One way to ensure your policy is as it should be is by examining the insurance declaration page. Read this FindLaw article to learn what the insurance declaration page is and why it’s important.

You’ve finally gone through the whole process of selecting and buying insurance. So, your job is done, right? Not quite. It’s important to keep an eye on your insurance policy after you purchase it because sometimes the contract includes errors, omissions, or even changes at some point down the road. One way to ensure your policy is as it should be is by examining the insurance declaration page. Read on to learn what the insurance declaration page is and why it’s important.

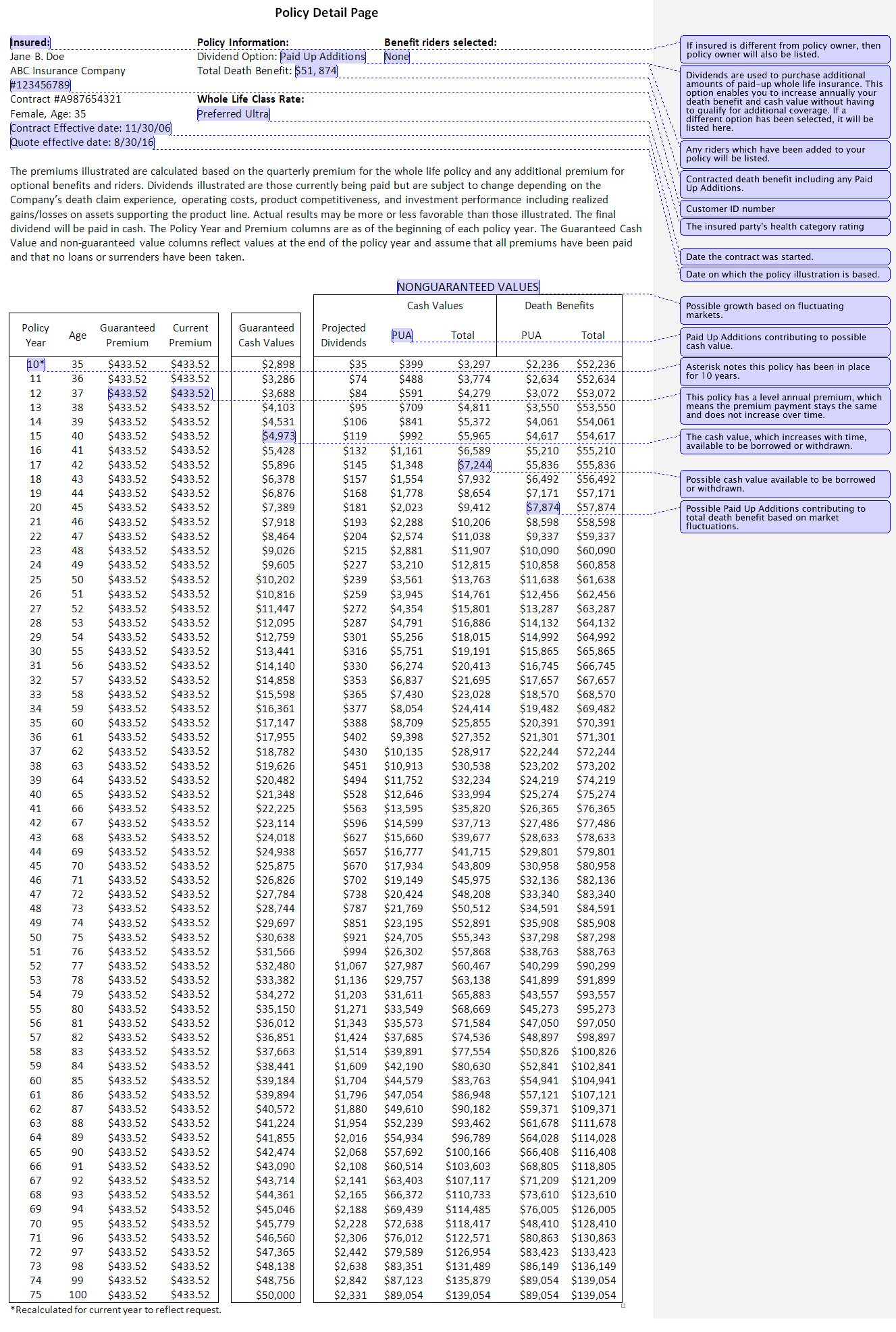

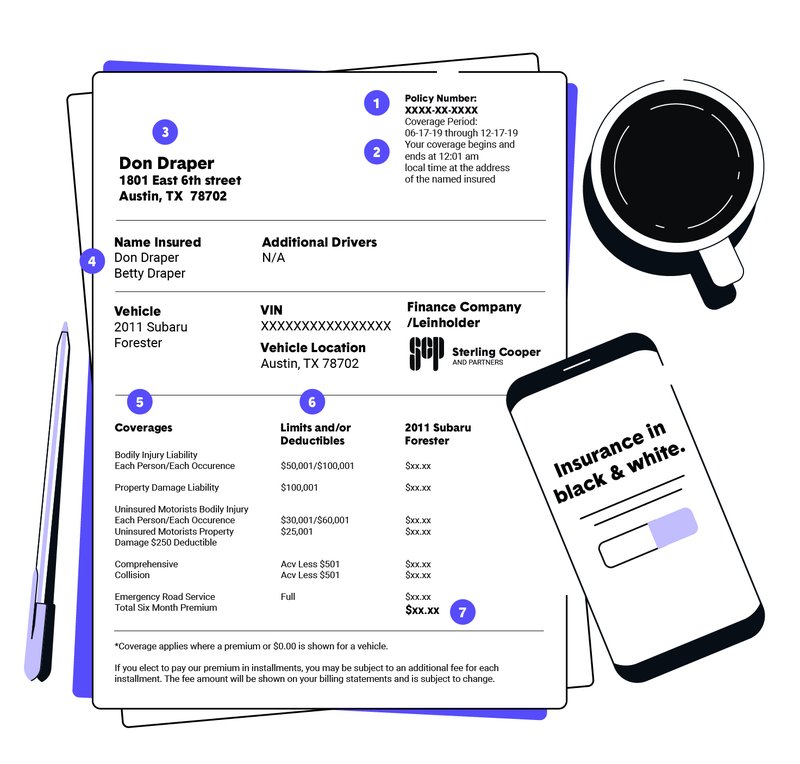

The insurance declaration section of your policy is usually the first page or pages of the insurance document. Often referred to as the "Dec Page," it provides key information for your individual policy. This section identifies the individuals covered by the policy, your address, a description of what's insured, and the policy limits, among other important information. You should still read the other parts of your insurance policy for more detail about your coverage, rights, and responsibilities, but the declaration page provides a good overview of what’s included.

The first thing to do when you receive the insurance declaration page from your insurer is to read it over carefully. Check that the contract terms are as you agreed to, including any discounts you expected, and that the names and addresses are all correct. If there are any typos or other errors, have them corrected as soon as possible. Additionally, if you’re unsure about a given term or some element of coverage, contact your insurance agent or representative for a thorough explanation, or to correct the policy and issue a revised declaration page.

These tips also apply whenever you receive a new declaration page, such as when you renew your policy. You should check the new page to see if your insurer has changed any terms, or to check whether you might be eligible for better coverage or additional discounts at that time. Lastly, keep the insurance declaration page in a safe place since it is a key part of your legally binding insurance contract.

When it works as you expect it to, an insurance policy can help you through very difficult times. However, if your insurance company denies your legitimate claim or otherwise acts unfairly, it can be devastating. Whether you read your insurance declaration page thoroughly and understood every word, or you’re confused about your whole insurance contract, an experienced, legal professional can help protect your rights. Contact a local insurance attorney today to get started.

/dotdash-TheBalance-what-is-an-insurance-declaration-page-2645728-final-6f2ec403156f423d95d11e3479cd1789.jpg)