Top FAQs for State Of Maryland Car Insurance

People also ask - State Of Maryland Car Insurance FAQs

Who really has the cheapest car insurance in Maryland?

Metlife offers the cheapest auto insurance premiums for Maryland drivers, with an average rate of $700 for a six-month policy, or $116 per month. I...Read more

Why is car insurance so expensive in Maryland?

Drivers in Maryland pay 12% less than the national average for car insurance — $619 vs $698 per six-month policy. If you feel you're overpaying for...Read more

Is it illegal to not have car insurance in Maryland?

If your vehicle is driven or parked on public roads, you legally need to carry insurance at or more than Maryland's liability limits. Use The Zebra...Read more

What is the best car insurance in Maryland?

Top 5 Maryland Auto Insurance Providers 1. USAA Auto Insurance. 2. Erie Auto Insurance. 3. State Farm Auto Insurance. 4. Allstate Auto Insurance. 5. Geico Auto Insurance. This is because our ratings take into account nationwide factors, while our ranking for this...

What is the minimum car insurance required in Maryland?

- Maryland drivers are required to purchase liability insurance, uninsured motorist coverage, and personal injury insurance to comply with state law

- Some Maryland drivers purchase more coverage than what is required

- This state monitors your insurance electronically and may immediately become aware of a cancellation or other change in your coverage

More items...

How much is auto insurance in Maryland?

While rates vary based on zip code, driving profile, coverages and vehicle type, the average cost of car insurance in Maryland is about $156 per month for full coverage and $64 per month for state minimum liability auto insurance coverage. How much car insurance do I need in Maryland?

Does Maryland car insurance cover rental cars?

Under this holding, UIM coverage must fully cover rental car expenses even if they are not otherwise covered under the general insurance section of the policy. Applying this ruling to the underlying cases, the Maryland high court concluded that State Farm was obligated to cover the rental car expenses.

Maryland Insurance Administration

An official website of the State of Maryland.

This Week at the MIA Your Life, Your Decisions: A Guide to Electronic Advance Directives Reporting Cybersecurity Events to the Maryland Insurance Administration How to request a referral to a healthcare specialist Office of Hearings: COVID-19 Updates Facts About the Federal No Surprises Act 2022 Bulletins Word of the Day Flood Insurance: FAQs Lunch with MIA: How to Protect Yourself from Identity Theft, Fraud and other Scams January 10, 2023 Lunch with MIA: How to Prepare for Winter Weather January 12, 2023 Check out our Listening Sessions MIA Approves 2023 Affordable Care Act Premium Rates COVID-19 Resources GoVAX: Learn More about COVID-19 Vaccines MDOT Customer Connect Update: Reduction of FR-13 Errors Facility Accessibility Notification

javascript:if (typeof CalloutManager !== 'undefined' && Boolean(CalloutManager) && Boolean(CalloutManager.closeAll)) CalloutManager.closeAll(); commonShowModalDialog('{SiteUrl}'+

'/_layouts/15/itemexpiration.aspx'

+'?ID={ItemId}&List={ListId}', 'center:1;dialogHeight:500px;dialogWidth:500px;resizable:yes;status:no;location:no;menubar:no;help:no', function GotoPageAfterClose(pageid){if(pageid == 'hold') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

'/_layouts/15/hold.aspx'

+'?ID={ItemId}&List={ListId}'); return false;} if(pageid == 'audit') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

'/_layouts/15/Reporting.aspx'

+'?Category=Auditing&backtype=item&ID={ItemId}&List={ListId}'); return false;} if(pageid == 'config') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

'/_layouts/15/expirationconfig.aspx'

+'?ID={ItemId}&List={ListId}'); return false;} if(pageid == 'tag') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

'/_layouts/15/Hold.aspx'

+'?Tag=true&ID={ItemId}&List={ListId}'); return false;}}, null);

About MIABulletinsCommissioner BirraneCompany and Producer SearchFederal No Surprises ActFlood Insurance: FAQsFraudGlossary of Insurance TermsHearings CalendarJob OpportunitiesLaws & RegulationsLegal ProceduresLegislative InformationLong-Term CareMental Health Parity Survey and OrdersNews CenterOnline ServicesOrders and Exams SearchProcurementPublic DocumentsPublic Information Act RequestsRegulatory ActivityWebinarsWorkgroups

Company Licensing Phone: 410-468-2104Producer Licensing Phone: 410-468-2411Auto or Homeowners Insurance Complaint Line: 410-468-2340 or 800-492-6116Life and Health Insurance Complaints Line : 410-468-2244 or 800-492-6116Insurance Fraud Tip Line: 800-846-4069Maryland Crisis Line for Substance Use Disorders 1-800-422-0009

The current browser does not support Web pages that contain the IFRAME element. To use this Web Part, you must use a browser that supports this element, such as Internet Explorer 7.0 or later.

Insurance Requirements for Maryland Vehicles -

Pages

An official website of the State of Maryland.

New to MarylandVehicle InsuranceVehicle Titling and RegistrationRegistration Renewal InformationRegistration for MilitaryVehicle Registration and Titling QuestionsVehicle Registration FormsLicense PlatesInteractive Business Licensing ManualVehicle EmissionsAutomated VehiclesBuy, Donate or Sell a VehicleConsumer Tips for Purchasing a New VehicleVehicle Titling AppointmentCurbstoningTitling - Excise Tax Credit for Plug-in Electric Vehicles

Did you know Maryland is a mandatory vehicle insurance state? What does this mean for you? MDOT MVA now validates your vehicle insurance at registration renewal. Customers can update insurance with MDOT MVA anytime on myMVA eServices. Insurance agents may also update insurance information on behalf of their customers using myMVA.

4. If you have moved to Maryland and are continuing vehicle insurance coverage from your previous state of residence, you will need to contact your vehicle insurance company or agent and let them know you need to convert your policy to a Maryland policy. Note: Check to make sure your vehicle insurance company is licensed in Maryland.

The Maryland Automobile Insurance Fund (MAIF) provides automobile insurance to Maryland residents that have been turned down by two insurance companies or cancelled by one. To get more information on how to insure your vehicle, click here to visit MAIF's website.

The Maryland General A-sembly’s Office of Legislative Audits operates a toll-free fraud hotline to receive allegations of fraud and/or abuse of State government resources. Information reported to the hotline in the past has helped to eliminate certain fraudulent activities and protect State resources.

Maryland Car Insurance (Rates + Companies) – CarInsurance.org

Learn about the insurance and driving laws for MD as well as get rates for age, zip code, and city. Plus compare companies' coverage and costs. Get started.

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Jeffrey Johnson is a legal writer with a focus on personal injury. He has worked on personal injury and sovereign immunity litigation in addition to experience in family, estate, and criminal law. He earned a J.D. from the University of Baltimore and has worked in legal offices and non-profits in Maryland, Texas, and North Carolina.

He has also earned an MFA in screenwriting from Chapman Univer...

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

Admiral Insurance | Best Car Insurance For UK | Donating a Car in Maryland |TExpart

9:10 - 3 years ago

100K views Admiral Car Insurance Admiral has a reputation for value and straight-talking customer service. Their employees have ...

Best Cheap Car Insurance in Maryland (from $104/mo)

Oct 21, 2022 · Across the Old Line State, there are 68,889 miles of road just waiting to be driven. The average car insurance rate in Maryland is

$1,305 per year — 15% less than the U.S. …

Best Cheap Car Insurance in Maryland for 2022 | U.S. News

Category:

Car Insurance

The minimum liability

car insurance requirement for

Maryland drivers is $30,000 for bodily injury per person, $60,000 for two or more people per accident, and $15,000 for property damage per …

Motor1 Product & Service Reviews

Category:

Maryland Car Insurance

Partner Content: This content was created by a business partner of Motor1.com and researched and written independently of the Motor1.com newsroom. Links in this article may result in us earning a commission. Learn More

When Should You Buy Extended Warranty Coverage? (2022)

Extended warranties are designed to protect car owners from paying the full cost of repairs, but can you add an extended warranty after purchase?

Can A Car Be Registered And Insured In Different States? (2022)

Advertiser Disclosure

Vehicle registrations and auto insurance can be tough to navigate, and you may find yourself asking: Can my car be register...

How To Renew Auto Insurance And Get The Best Rates (2022)

Don’t settle for the same insurance company when you can shop around for a policy that will save you money.

A-MAX Auto Insurance: Reviews, Cost & Coverage (2022)

Our team rated A-Max auto insurance 4.0 out of 5.0 stars for their good coverage options, affordable prices, and good service in Texas.

Maryland Car Insurance Laws (Updated 2022) | The Zebra

Jan 5, 2022 · If you are caught driving without

insurance in the

state of Maryland, you can expect the following penalties: Fine of up to $1,000; Imprisonment up to one year; License plates …

Maryland Car Insurance ~ MD Auto Insurance Quotes | GEICO

Looking for auto insurance that delivers great discounts with amazing service? Get a Maryland car insurance quote and you could save up to 15% with GEICO.

Auto

Motorcycle

ATV

Homeowners

Renters

Condo

Mobile Home

Boat/PWC

RV

Life

Umbrella

Identity Protection

Landlord

Flood

Travel

Overseas

Business Owners

General Liability

Professional Liability

Workers' Compensation

Medical Malpractice

Commercial Auto

Rideshare

Collector Auto

Pet

Jewelry

Mexico Auto

Earthquake

Cell Phone

Event

Bicycle

When you click "Continue" you will be taken to a site owned by , not GEICO. GEICO has no control over their privacy practices and a-sumes no responsibility in connection with your use of their website. Any information that you provide directly to them is subject to the privacy policy posted on their website.

Whether you live in Bethesda near the nation's capital or the state capital of Annapolis, you could find great auto insurance rates with GEICO. If you're new to Maryland or just making sure you have the best car insurance quote, GEICO can work with you to make sure you have the right car insurance coverage in MD. Check car insurance rates by getting a free quote with GEICO.

To register your car in Maryland, you will need to show proof that you have car insurance. If you've just moved to Maryland, be sure to inform GEICO of your new address so we can make sure that your auto insurance matches the requirements for Maryland registration.

Unlike other states, Maryland has a state inspection called the Maryland Safety Inspection. You will need to pass this inspection and receive a Maryland Safety Inspection Certificate before you can register your vehicle. Each county in Maryland has authorized inspection stations, so find the one nearest to you. The inspection will ensure that your vehicle is up to the state's safety standards.

Maryland Approved Vehicle Insurance Companies -

Pages

An official website of the State of Maryland.

New to MarylandVehicle InsuranceVehicle Titling and RegistrationRegistration Renewal InformationRegistration for MilitaryVehicle Registration and Titling QuestionsVehicle Registration FormsLicense PlatesInteractive Business Licensing ManualVehicle EmissionsAutomated VehiclesBuy, Donate or Sell a VehicleConsumer Tips for Purchasing a New VehicleVehicle Titling AppointmentCurbstoningTitling - Excise Tax Credit for Plug-in Electric Vehicles

Vehicle liability insurance, pays damages that are caused by you and suffered by the other party for personal injury, death, or property damage. You must carry at least the minimum amounts of vehicle insurance required by the Maryland Motor Vehicle Laws.

Uninsured motorist coverage pays damages, after any applicable deductible, that are caused by an uninsured motorist and suffered by you. You must carry at least the minimum amounts of vehicle insurance required by the Maryland Motor Vehicle Laws.

Personal Injury Protection (PIP) coverage provides the benefits for medical, hospital and disability up to $2,500 for all reasonable expenses arising out of an accident. Full personal injury protection provides benefits for you, any member of your family, and any non-family occupant of your vehicle. You may also choose limited protection, which excludes benefits for you and members of your family who are 16 years of age and older. The alternative costs less and should be considered if you already have medical and hospitalization insurance.

The Maryland General A-sembly’s Office of Legislative Audits operates a toll-free fraud hotline to receive allegations of fraud and/or abuse of State government resources. Information reported to the hotline in the past has helped to eliminate certain fraudulent activities and protect State resources.

Maryland Auto Insurance

Maryland Auto Insurance will help you get the coverage you need to keep moving forward—in your car and in life. We insure the uninsured. Get a quote today.

Automobile, Motorcycle, ATV and RV Insurance

An official website of the State of Maryland.

Due to COVID-19, the Maryland Insurance Administration is not participating in in-person events. f your community group, HOA or organization is interested in a virtual presentation contact Kejuana Walton at [email protected] or 410-468-2255.

A Consumer Guide to Auto Insurance for Teen and Young Adult

DriversGuia Para El Consumidor: Seguro

De Automovil Para Conductores Adolescentes y Jovenes Adultos청소년 및 청년 운전자를 위한 자동차 보험 가이드

Consumer

Alert: Maryland Insurance Administration Offers tips on GAP Insurance and

Debt Cancellation AgreementsSpanish: la

Administración de Seguros de Maryland ofrece consejos sobre el seguro de

protección de automóvil garantizada (GAP) y acuerdos de cancelación de

deudas

Consumer Advisory: Understanding your options for Uninsured and Underinsured Motorist Coverage in MarylandAviso al consumidor: Comprenda sus opciones de cobertura contra conductores no asegurados e infrasegurados en Maryland소비자 권고 사항: 메릴랜드의 무보험 및 저보험 운전자 보험에 대한 옵션 이해하기

The Maryland General A-sembly’s Office

of Legislative Audits operates a toll-free

fraud hotline to receive allegations of

fraud and/or abuse of State government

resources. Information reported to the

hotline in the past has helped to eliminate

certain fraudulent activities and protect

State resources.

Maryland Car Insurance Coverage | Allstate Car Insurance

Category:

Maryland Car Insurance State

Maryland car insurance state minimums. Coverage type.

State requirements. Bodily injury liability. Helps cover expenses related to the injury or death of another driver or a pedestrian when an …

How Much Is Car Insurance in Maryland in 2022? | House Grail

Category:

Car Insurance

The price of car insurance will vary depending on the state you live in. This article goes over car insurance costs for people who live in Maryland.

Any car owner will tell you that the expenses do not stop once you purchase the vehicle. The cost of gas must be factored into the budget. Taxes and registration of the vehicle need to be considered as well. If you purchased the car with a loan, the car loan interest will something else added to the expenses. And, of course, there is car insurance.

Like the cost of buying a new home or even buying groceries, the price of car insurance will vary depending on the state you live in. This article goes over car insurance costs for people who live in Maryland.

In Maryland, car insurance is required by law. You simply must have it. Besides Virginia and New Hampshire, all states require car owners to have insurance, so Maryland is not that different from the rest of the United States.

Besides car insurance being mandatory, it offers the owner of the car some financial protection. Getting into an accident is costly. Uninsured car owners will need to pay out-of-pocket for the victim’s injuries and damage to the car, their own injuries and car damages, and any lawyer or legal fees to settle the situation. If any damage was done to private or public property, that will also need to be paid for. Needless to say, this will cost tens of thousands of dollars, possibly over $100,000.

Yes, paying monthly car insurance may seem like an unnecessary expense—especially if you are a careful driver—but it is simply unwise to drive uninsured. And in Maryland, it is illegal to do so.

Maryland Car Insurance | Get a Quote | Liberty Mutual

Category:

Car Insurance

The average cost of

car insurance in

Maryland is $1,440 per year according to thezebra.com. 2 That’s 3% lower than the national average. Of course, your auto

insurance cost will depend on …

Maryland Auto Insurance Laws: Everything You Need to Know

Maryland auto insurance laws require that you carry 30/60/15 bodily injury, as well as 30/60 uninsured coverage.

Maryland auto insurance laws require that you carry 30/60/15 bodily injury, as well as 30/60 uninsured coverage. You may decide to buy additional coverage and knowing how to save can get you the best rates possible.

Maryland auto insurance laws require that you carry 30/60/15 bodily injury, as well as 30/60 uninsured coverage. You may decide to buy additional coverage and knowing how to save can get you the best rates possible.

Drivers do have the option of forgoing the personal injury protection (PIP). If you want to opt out of PIP, then you will need to submit a notification in writing to your insurance company.

These minimum requirements don't pay for your medical bills or damages if you're in an accident. Instead, they cover any damages you might cause to others in an auto accident. Bodily injury covers up to $30000 per person and $60000 per accident of other drivers and their passenger's medical bills and lost wages. Property damages cover up to $15000 total in damages that you cause to someone else due to an accident. Uninsured coverage pays for your medical bills and damages if you are in an accident with a driver who is at fault, but who does not have any car insurance.

According to the Maryland Department of Transportation Motor Vehicle Administration, the state even has the right to garnish income if you still don't pay fines. You are also required to have proof of insurance whenever driving a vehicle. Maryland does allow you to show proof of insurance on your phone so download your provider's app ahead of time.

licensing

An official website of the State of Maryland.

About MIABulletinsCommissioner BirraneCompany and Producer SearchEventsFlood Insurance: FAQsFraudGlossary of Insurance TermsHearings CalendarLaws and RegulationsLegal ProceduresLegislative InformationLong-Term CareMental Health Parity Survey and OrdersOnline ServicesOrders and Exams SearchProcurementPublic DocumentsPublic Information Act RequestsRegulatory ActivityWebinarsWorkgroups

Company Licensing Phone: 410-468-2104Producer Licensing Phone: 410-468-2411Auto or Homeowners Insurance Complaint Line: 410-468-2340 or 800-492-6116Life and Health Insurance Complaints Line : 410-468-2244 or 800-492-6116Insurance Fraud Tip Line: 800-846-4069Maryland Crisis Line for Substance Use Disorders 1-800-422-0009

The Maryland General A-sembly’s Office

of Legislative Audits operates a toll-free

fraud hotline to receive allegations of

fraud and/or abuse of State government

resources. Information reported to the

hotline in the past has helped to eliminate

certain fraudulent activities and protect

State resources.

Maryland Car Insurance - Quotes, Coverage & Requirements | DMV.ORG

Category:

Car Insurance

Maryland car insurance requirements. Find which coverage options are best for you and see if you qualify for discounts. Get a quote online to save money on a new auto insurance policy.

When registering your car in Maryland, your car insurance ID card will not be accepted as proof of insurance. Instead, your car insurance carrier will provide you with a Maryland Insurance Certification that you must sign and submit along with your registration.

PIP coverage will help pay for your medical costs after a car accident, regardless of who is at fault for the accident. Once you have reached your PIP's limits, your health insurance may be able to cover additional costs.

NOTE: While Maryland law does not require it, you may be required to purchase comprehensive and collision coverage as part of a loan or lease agreement. If you neglect to purchase required coverage, it might be purchased for you (see below).

If your car is being financed and you fail to purchase collision and comprehensive coverages as per your loan agreement requirements, your lender may purchase these coverage types and charge you for them.

When registering your car with the Maryland Motor Vehicle Administration (MVA), you must submit a signed Maryland Insurance Certification (FR-19) acknowledging that you will maintain at least the minimum Maryland car insurance requirements.

Maryland Minimum Car Insurance Requirements - Maryland Car Insurance Requirements - Maryland Auto Insurance Requirements

| Insurance Navy

Category:

Car Insurance

Insurance Navy specializes in providing affordable Minimum Car Insurance Coverage to our clients in Maryland. Our team of agents will get you a liability policy the same day.

Like many other states, Maryland requires all drivers to carry a certain minimum liability insurance amount. However, they also require uninsured/underinsured motorist coverage and personal injury protection (PIP). The mandatory minimums for each type of insurance are outlined below.

As a driver, you must always carry proof of insurance and be ready to present it should you be asked by law enforcement. Also, keep in mind that if you have an auto loan or lease your vehicle, your lender or leasing company could require you to carry additional insurance.

Uninsured/underinsured motorist coverage offers you protection when you end up in an accident with someone lacking insurance. This can apply to someone without any liability insurance at all or someone whose insurance plan is not adequate enough to fully cover claims. Typically, when you find this type of insurance mandated by a state, it only goes towards bodily injury. Maryland is pretty unique as it also requires uninsured motorist property damage (UMPD) coverage. Both your personal injuries and property will be protected if you get into an accident with a driver lacking insurance.

Personal injury protection (PIP) coverage helps pay for the medical expenses you or your passenger(s) accumulate due to an accident. The limit for PIP coverage in Maryland is a bit on the lower end, but you do have the ability to increase it. It is also worth noting that PIP coverage will pay for your medical bills no matter who is deemed responsible for the accident.

Liability insurance is a pretty standard requirement in every state. Maryland is no exception. Every driver in the state of Maryland must carry at least the mandated minimum in order to be recognized as a legal driver. This type of insurance pays for the injuries the other drive sustains in an accident you caused. It will also extend to any property damage you cause. If the other driver is at fault, you will then be able to receive the payout from their liability insurance. These coverage limits are expressed by three numbers, with each representing its own aspect of liability insurance. In Maryland, the minimum liability insurance is 30/60/15. What each of these refers to will be explored in a later section.

MDOT MVA INSURANCE COMPLIANCE DIVISION (ICD) FREQUENTLY ASKED QUESTIONS (received letter notice) -

Pages

An official website of the State of Maryland.

New to MarylandVehicle InsuranceVehicle Titling and RegistrationRegistration Renewal InformationRegistration for MilitaryVehicle Registration and Titling QuestionsVehicle Registration FormsLicense PlatesInteractive Business Licensing ManualVehicle EmissionsAutomated VehiclesBuy, Donate or Sell a VehicleConsumer Tips for Purchasing a New VehicleVehicle Titling AppointmentCurbstoningTitling - Excise Tax Credit for Plug-in Electric Vehicles

Maryland Law requires all vehicles registered in the State of Maryland to maintain insurance. The Maryland Department of Transportation Motor Vehicle Administration (MDOT MVA) received a cancellation notice from your vehicle’s Insurance Provider and we do not have a record of your current vehicle insurance. If your vehicle is insured, please contact your Insurance Agent and ask them to submit an e-FR 19 form to the MDOT MVA.

Proof (Verification) of Vehicle Insurance

I have vehicle insurance; how do I provide verification to MDOT MVA?If you have received a Proof of Vehicle Insurance Needed Letter, the only acceptable proof of insurance is documentation provided by your Insurance Provider.

Maryland Law requires you must maintain Insurance with a Maryland Insurance Provider if your vehicle is registered in Maryland. It is against regulations to have Maryland registration and out of state insurance, you must either obtain Maryland Insurance or register your vehicle in the state you Insured the vehicle.

Maryland Auto Insurance

Maryland Auto

Insurance was created by the

Maryland legislature to make

insurance available to drivers who have been turned down or cancelled by other carriers. We help drivers get the …

Videos of State Of Maryland Car Insurance

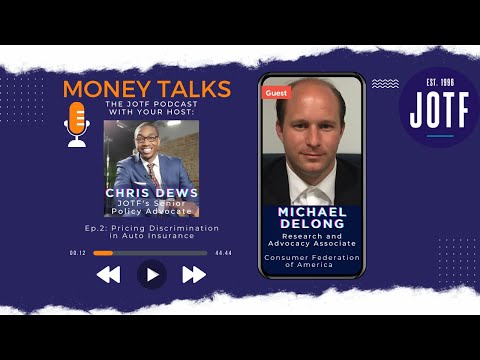

JOTF MoneyTalks #2 - Pricing Discrimination in Auto Insurance

44:45 - 3 years ago

MoneyTalks is a podcast examining how governmental laws, policies, and programs impact Maryland's workforce and finances.

Washington DC Commercial vehicles insurance offshore United States cargo truck insurance Maryland

4:16 - 3 years ago

Join YAA today! ⮕ https://joinyaa.com/plans Get educated on buying a car with YAA's Deal School: ...

JOTF MoneyTalks #2 - Pricing Discrimination in Auto Insurance (Audio Only)

44:42 - 3 years ago

MoneyTalks is a podcast examining how governmental laws, policies, and programs impact Maryland's workforce and finances.

What is the STET Docket | Maryland

2:26 - 3 years ago

Expert Maryland Lawyer Eric Reitz explains the STET Docket. The Ruben Law Firm has been providing top quality, affordable ...

You may also like

-

American International Group’s announcement last week that it was cutting ties with its incoming president, John Neal, left the insurance world stunned — and sparked a wave of questions about how a seasoned executive could lose a $17 million job before even stepping into the role.

-

President Trump called Rep. Marjorie Taylor Greene’s unexpected resignation on Friday 'great news' for America, sending shockwaves through the political world.

-

A rogue weather balloon has been identified as the mysterious object that smashed into a United Airlines jet last month, shattering its windshield and sending shards of glass flying across the cockpit as the plane soared 36,000 feet above Utah.

-

A new report claims the Florida cheerleader found dead aboard a Carnival cruise was killed by a brutal bar-hold strangulation — a chilling twist that’s raising even more questions about what really happened at sea.

-

Anna Kepner’s younger stepbrother—a suspect in her murder—was reportedly obsessed with the Florida cheerleader and once even climbed onto her while she slept, according to the father of her slain 18-year-old ex-boyfriend.

-

A teenage apprentice at a woodshop in Turkey has died after coworkers forced a high-pressure air hose into his rectum in a brutal so-called ‘prank’ — the latest case in which this reckless misuse of an air compressor has ended a young man’s life by causing catastrophic internal injuries.

-

Florida cheerleader Anna Kepner’s killing has taken a dark turn, as court documents reveal her 16-year-old stepbrother is now considered an FBI suspect — all while unsettling new allegations surface about the family behind closed doors.

-

One of Jeffrey Epstein’s victims has revealed that the convicted pedophile had an ‘extremely deformed’ penis, oddly shaped like a lemon.

-

Federal investigators may be zeroing in on the stepsibling of a Florida high school cheerleader whose body was discovered wrapped in a blanket and hidden under a bed aboard a Carnival cruise ship, according to a startling new court filing.

-

A Florida high school cheerleader who died aboard a Carnival Cruise ship was reportedly discovered by a cabin steward—wrapped in a blanket and hidden under a bed.