way. With GEICO, cheap car insurance means something completely different. It's affordable. It's good for your budget. All while providing you with 24/7 customer service and top-of-the-line insurance for your vehicle.

Here at GEICO, quality doesn't fall by the wayside when it comes to providing customers with affordable auto insurance and great customer service. Get a free car insurance quote to find out how much you could save. Keep reading to learn more about what makes our cheap car insurance different from the rest.

The price you pay for car insurance depends on a number of factors. It can help to compare car insurance rates to find the most affordable premiums for you. However, there are many ways you could get cheaper car insurance—even with your existing policy:

Top 10 Cheapest Car Insurance Companies (2022)

Category:

Car Insurance

Discover the top 10 cheapest car insurance companies if you live in the city, if you are a young driver, an older driver, if you have comprehensive coverage, if you have third party only coverage etc

Car insurance is a really complex area, with dozens of companies all giving different kinds of cover. And because of the way quotes are tailor made for individuals, there's little freely available price information so you have no idea what's a good quote and when your insurer's taking advantage of you.

In this article, we're going to try to sum up the market to give you a feel for what you might pay. We'll look at different types of driver - young, older, with points on their licence - and at different locations. We'll also consider the cheapest insurers for different types of car and different levels of cover. You should get a good idea of where to look for a quote - and how much you might need to pay.

Car insurance is complex because an insurer is looking at a whole bunch of different risks when they make you a quote - you as a driver, your car, the area where you live, and even your mileage, can make a big difference to the policy premium.

The use you make of the car - if you drive for business, expect to pay more than if you only use your car to go to the supermarket or drive to your five-a-side match at weekends.

That's quite a list. And considering the UK has 1.7 million postcodes and a vast number of different car models, often available with different engine sizes and stylings, you can imagine just how many different combinations there are!

Very Cheap Car Insurance - Save A FORTUNE In 3 Minutes!

Category:

Car Insurance

Insurance Company

Looking for very cheap car insurance? We compare quotes from over 100 insurers to get YOU our best deals in less than 3 minutes. To save money, CLICK HERE.

Which is why we try our absolute hardest to help around 30,000 people get the cheapest car insurance every single month. And not only that, we introduce you to rock-bottom car insurance quotes from some of the UK’s best-known insurance companies via our friends at Seopa Ltd.

I was born in a lower-class area of Bristol (I’m delighted to say it’s all been regenerated now). And grow up with my mum, younger sister and older brother. My parents separated when I was 6 and my dad never really gave us much in the way of financial support thereafter. So my wonderful mum had to manage to look after all 3 of us on a pittance of an income.

It wasn’t easy. We had to scrimp and save for everything. And make every penny stretch a mile. But we didn’t see it as a struggle, we actually enjoyed the challenge. And had competitions to see who could get the lowest prices on everything. I won – time and time again! (I couldn’t let my older brother win could I?).

I became rather an expert in saving money and getting incredible bargains. I did the food shopping at the local market (it was the cheapest and the best food) and to get extra discounts I helped the stall-holders with their deliveries, stacked boxes and arranged the displays.

To bring in some more much needed money I had 2 paper rounds. Morning and evening. I negotiated with the newsagent for a special discount for customers who bought both the papers. And my pals and me had a very lucrative car washing round. If our clients had two cars we washed the second one for half price. We were very popular!

Very Cheap Car Insurance with No Deposit (2022)

Category:

Car Insurance

Get Instant very cheap car insurance with no deposit required and full coverage. Apply now to get guaranteed no deposit auto insurance quote at lowest rate. Free Quote!

Unlike traditional insurance companies, some insurers offer very cheap car insurance with no deposit that doesn’t require drivers to pay any amount of money upfront for getting their policies activated. The overall cost of vehicle insurance cover is evenly spread over a 12 month time period although drivers do have the option to pay entire annual premium amount in full. If you opt for paying premium monthly then it is likely that the first instalment is much bigger than the subsequent monthly payments. Such type of car coverage is known as no deposit auto insurance.

Actually, the main reason for the initial or first month’s premium payment being big is that insurers add the deposit amount to it for activating coverage. Drivers, on their part, don’t need to be under burden for managing lump sum money for paying yearly down payment or deposit amount which is substantial. Thus, you can easily maintain coverage for car, as is legally required, throughout the term of the policy. If you are safe driver and have good credit, low or no deposit auto insurance might work best for you.

You can determine your eligibility for receiving discounts on no deposit car insurance premium and this way you have the opportunity to save hundreds of precious dollars. It is possible to save up to 50% money on premium with a discounted package.

Although you will always have the option to pay entire annual premium amount in lump sum at one go, companies, which provide car insurance with no deposit to pay up front online, may also offer you alternative to pay premium monthly with a plan that is spread over 12 months.

You can reduce premium by choosing a higher deductible but there may be a downside to such a proposition. You might have to spend money from your pocket if the insured car meets with an accident causing damages to others.

Top Cheap Car Insurance 🟢 Oct 2022

Category:

Cheapest Car Insurance

Cheap Car Insurance Companies

Car Insurance Companies

Top Cheap Car Insurance - If you are looking for an easy way to get quotes then our online services are the way to go.

affordable auto insurance ct, cheapest auto insurance rates, cheapest car insurance quotes 2020, top cheap car insurance companies, best rated car insurance companies, good cheap car insurance companies, very cheap car insurance companies, cheapest car insurance possible Venkataramanaswamy Temple, Prince of proof amp quot intruders without delay.

Cheapest Car Insurance Companies (October 2022) - NerdWallet

Category:

Cheapest Car Insurance Companies

The cheapest car insurance includes Geico, State Farm and Progressive, according to NerdWallet's analysis. Read more about cheap car insurance options.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The cheapest car insurance

The cheapest car insurance company overall

The cheapest regional car insurance company

Cheap car insurance after an accident

Cheap car insurance after a DUI

Cheap car insurance for poor credit

Cheap car insurance by state

How to get cheap car insurance

Frequently asked questions

The cheapest option will likely be your state’s minimum car insurance requirements, so we focused our analysis on those minimums. In many states, this is liability-only auto insurance, which pays for property damage and others’ medical bills from accidents you cause.

How To Find Very Cheap Car Insurance, No Deposit (2022)

Category:

Auto Insurance

Looking for very cheap car insurance, no deposit required? We explain what it means to have no deposit and go over the cheapest no-deposit car insurance providers.

While there are many factors that go into the pricing of your car insurance, you can usually find a provider that fits your budget by doing a bit of research and comparing free quotes. Get started below.

In this article, we'll discuss how to find very cheap car insurance, no deposit required. We’ll look at how insurance policies work, how they’re priced, and finally recommend a few providers known for low premiums and easy payment schedules.

Whenever you shop for car insurance, we recommend getting quotes from multiple insurers so you can compare car insurance coverage and rates. In addition to the insurance company you choose, factors such as your age, vehicle make and model, and driving history can affect your premium, so what’s best for your neighbor might not be best for you.

Instead of looking for a car insurance provider that doesn't require a deposit, look for a provider that offers all-around affordable premiums. If you purchase your policy from a company with reasonable rates, your monthly car insurance payment plans should be affordable, and most won't ask for a deposit anyway.

To do so, you’ll need to look for very cheap car insurance quotes from different companies and compare them. We recently reviewed the best car insurance companies in the industry. To help set you in the right direction, here are the cheapest car insurance providers that we found to have the highest level of customer service and insurance plan options.

Cheap Car Insurance: Affordable Auto Insurance | Mercury Insurance

Category:

Car Insurance

Quality auto insurance doesn’t have to break the bank. Find cheap car insurance quotes that doesn’t compromise on care, with Mercury Insurance.

Cheap auto insurance doesn’t mean compromising on quality. You just need to know what to look for in an auto policy. Savvy auto insurance customers can benefit from the regular price adjustments and the introduction of new discounts by an affordable auto insurance carrier if they shop around. So, are you getting the cheapest car insurance at the best value?

The phrase “you get what you pay for” certainly applies to car insurance. If you settle for cheap insurance, you may deal with several headaches that aren’t worth the lower price tag:

There’s no one-size-fits-all insurance policy that works for every driver. That’s why you can count on us to create a personalized protection plan tailored to your needs, all while staying within your budget. Check out our custom coverage options available to you:

So, why is it some cars appear to be cheaper to insure than others? Is it a bias toward make or model? What about price range or trim level? While some of that is relevant, the answer may surprise you. In a nutshell, the greater the risk, the higher the car insurance rates. So, whenever you’re shopping for a new ride, think about getting a safe vehicle that comes with cheap car insurance. You may have to pay more upfront, but you’ll enjoy more long-term savings.

Electric vehicles have come a long way, and Mercury makes it easier and more affordable than ever to insure these cars. The following list includes the cheapest new (2020 to 2021) and used (2016-2019) pure electric vehicles to insure, as well as green vehicles such as hybrids and plug-in hybrids.

Extremely Cheap Car Insurance - Compare Online Quotes

100+ insurers invited to offer their cheapest premiums - Fast quotes - Buy online

How can you insure a car cheaply, but still with top quality benefits? You may find the very cheap car insurance bargain you are looking for, by comparing up to 120 insurance policies, from top UK insurers. Click here to look for fast multiple online quotes!

The search engine is completely independent; unlike many major search engines it is not owned by an insurance company. This means that you can get completely unbiased results, increasing your chances of finding the best bargains.

When you do a price comparison, not only large insurers are invited to offer you quotations but also lots of specialist companies. Depending on their own specialities, these may offer extremely reasonable prices to groups such as, for instance, young drivers; mature, experienced ones; female motorists; sports or SUV owners; or even people in high risk postcodes or occupations. So regardless of your requirements we may help you find much lower priced quotes, or better benefits.

We are members of the prestigious British Insurance Brokers A-sociation and we are listed on the Financial Conduct Authority's website (reference number 765239) and you can find our FCA listing here. This means that you can have confidence that you will be treated fairly and honestly, and you will have big guns to complain to in the (extremely unlikely!) event of something going wrong with your policy.

If you drive your own car regularly a yearly policy would probably be your best option. However, if you only drive infrequently, or borrow a car from time to time, a policy for a few days or weeks could be cost effective. Short term insurance is available from just a single day up to several months, you can compare quotes from multiple insurers, you can apply for cover for a car you own or one that you've borrowed, and quotes can be compared from multiple insurers.You can get more information from our short term car insurance page.

Very Cheap Car Insurance With No Deposit in 2022 | MoneyGeek.com

Category:

Very Cheap Car Insurance

Get very cheap no deposit car insurance by paying monthly rather than paying in full. GEICO offers the cheapest no deposit insurance at $42 a month.

Car InsuranceCheapest Car Insurance CompaniesBest Car Insurance CompaniesCheap Full Coverage Car InsuranceCheap Liability-Only Car InsuranceCompare Car Insurance QuotesCar Insurance Cost CalculatorHow Much is Car Insurance on Average? Best Auto and Home Insurance Bundle

Best American Express CardsBest Capital One Credit CardsBest Chase Credit CardsBest Business Credit Cards for Cash BackBest Credit Cards for Delta FlyersBest Rewards Cards with No Annual FeeSee All Credit Card Reviews

How Credit Cards WorkA Guide to Your First Credit Card7 Myths About Credit ScoresCredit Card Fees & Common TermsUnderstanding Your Card Holder RightsPros & Cons of Balance TransfersGetting a Credit Card Without IncomeHow Credit Card Interest WorksWhat is a Good APR

Best Personal Loans for Bad CreditBest Personal Loans for Fair CreditBest Personal Loans for Good CreditBest Personal Loans for Excellent CreditBest Personal Loans for Debt ConsolidationBest Personal Loans with Low-Interest RatesBest Personal Loans with Low-Income LimitsBest Online-Only Personal Loan Lenders

Very cheap car insurance with no deposit actually means paying the lowest possible monthly cost upfront. You can't get a car insurance policy without making a first-month payment, but GEICO,State Farm and Progressive offer affordable monthly payment options.

The Cheapest Car Insurance Companies in September 2022

Category:

Cheapest Car Insurance Companies

Looking for cheaper car insurance? We've found the cheapest companies in 2022 broken down by all sorts of factors. Learn more with Compare.

At Compare.com, it’s our mission to find simple ways to help our customers save money on the things they need. While we partner with some of the companies and brands we talk about in our articles, all of our content is written and reviewed by our independent editorial team and never influenced by our partnerships. Learn about how we make money, review our editorial standards, and reference our data methodology to learn more about why you can trust Compare.com.

Finding affordable car insurance can be a frustrating, mysterious process. Why do some insurers charge hundreds more for the exact same coverage? Why do your insurance rates go up each year with no explanation? Are there any companies that offer fair rates?

If you’ve gotten two speeding tickets in the past year, and you also rear-ended someone at a stoplight, car insurance companies will a-sume — rightly or wrongly —that you’re a high-risk driver and you’ll be expensive to insure.

What if you had an unlucky year, but in general you’re a good driver? The good news is that insurance companies only consider events within a certain lookback period — usually three years, but it varies by state and insurance company. Tickets, convictions, and accidents from before that period won’t affect your insurance rates.

If you’re looking for cheap car insurance when you have a bad driving record, we have two pieces of advice: One, don’t lie! When insurance companies ask you about recent moving violations and accidents, you might be tempted to fudge the details. But they’ll get your motor vehicle record (MVR) summary directly from the state, so the truth will come out. And two, compare quotes from several car insurers. As you see below, insurance rates for someone with a speeding ticket, an accident or a DUI can vary a lot by company.

Shop Car Insurance: Compare Online Rates (2022)

Category:

Car Insurance

Partner Content: This content was created by a business partner of Motor1 and researched and written independently of the Motor1 newsroom. Links in this article may result in us earning a commission. Learn More

It can be difficult to shop car insurance. Between comparing car insurance quotes, providers, and coverage options, you must consider a lot of information. This article will help you navigate the important details and explain how to find the lowest car insurance quotes for the coverage you need.

Our review team has researched dozens of providers and compiled a list of the best car insurance companies in the business, ranking insurers based on price, customer service, and financial stability. When you’re ready to shop car insurance and start comparing options, this list is a good place to start.

Below are the 10 cheapest car insurance providers, according to our rate estimates, which apply to full coverage insurance for 35-year-old drivers with good driving records. Our estimates also combine driving profiles from all 50 states.

The best car insurance coverage may not necessarily be the cheapest. While cost is an important factor to consider, you should also make sure your insurer offers the coverage you need and has an excellent reputation for meeting customer claims obligations. Compare car insurance companies on more than price to find the best option.

Who Has the Cheapest Car Insurance in New Jersey? - ValuePenguin

Category:

Cheapest Car Insurance Company

Geico has the best cheap car insurance quotes in New Jersey, at $44 per month for minimum coverage and $94 per month for full coverage.

To help you choose the best cheap car insurance in New Jersey, our editorial team gathered quotes from every ZIP code for some of the largest car insurance companies in the state. We ranked the top companies in New Jersey based on convenience, customer service and coverage availability. We also rated the best companies based on cost for multiple driver profiles.

To find the cheapest insurers, we averaged quotes for liability-only coverage, which meets the state minimum requirements in New Jersey: $15,000 in bodily injury liability per person and $30,000 per accident, and $5,000 in property damage coverage, along with $15,000 in personal injury protection (PIP).

Minimum coverage auto insurance quotes meet New Jersey's minimum state legal requirements, which includes $15,000 in bodily injury liability per person and $30,000 per accident, $5,000 in property damage coverage and $15,000 of personal injury protection (PIP).

Unlike full coverage policies, minimum coverage doesn't include comprehensive and collision insurance. Although minimum coverage costs less, you might not have enough protection after an accident because you have less liability coverage and you skip comprehensive and collision coverage.

The cheapest full coverage auto insurance company in New Jersey is Geico, where coverage costs an average of $1,153 per year — or $96 per month. Alternatively, drivers can find cheap rates from Plymouth Rock, which also offers car insurance quotes for $1,560 per year.

Cheap Car Insurance Ajax | Compare Auto Insurance Quotes …

Category:

Car Insurance

Oct 03, 2022 · In 2021, Ajax's average

car insurance premium cost $2,104 per year or $175 per month, based on our current RATESDOTCA Insuramap Report, which is $549 more than …

Compare Best Cheap Car Insurance Quotes in West New York, …

Category:

Car Insurance

While West New York

car insurance costs on average $197-$295, Jerry drivers only pay $172. Find out if you're overpaying for

car insurance by comparing 20+ free quotes from 50 top …

Videos of Very Cheap Car Insurance Companies

Cheap Car Insurance Companies in USA I 2022 by Zain

2:37 - 3 years ago

Hello Friend, today in this video i will describe Cheap Car Insurance Companies in USA. You must to know the importance of car ...

Cheapest Auto Insurance Rates

0:46 - 3 years ago

Get the lowest best cheap Car Insurance Quote Online from the nations top providers. Credit Score with 650+ get Best car ...

Top 5 best car insurance companies in USA | cheap car insurance

4:03 - 3 years ago

Top 5 best car insurance companies in USA | cheap car insurance.

What is the cheapest car insurance company

1:29 - 3 years ago

what is the cheapest car insurance company our analysis found that State Farm and USAA are the most affordable major insurers ...

You may also like

-

Mayor-elect Zohran Mamdani urged undocumented immigrants to ‘know your rights’ and stand up to ICE in a video message Sunday, offering guidance on how to protect themselves from federal enforcement.

-

A Cinnabon worker in Wisconsin has been fired after a viral video caught her unleashing the N-word and other racist insults at a Somali couple over the weekend.

-

Two baby-faced Florida teens allegedly lured a 14-year-old girl into the woods, where they fatally shot her and set her remains on fire — all over a clash that began online.

-

Former President Joe Biden sparked headlines Friday afternoon after stumbling over the word ‘America’ during remarks criticizing the Trump administration at an LGBTQ rights forum in Washington, DC.

-

In the moments before Texas A&M cheerleader Brianna Aguilera fell to her death, witnesses say they heard someone scream, 'Get off me!' — and the so-called 'suicide note' police found deleted from her phone was actually a creative writing essay, her mother’s lawyer revealed Friday.

-

Anna Kepner’s 16-year-old stepbrother was forced out of the family’s Florida home just as federal investigators are reportedly weighing charges against him in the cheerleader’s tragic cruise-ship death.

-

CNN anchor Jake Tapper came under fire Thursday after mistakenly referring to accused D.C. pipe-bomb suspect Brian Cole Jr. as a 'white man.’

-

Police revealed that Texas A&M cheerleader Brianna Aguilera had written—and then deleted—a suicide note on her phone just days before she plunged 17 stories from an Austin apartment building, a fall authorities have now ruled as a tragic act of self-harm.

-

The face of accused D.C. pipe-bomb suspect Brian Cole Jr. has surfaced publicly for the first time since his arrest for allegedly placing explosive devices outside the Republican and Democratic National Committee buildings just before the Jan. 6, 2021, Capitol attack.

-

Ilhan Omar’s connections to a welfare fraud in her Minnesota district are drawing fresh scrutiny as new details come to light—and the story is only getting bigger.