Something that we are definitely not taught in school as children is understanding Auto Insurance Policies. Did you know that there are different types of insurances within your policy, that some of them will pay out even if you are fault at for the accident, and that some types may have been removed without your

Jun 29, 2021

auto, auto insurance, automobile, Car, insurance, insurance policy, Liability, Liability Insurance, Medical Payments, Medical Payments Coverage, MedPay, Personal Injury, Personal Injury Protection, PIP, policy, UIM, Uninsured Motorist, Uninsured Motorist Insurance

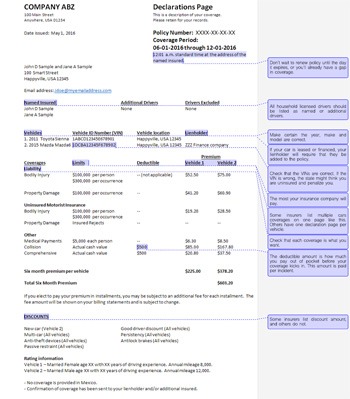

Something that we are definitely not taught in school as children is understanding Auto Insurance Policies. Did you know that there are different types of insurances within your policy, that some of them will pay out even if you are fault at for the accident, and that some types may have been removed without your understanding what they are only to save the insurance company from having to protect you if you are ever in an accident? Did you also know that the rules for insurance are different depending on the state that you are in? It can all be extremely confusing – but understanding what your policy really covers can help you plan for the future and keep you from skyrocketing bills should you ever be in an accident.

We have included some of the different types of insurances commonly found within policies that YOU need to be aware of below. If you don’t know if your policy includes any of these, make sure you speak with your provider ASAP so that you get the protection you need. Often, adding one of these components will cost no more than a few dollars per month.

This term is probably one that you are familiar with. Liability insurance covers the medical care for injuries caused to the other party of the accident. This could be a pedestrian that was hit in the crosswalk, or the driver of a car that you rear ended. For the other party to be able to utilize this insurance, YOU must have been deemed to be “at fault” for the accident. If you were deemed “not at fault” (i.e. the other party caused the accident), then they would not have access to your liability in order to pay for the medical care resulting from their injuries.

Personal Injury Protection insurance covers the medical care for injuries caused to yourself in an accident. This is also commonly known as “no-fault insurance” because fault is not a determining factor in utilizing this component of your policy. Which means, whether you caused the accident, or the other party caused the accident, you would still have access to these funds to pay for your medical bills and other a-sociated costs having to do with your accident. While this coverage does not extend to the other parties involved in the accident, it does extend to any passengers in your vehicle at the time of the accident.