In the event of an accident, your auto insurance policy can make all the difference. Unfortunately, most drivers don’t know how to read their policy, much

And if you don’t fully grasp your policy, you may encounter some nasty surprises in terms of coverage. Alternately, you may be paying way too much money for coverage you don’t really need.

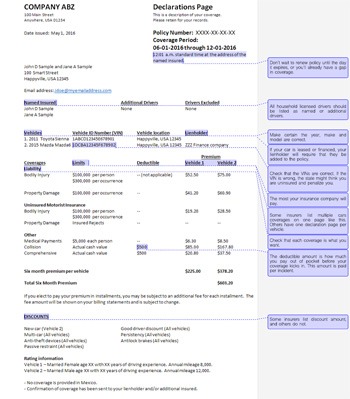

This is likely the first page of your policy and should clearly be labeled as “policy declarations” or “declarations page.” This page will offer important information about your coverage, cost, deductions, and the names of those on your policy.

While the exact information may vary, most declaration pages will have your personal info, the names of drivers on your policy, the vehicles insured, and the coverage schedule (which includes coverage info as well as info about deductions and premiums). The declaration will also have information about your policy period, discounts, and surcharges (depending on your driving record or recent insurance claims).

When should you review your insurance policy? There is no “wrong” time to review key information. However, it is absolutely critical to review your insurance policy after you make any changes to it (for example, after making changes to prepare for your teenage driver hitting the road).

After you make a change, you should get a notification from your insurance carrier. If you have not received such a notification after a week, then call them to confirm the changes have been made.