When you are shopping around for a homeowners insurance policy, you need to understand the major components of your policy so that you can make an apple-to-apple comparison. Below is an image showing a typical policy declaration page. The declaration page contains all the vital information at a glance; however, it is still important for ... Read more

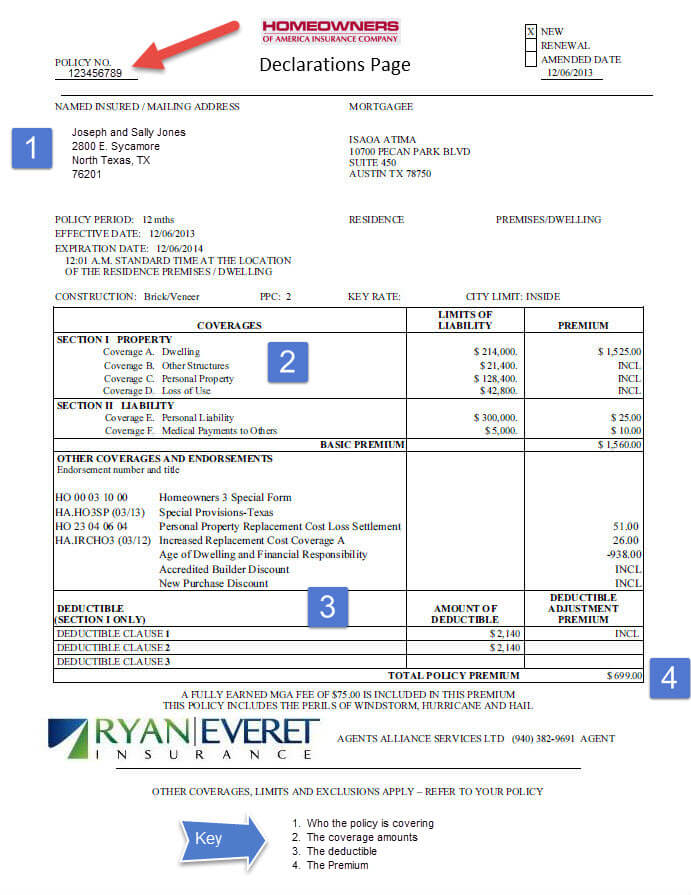

When you are shopping around for a homeowners insurance policy, you need to understand the major components of your policy so that you can make an apple-to-apple comparison. Below is an image showing a typical policy declaration page. The declaration page contains all the vital information at a glance; however, it is still important for you to read the entire insurance contract to make sure you know the details of your coverage.

The insurer’s name usually appears at the top of the declaration page. The key takes away here is to check your insurer’s rating at AM Best. You can also search for “[insurer’s name] reviews” to get an idea of how stable and how well run the company is.

A. Dwelling – this is the maximum amount that the insurance company will pay to repair or replace the main structure of the property. This amount will be lower than your home market value because the amount does not include the value of your land.

B. Other Structures – This is the maximum amount that the insurance company will pay to repair or replace other structures not attached to the main property. For example, fencing, driveways, sidewalks, storage sheds, detached garages, etc.

C. Personal Property – anything that is not part of the house is considered personal property, e.g., clothing, furniture, electronics, appliances, etc. — basically, anything that would fall out if you turn the house upside down and shake it. This is the maximum amount that the insurance company will pay to replace your personal property. However, some high-value items have their own limits or may not be covered, e.g., fur coat, jewelry, money, firearms, etc.