We have compiled some helpful tips on healthcare costs for seniors, boomers and retirees. Click here to learn more.

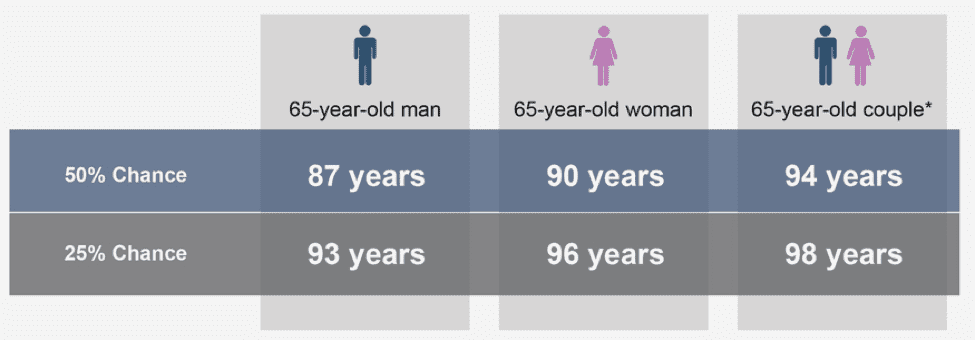

*At least one surviving individual.Source: Society of Actuaries RP-2014 Morality Table projected with Mortality Improvement Scale MP-2014 as of 2015. For illustrative purposes.The average 65-year-old couple who retired in 2015 with Medicare insurance coverage will needed an average of $276,000 to cover medical expenses during the combined remainder of their lifetimes. This estimate includes deductibles, supplemental insurance premiums, out-of-pocket expenses, and services excluded by Medicare. The figure does not include over-the-counter medications, most dental services, and most long-term care expenses and would be a good deal more if they need to use a nursing home. Health care after retirement is more expensive than most realize. Traditional Medicare (Part A) covers inpatient hospital costs and stays in skilled nursing facilities plus hospice care.According to HSBC’s annual retirement survey, 76% of Americans see the cost of healthcare as the largest barrier to retirement saving while 61 percent consider illness in a partner as a close second.

Long-term care is very expensive. According to a John Hancock national study of long-term care costs, in 2013, the average annual cost of care in the U.S. was $94,170 for a private room in a nursing home ($82,855 for a semi-private room); $41,124 for an a-sisted living facility and $18,460 for adult day care. The average annual cost of care received at home was approximately $29,640.In an EBRI study, during the two-year period examined, households with a member aged 85 or above spent an average of $24,185 out-of-pocket for long-term care expenses. But the households in the top 10 percent of nursing-home spending spent more than $66,600.Long-term care costs are probably most concerning for middle-income households. High-income households may be able to self-insure and low- income households may not have enough a-sets to protect, so Medicaid will likely cover their expenses.According to EBRI’s Retirement Security Projection Model predictions, 89 percent of households in the second-income quartile will not run short of money in retirement if these unpredictable health care costs are ignored. However, if these costs are included, only 42% of households in that income group won’t run short of money, based on projections.Medicare’s trustees reported recently that the monthly premium for Part B (outpatient services) will stay at $104.90 in 2015 for the third consecutive year; separately, the federal government forecasts that average monthly Part D (prescription drug) premiums will rise just $1, to $32 next year. Average premiums have been right in that range for the past four years.

Medicare offers two basic coverage options: traditional fee-for-service or Medicare Advantage, which is a managed-care alternative that offers all-in-one coverage for hospitalization, outpatient services, and (often) prescription drugs.You may be able to save money by joining an Advantage plan, and nearly 30% of eligible Medicare beneficiaries now use this option. When you join an Advantage plan, Medicare provides a fixed payment to the plan to cover your Medicare Part A (hospital) and Medicare Part B (medical insurance) coverage. There may be additional copayments and deductibles, depending on the type of plan you join, but your total annual out-of-pocket costs are capped. Many Advantage plans also offer–and charge for–supplemental benefits such as vision, hearing, and dental care. Tradeoffs to consider: You are agreeing to use physicians in the Advantage plan’s provider network. It’s also critical to take a close look at the plan’s prescription-drug coverage to make sure it will cover your medications without additional expense or qualification hassles.The alternative is traditional fee-for-service Medicare. You’ll be able to use virtually any health-care provider; you’ll need to sign up for a Part D prescription-drug plan and will probably want a Medigap supplemental plan, which helps cover out-of-pocket costs.Watch out for premium “brackets.” High-income households pay more for Medicare–and for policies bought through the ACA exchanges. In both cases, careful income planning can save you money on insurance premiums.In the Medicare program, premium surcharges are applied to Part B and Part D. The surcharges affect individuals with more than $85,000 in annual income and joint filers with total annual income of more than $170,000. The surcharges start at $42 per month, and run up to $231 monthly for the highest-income seniors. The Social Security Administration determines who pays the premium surcharge using recent tax returns. Eligibility is determined on the basis of modified adjusted gross income (MAGI), which includes adjusted gross income and tax-exempt interest income. Americans are living longer and as a result health care expenses continue for many years past what our parents and grandparents paid as a result of their shorter life spans. The latest figures show life expectancy is 78.2 years from birth; however, once Americans make it to age 65, men can expect to live an additional 17 years and women can expect to live 20 more years.The likelihood of developing Alzheimer's doubles every five years, beginning at age 65. As a result, after age 85, the risk of developing Alzheimer's in a single year reaches nearly 20 percent. According to a federally funded 90+ Study (reported in the Annals of Neurology).

Medicare Supplemental Insurance extends coverage over healthcare costs that Medicare doesn’t cover. Different plans offer different amounts of coverage and the costs can vary substantially. Click here to find the best plan to fit your needs and get an actual quote.Click here to find the best plan to fit your needs and get an actual quote.Medical Expense CalculatorTo calculate your out-of-pocket medical expenses during retirement enter the appropriate information into this free calculator click here.

This calculator will show you the average number of additional years a person can expect to live, based only on the gender and date of birth you enter. Click here According to EBRI a private, nonprofit research institute based in Washington, DC, in 2014, the amount of savings needed to cover health insurance premiums and out-of-pocket health care expenses in retirement are as follows: A married couple with average health care expenses would need savings of $268,000 to have a 50 percent chance of having enough money for retirement health costs, or $414,000 for a 90 percent chance. For those with very high drug expenses (in the 90th percentile), couples would need $807,000 to have a 90 percent chance of having enough money. These figures do not include the costs to cover long-term care or over the counter drugs. The full report is available online click here.