Top FAQs for Life Insurance Companies For Agents

People also ask - Life Insurance Companies For Agents FAQs

How does life insurance work?

Policyholders pay premiums for a life insurance policy. If the policy is in effect when the person dies, the life insurance company pays a death be...Read more

Which is better: term or whole life?

When it comes to term life vs. whole life insurance, the better choice depends on your specific goals. For example, if you’re looking for life insu...Read more

What kinds of death are not covered by life insurance?

Life insurance generally covers all types of death, whether it’s from illness, injury or old age. Even death by homicide and drug overdoses is cove...Read more

Can I buy life insurance on someone else?

You can purchase life insurance on someone else, such as a spouse or a parent, as long as you have an “insurable interest” in that person. That mea...Read more

What is underwriting?

Life insurance underwriting is the process insurers use to decide whether to offer someone a policy and how much to charge. A full underwriting pro...Read more

Should you buy life insurance from an agent?

You can purchase your life insurance from an agent who only represents a single company, or you can choose an independent agent who offers policies from many different insurers. It’s not surprising that millions of people want independent agents to get the best type of policy for their needs.

What products can a life insurance agent sell?

Life insurance agents are permitted to sell insurance products such as life insurance, accident and sickness insurance, individual variable insurance contracts (also called segregated funds), life annuities, disability insurance and critical illness insurance. This licensing guide provides detailed information on the requirements for obtaining ...

What are the best life insurance policies?

Let’s get right into our top picks:

- Haven Life: Overall best life insurance

- Bestow: Affordable term life insurance

- Fabric Life Insurance: Best life insurance for families

- Sproutt: No medical exam life insurance

- Policygenius: 4.8 out of 5 TrustPilot score

- Northwestern Mutual: Best financial planning

- Lincoln Financial Group: Most convenient claims

- New York Life: Most financially stable

Is being a life insurance agent a good job?

This is another reason that becoming an insurance agent is a great choice for a secondary career, as insurance agents have a very high earning potential right from the beginning. According to the BLS, the median wage for insurance agents is $47,860, more than $10,000 more per year than the average median wage for all workers.

Best Life Insurance Companies for Independent Agents (Discounts & Deals) | Clearsurance

Category:

The Hanover Group

Travelers Insurance

West Bend Mutual Insurance

The best life insurance companies for independent agents are some of the best-known. An independent agent may be able to help you find the best policy for the cheapest rates. Learn more.

AL

AK

AZ

AR

CA

CO

CT

DE

FL

GA

HI

ID

IL

IN

IA

KS

KY

LA

ME

MD

MA

MI

MN

MS

MO

MT

NE

NV

NH

NJ

NM

NY

NC

ND

OH

OK

OR

PA

RI

SC

SD

TN

TX

UT

VT

VA

WA

WV

WI

WY

AL

AK

AZ

AR

CA

CO

CT

DE

FL

GA

HI

ID

IL

IN

IA

KS

KY

LA

ME

MD

MA

MI

MN

MS

MO

MT

NE

NV

NH

NJ

NM

NY

NC

ND

OH

OK

OR

PA

RI

SC

SD

TN

TX

UT

VT

VA

WA

WV

WI

WY

AL

AK

AZ

AR

CA

CO

CT

DE

FL

GA

HI

ID

IL

IN

IA

KS

KY

LA

ME

MD

MA

MI

MN

MS

MO

MT

NE

NV

NH

NJ

NM

NY

NC

ND

OH

OK

OR

PA

RI

SC

SD

TN

TX

UT

VT

VA

WA

WV

WI

WY

AL

AK

AZ

AR

CA

CO

CT

DE

FL

GA

HI

ID

IL

IN

IA

KS

KY

LA

ME

MD

MA

MI

MN

MS

MO

MT

NE

NV

NH

NJ

NM

NY

NC

ND

OH

OK

OR

PA

RI

SC

SD

TN

TX

UT

VT

VA

WA

WV

WI

WY

AL

AK

AZ

AR

CA

CO

CT

DE

FL

GA

HI

ID

IL

IN

IA

KS

KY

LA

ME

MD

MA

MI

MN

MS

MO

MT

NE

NV

NH

NJ

NM

NY

NC

ND

OH

OK

OR

PA

RI

SC

SD

TN

TX

UT

VT

VA

WA

WV

WI

WY

Best Life Insurance Companies That Work Directly With Agents (2022) | Clearsurance

Looking for life insurance companies that work directly with agents? Popular brands like Allstate and State Farm are considered some of the best life insurance companies.

AL

AK

AZ

AR

CA

CO

CT

DE

FL

GA

HI

ID

IL

IN

IA

KS

KY

LA

ME

MD

MA

MI

MN

MS

MO

MT

NE

NV

NH

NJ

NM

NY

NC

ND

OH

OK

OR

PA

RI

SC

SD

TN

TX

UT

VT

VA

WA

WV

WI

WY

AL

AK

AZ

AR

CA

CO

CT

DE

FL

GA

HI

ID

IL

IN

IA

KS

KY

LA

ME

MD

MA

MI

MN

MS

MO

MT

NE

NV

NH

NJ

NM

NY

NC

ND

OH

OK

OR

PA

RI

SC

SD

TN

TX

UT

VT

VA

WA

WV

WI

WY

AL

AK

AZ

AR

CA

CO

CT

DE

FL

GA

HI

ID

IL

IN

IA

KS

KY

LA

ME

MD

MA

MI

MN

MS

MO

MT

NE

NV

NH

NJ

NM

NY

NC

ND

OH

OK

OR

PA

RI

SC

SD

TN

TX

UT

VT

VA

WA

WV

WI

WY

AL

AK

AZ

AR

CA

CO

CT

DE

FL

GA

HI

ID

IL

IN

IA

KS

KY

LA

ME

MD

MA

MI

MN

MS

MO

MT

NE

NV

NH

NJ

NM

NY

NC

ND

OH

OK

OR

PA

RI

SC

SD

TN

TX

UT

VT

VA

WA

WV

WI

WY

AL

AK

AZ

AR

CA

CO

CT

DE

FL

GA

HI

ID

IL

IN

IA

KS

KY

LA

ME

MD

MA

MI

MN

MS

MO

MT

NE

NV

NH

NJ

NM

NY

NC

ND

OH

OK

OR

PA

RI

SC

SD

TN

TX

UT

VT

VA

WA

WV

WI

WY

Best Life Insurance Companies Of October 2022 – Forbes Advisor

Here are the top picks in our analysis of the best life insurance companies. See how Lincoln Financial, Prudential, Pacific Life, AIG and others stack up against one another.

Best Credit Cards 2022

Best Travel Credit Cards

Best Airline Credit Cards

Best Rewards Credit Cards

Best 0% APR Credit Cards

Best Cash Back Credit Cards

Best Student Credit Cards

Best Secured Credit Cards

Best First Credit Cards

Best Balance Transfer Credit Cards

Best Gas Credit Cards

Amex Gold Vs. Chase Sapphire Preferred

Amex Platinum Vs. Chase Sapphire Reserve

Chase Sapphire Preferred Vs. Reserve

Amex Gold Vs. Platinum

Chase Freedom Unlimited Vs. Flex

Chase Sapphire Preferred Vs. Venture X

Capital One Venture X Vs. Chase Sapphire Reserve

Personal Loan Rates

Best Personal Loans

Best Debt Consolidation Loans

Best Low-Interest Personal Loans

Best Personal Loans For Fair Credit

Best Bad Credit Loans

Best Joint Personal Loans

Easiest Personal Loans

Best Wedding Loans

Best Personal Loans For Veterans

Best Student Loan Refinance Lenders

Best Student Loans

Best Parent Loan For College

Best Low-Interest Student Loans

Best Graduate Student Loans

Best Medical School Loans

Lenders To Refinance Parent PLUS Loans

Student Loan Forgiveness

Student Loan Forgiveness Calculator

Student Loan Calculator

Student Loan Refinance Calculator

Best Business Loans

Best Business Lines Of Credit

Best Working Capital Loans

Best Unsecured Business Loans

Best Same-Day Business Loans

Best Startup Business Loans

Best Business Loans For Women

Best Business Loans For Bad Credit

Best LLC Loans

Business Loan Calculator

How do I pick a life insurance company | How do I select a life insurance agent .

4:16 - 3 years ago

How do I pick a life insurance company | How do I select a life insurance agent . Roughly 1000 life insurance companies sell life ...

Looking for the Best Life Insurance Companies for Independent Agents? | Smart Choice

The Smart Choice Life program is where your search ends! Choco Harwell, Smart Choice’s life insurance expert, talks about the Smart Choice Life program and why it’s the best opportunity independent insurance agents have to grow their book of business through it.

Just a couple of years ago, many of Smart Choice’s Personal Lines agents were reluctant to sell life insurance policies because of their unfamiliarity with it or their concern that it was a time-consuming task that didn’t have recurring revenue to justify the effort. So much has changed in the past two years, and selling life policies has never been easier.

Choco Harwell has been part of the Smart Choice® brand since 1994. He has spent 40+ years working in the insurance industry, with previous experience as a life insurance agent, sales manager, and independent agency manager. He currently manages the life insurance program offered through Smart Choice®.

As Smart Choice’s life insurance expert, Choco Harwell, sat down with me to talk about the Smart Choice Life program and why it’s the best opportunity independent insurance agents have to grow their book of business through it.

Choco: Smart Choice Life is a robust platform with three different options. Just as you look at Smart Choice on the P&C side, you have multiple companies you can write life with. They are:

Agents can fully immerse themselves in life policies — whether doing the work themselves or handing it off to our team. We certainly have the right fit for each agency’s needs. We can do the same for business life insurance — which can be a complicated part of business and estate planning. All our platforms have an account manager. The agents will have access to the account manager to answer questions. And I’m always here in the home office to field those questions.

Life Insurance Services for Independent Agents & Financial Advisors :: Brokers Alliance

Discover why Brokers Alliance is a key partner for independent insurance agents and life insurance brokerage companies. Rely on us for Term, IUL, and complex case solutions.

Since Brokers Alliance® was founded nearly 40 years ago, our core competency has been to provide all manner of support for the independent life insurance salesperson. Our experienced staff offers training, case design, and on-going support to a-sist you with each and every case.

There are few more noble endeavors than that of providing life insurance to American families, and no better way to provide American families with basic long-term security in an insecure world. Brokers Alliance is proud of our mission of a-sisting and supporting life insurance professionals by providing life insurance services, life insurance training, and life insurance programs. We offer the independent insurance and financial professional with a best-in-class team of life insurance specialists to a-sist in every step of the process, from illustration to underwriting to case placement.

Life insurance is a unique a-set class; it takes a relatively small amount of money (premium) and increases it into a large amount of money (death benefit or retirement income), and delivers that increased value tax-free when families or a business most need it; upon the death of a breadwinner or key business a-sociate, or as an income stream in retirement.

Brokers Alliance is a leading life insurance brokerage a-sisting insurance and financial professionals in the design and placement of life insurance strategies to provide your client with protection now, and retirement income later. Our innovative and unique myAdvisorCloud platform provides you with interactive tools to explain and present life insurance concepts to your clients, and our best-in-class life insurance support team provides expertise in case design, exams and underwriting.

Brokers Alliance is a life insurance IMO that has the expertise and experience to a-sist the insurance professional with the entire range of life insurance solutions, from simple term insurance to complex business and estate planning situations involving permanent policies, and premium financing solutions for high net worth individuals. Don’t trust your reputation and income to amateurs or “Johnny come lately” entrants to Indexed Universal Life Insurance – Brokers Alliance core competency for nearly 40 years is providing expert life insurance support.

Becoming a Life Insurance Agent

Category:

Life Insurance Companies

The pros and cons of becoming a life insurance agent and selling life insurance, a field that can be hard to crack, but can pay off big when you do.

Mary Hall is a freelance editor for Investopedia's Advisor Insights, in addition to being the editor of several books and doctoral papers. Mary received her bachelor's in English from Kent State University with a business minor and writing concentration.

Suzanne is a researcher, writer, and fact-checker. She holds a Bachelor of Science in Finance degree from Bridgewater State University and has worked on print content for business owners, national brands, and major publications.

The retail life insurance industry is not an easy industry to break into or succeed in. According to the Bureau of Labor Statistics (BLS), there were 409,950 life insurance agents in the United States in 2020. With the U.S. population just over 332 million as of April 2020, the size of the life insurance industry provides one agent for every 1,234 people.

This highly competitive environment is conducive to filling America's life insurance needs, but it can prove to be a tough environment for a new agent who typically makes a living on commissions from sales.

The burnout rate for life insurance sales agents is high. More than 90% of new agents quit the business within the first year. The rate increases to greater than 95% when extended to five years.

Best Whole Life Insurance Companies Of October 2022 – Forbes Advisor

Category:

Life Insurance

We evaluated insurers on five important measurements to find the best whole life insurance companies. Before you buy whole life insurance, see the top companies and understand why whole life isn't as simple as it may seem.

Best Credit Cards 2022

Best Travel Credit Cards

Best Airline Credit Cards

Best Rewards Credit Cards

Best 0% APR Credit Cards

Best Cash Back Credit Cards

Best Student Credit Cards

Best Secured Credit Cards

Best First Credit Cards

Best Balance Transfer Credit Cards

Best Gas Credit Cards

Amex Gold Vs. Chase Sapphire Preferred

Amex Platinum Vs. Chase Sapphire Reserve

Chase Sapphire Preferred Vs. Reserve

Amex Gold Vs. Platinum

Chase Freedom Unlimited Vs. Flex

Chase Sapphire Preferred Vs. Venture X

Capital One Venture X Vs. Chase Sapphire Reserve

Personal Loan Rates

Best Personal Loans

Best Debt Consolidation Loans

Best Low-Interest Personal Loans

Best Personal Loans For Fair Credit

Best Bad Credit Loans

Best Joint Personal Loans

Easiest Personal Loans

Best Wedding Loans

Best Personal Loans For Veterans

Best Student Loan Refinance Lenders

Best Student Loans

Best Parent Loan For College

Best Low-Interest Student Loans

Best Graduate Student Loans

Best Medical School Loans

Lenders To Refinance Parent PLUS Loans

Student Loan Forgiveness

Student Loan Forgiveness Calculator

Student Loan Calculator

Student Loan Refinance Calculator

Best Business Loans

Best Business Lines Of Credit

Best Working Capital Loans

Best Unsecured Business Loans

Best Same-Day Business Loans

Best Startup Business Loans

Best Business Loans For Women

Best Business Loans For Bad Credit

Best LLC Loans

Business Loan Calculator

What Is a Life Insurance Agent and Do You Need One?- Ramsey

Category:

Life Insurance Agents

Life Insurance

Insurance Company

A life insurance agent’s job is finding life insurance that meets your needs. We’ll show you what an insurance agent does and how to choose the right one.

FBI agents . . . secret agents . . . life insurance agents. Okay, insurance agents might not be up there in the world of international espionage. Does James Bond have life insurance? If he does, you can bet he got an insurance expert to find the best deal for him!

In the complex world of life insurance, having someone on your side who knows the industry is always a good thing. Hey, even Dave Ramsey has one! An agent is in the best position to find you the ideal life insurance policy for you—whatever your situation.

Life insurance agents are licensed professionals who sell life insurance. They will work for an insurance company and sell policies “carried” by that insurance company, or can work more independently and are able to sell life insurance from a range of companies.

A life insurance agent’s job is to sell life insurance policies. If you call an insurance company looking for a quote, you’ll speak to an agent. This is what they’ll do:

Put together personalized advice for you. They should write up a summary of your call, along with their advice on the sort of life insurance that could work for you. This document is yours to take away and consider before you make any decisions.

Which Life Insurance Company Provides Highest Commission For Agents in 2022? - AETOS Financial

Category:

Insurance Company

The job of being a financial advisor in the Philippines is quite different from other advanced countries. In other countries,

For example, if you will be employed would you choose to work for a company that gives P100,000 per month vs only P50,000 per month for the same level of effort? Most likely you would go for the highest offer. Aside from compensation, financial advisors also look at the kind of products being sold if they are good quality or affordable.

Before this blog was written we took a research among all major life insurance companies in the Philippines to determine which life insurance company provides the highest commission for financial advisors. And here is the result of our research:

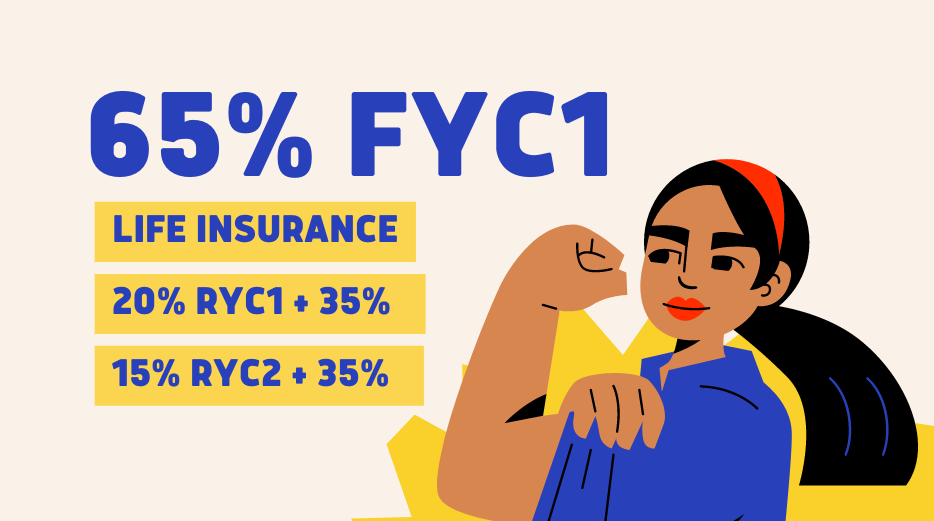

Based on our research Insular Life is the insurance company that provides the highest commission for financial advisors for 2022. This is because for a sale of P30k per year (10 years payment) of its product the agent can earn 65% on the first year (FYC), 27% on the second year and 20% on the third year payments of the client. There are many reasons why Insular Life is able to do this. One of which is that they do not have a lot of layers in the organization. There is just agent, unit manager and agency manager. Just 3 levels.

Let’s simplify and make it clearer. Suppose the financial advisor sold P30,000 per year Multiple Pay VUL plan (lifetime paying or limited premium holiday), this is how much the agent will earn:

Year1: P30,000 x 65% = P19,500 First Year Commission (FYC) *Top of the Table and Court of the Table members earn 75% and not 65% FYC. *Based on the current commission rate for advisors July 2022 – Sept 2022.

The 6 Best Digital Insurance Companies of 2022

Category:

Life Insurance Company

Read reviews and buy from the best digital insurers, including companies such as Metromile, Lemonade, Ladder Insurance, Oscar Health, Root, and more.

Janet Hunt is an expert in car insurance, homeowners insurance, and health insurance with over 20 years of experience covering trends, regulations, and writing company reviews. Her lengthy career in insurance includes stints in customer service and selling personal lines of insurance. She earned her Property and Casualty license in 1995.

Maddy Simpson is a journalist based in St. Louis. She studied at journalism and finance at Bethel University, and worked as a financial analyst at a consulting firm before attending Columbia Journalism School. She's worked on projects at the Columbia Journalism Review, Detroit Free Press, and currently is a fact checker and reporter at various publications, including Investopedia and The Balance.

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

In today’s connected world, insurance customers want products that are linked to the Internet, their preferred method of communicating and receiving information. And many insurers are now offering new digital technologies to meet the needs of today’s consumer. So whether you're looking for health, life, car or home insurance, there are a handful of companies that can help you enroll easily through an app or website. Here are some of the best digital insurance options to buy now.

Lemonade is a digital insurer founded in 2015 offering homeowners, condo, and renters insurance to residents of over 30 states. Customers can buy insurance directly online without the use of an agent. Lemonade is not your typical insurance company. The company keeps a set amount of your paid premium to pay for operating expenses and uses the rest to pay claims. Any unclaimed premium can go to a nonprofit of your choice.

The 20 Largest Life Insurance Companies - Policygenius

Category:

Life Insurance Companies

New York Life and Northwestern Mutual top the list of largest life insurance companies in the U.S. in 2022.

Nupur Gambhir is a licensed life, health, and disability insurance expert and a former senior editor at Policygenius. Her insurance expertise has been featured in Bloomberg News, Forbes Advisor, CNET, Fortune, Slate, Real Simple, Lifehacker, The Financial Gym, and the end-of-life planning service Cake.

Amanda Shih is a licensed life, disability, and health insurance expert and a former editor at Policygenius, where she covered life insurance and disability insurance. Her expertise has appeared in Slate, Lifehacker, Little Spoon, and J.D. Power.

The size of a life insurance company can be measured by how many policyholders it has (its market share) and total premiums received from customers (its direct written premiums). New York Life is currently the largest life insurance company in the U.S., with more than $11.6 billion in direct written premiums. [1]

Choosing a larger life insurance company vs. a smaller one is unlikely to affect your policy on a day-to-day basis. But, bigger life insurance companies can offer higher coverage amounts than smaller companies, while smaller companies might be able to offer more personalized customer service.

Are concerned about financial stability: Life insurance companies rarely go bankrupt, but larger companies provide more peace of mind if you're concerned. Larger companies have bigger cash reserves to tap to pay out claims if they go out of business.

How to Get Appointed as a Life Insurance Agent

Category:

Insurance Company

If you're wondering how to get appointed with life insurance companies, this step-by-step guide will walk you through the process. Learn how to get licensed.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance company and cannot guarantee quotes from any single insurance company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

If you are looking to sell life insurance as a career, you’ll need to earn a life insurance appointment. Life insurance appointments are simply the insurance company giving an agent legal permission to sell on its behalf, but it can be a competitive market to get an appointment in.

If you are looking for how to be appointed as a life insurance agent, we are a-suming you have already passed your state licensing requirements to sell insurance. If not, that is the first step to getting appointed as a life insurance agent.

Different states have different requirements for getting a license, so make sure to read up on the requirements in your area and get your license before you start applying for life insurance appointments.

30 Best Milwaukee Life Insurance Companies | Expertise.com

Category:

Life Insurance

Find and connect with the 30 Best Life Insurance Companies in Milwaukee. Hand picked by an independent editorial team and updated for 2022.

Allied Senior Services Insurance & Investments Ltd. Inc. is an independent health insurance company in Milwaukee, serving the metro area's residents since 1989. Its agents shop from a selection of insurance carriers to find the right policy for each client. They specialize in arranging health insurance for individuals and groups. They also find policies that cover other health care needs, such as long-term medical care and short-term major medical treatments.

American Advantage - Petersen Group partners 20+ insurance companies to ensure it finds the best life insurance policies for its clients. The family-owned and operated agency doesn't use call centers, so clients are sure to speak directly to someone who can help. Every client gets a dedicated account manager who deals with claims and annually reviews their policies. The agency also arranges other forms of insurance to protect drivers, homeowners, and renters.

American Advantage Insurance -TU Agency is a company that offers various types of insurance packages for clients in Milwaukee. It caters to its clients' wide range of personal and business insurance needs. Its life insurance services include whole life, term, children's life, disability, and long-term care. It offers home insurance services that cover primary homes and vacation homes. It also provides auto insurance, including insurance for primary vehicles, motorcycles, and trucks. The company also provides business insurance for restaurants, properties, and workers' compensation.

American Advantage Insurance Group serves clients in and around the Milwaukee metro. It offers life insurance with IPW Insurance, working with the clients to find easy and affordable solutions. Some of the carriers it works with are The Hartford, American Modern Home, Berkshire Hathaway, Liberty Mutual, and Hagerty. The Pewaukee-based business has been in the industry since 1995, partnering with like-minded insurance agencies to be able to offer a wide selection of carriers to the clients.

American Advantage Lindow Insurance is an independent agency that brokers policies from more than 40 insurance carriers for its personal and business clients. The agency arranges multiple types of insurance, including life and health for its personal customers. Its areas of coverage include term life and whole life for life insurance, and health policies that cover a range of needs, from vision and dental to major medical and long-term care.

Best Life Insurance Companies of October 2022

Category:

Life Insurance

Life insurance protects your family if you die, so it’s important to choose a good company. We looked at features like cost and financial stability to determine the best.

Meredith Mangan has 15 years of experience in insurance, personal finance, and publishing, including six years as a licensed life insurance agent and five years as the managing editor for Money Crashers. She joined Dotdash Meredith in 2020 and is currently the Senior Insurance Editor overseeing all insurance-related reviews across Dotdash Meredith, including Investopedia and The Balance. Prior to her editing career, Meredith was a licensed financial advisor.

Richard has been a licensed insurance agent since 2017. He earned a bachelor's degree in literature from Middlebury College and has developed an impressive list of clients, including Citizens Bank, Fidelity Investments, Bank of America, New England Law, Harvard University Development Office, and Northeastern University's College of Arts, Media and Design.

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

Life insurance is a great way to protect your family or leave a legacy. It can cover funeral expenses, medical bills, or long-term costs like mortgage payments while your estate is sorted out. But the path to getting it can vary. If you’re young, healthy, and looking for quick coverage, comparing online life insurance quotes is a great place to start. But if you’re over 50 or in poor health, you may need to work directly with an agent to figure out the best coverage for your needs.

Top Companies Hiring for Insurance Sales Agent Jobs

At a bird’s eye view, Bankers

Life focuses on the

insurance needs of the middle-income retirement market from more than 300 offices across the country. But we are so much more than just an …

Senior Life Insurance Company hiring Insurance Agent in …

Category:

Life Insurance Company

You can build your own business by recruiting people anywhere in the country. Join the

life insurance company that will a-sist you in reaching the level of success you deserve. Please …

Life Insurance Agents | New Jersey - Manta.com

Category:

Life Insurance

Insurance Agents

Excalibur Brokerage Agency is a team of experienced

life insurance brokers who are dedicated to helping

insurance agents to grow their business by providing them with top notch programs …

life insurance agents - leads, quote engine, software

Category:

Life Insurance Agent

Obtaining top search positions and developing leads through pay-per-click advertising is a full time job. Being a

life insurance agent is also a full time job. We are in the business of …

North Bergen, New Jersey Insurance Agents - Nationwide

And many of the same types of

insurance products (liability, property, and fleet

insurance coverage) are needed by small and medium-sized businesses. Likewise, our North Bergen …

Allstate | Car Insurance in North Bergen, NJ - Jesse Henriques

2531 JFK Blvd. North Bergen, NJ 07047. Email. Make an appointment. Call 24/7. (201) 472-6068 to quote by phone. Quote online.

Videos of Life Insurance Companies For Agents

5 Easy Steps to Getting a Contract with Insurance Companies as a New Agent

6:02 - 3 years ago

This is the simplistic way to get a contract, otherwise called a carrier appointment, with an insurance company as a new agent.

Life Insurance Agent Qualifications

5:06 - 3 years ago

Life Insurance Agent Qualifications As mentioned before, a life insurance agent is not a profession for the thin-skinned or faint of ...

How I Grew One of The Fastest Life Insurance Agencies With Dave Whichard

25:37 - 3 years ago

To Work with Family First Life Impact Agency call or text 786-683-3315. Learn more about FFL The Impact Agency ...

David Price Teaching Agents How To Sell On The Phone

2:15 - 3 years ago

As an insurance agent, you sign up for freedom when you get your insurance license. Your most valuable asset is time, and “the ...

You may also like

-

Former President Joe Biden sparked headlines Friday afternoon after stumbling over the word ‘America’ during remarks criticizing the Trump administration at an LGBTQ rights forum in Washington, DC.

-

In the moments before Texas A&M cheerleader Brianna Aguilera fell to her death, witnesses say they heard someone scream, 'Get off me!' — and the so-called 'suicide note' police found deleted from her phone was actually a creative writing essay, her mother’s lawyer revealed Friday.

-

Anna Kepner’s 16-year-old stepbrother was forced out of the family’s Florida home just as federal investigators are reportedly weighing charges against him in the cheerleader’s tragic cruise-ship death.

-

CNN anchor Jake Tapper came under fire Thursday after mistakenly referring to accused D.C. pipe-bomb suspect Brian Cole Jr. as a 'white man.’

-

Police revealed that Texas A&M cheerleader Brianna Aguilera had written—and then deleted—a suicide note on her phone just days before she plunged 17 stories from an Austin apartment building, a fall authorities have now ruled as a tragic act of self-harm.

-

The face of accused D.C. pipe-bomb suspect Brian Cole Jr. has surfaced publicly for the first time since his arrest for allegedly placing explosive devices outside the Republican and Democratic National Committee buildings just before the Jan. 6, 2021, Capitol attack.

-

Ilhan Omar’s connections to a welfare fraud in her Minnesota district are drawing fresh scrutiny as new details come to light—and the story is only getting bigger.

-

State Farm Mutual Automobile Insurance Co. is facing a lawsuit that claims the company misled customers and unfairly profited by selling insurance products from PHL Variable Insurance Co.—a firm regulators say is grappling with a staggering $2.2 billion capital deficit. The alleged shortfall reportedly resulted in policyholders receiving payouts far below what they were originally promised, raising serious questions about transparency, accountability, and who ultimately pays the price.

-

A wealthy California doctor and his wife were gunned down inside their $1.3 million home by their own son — who then fled, set his car on fire, and turned the gun on himself, police said.

-

Before takeoff, one woman on a Delta flight found herself fighting back quiet sobs after catching a glimpse of her seatmate’s hurtful message, lamenting the misery of being squeezed in beside a 'huge woman.'

/business_building_153697270-5bfc47bbc9e77c002636d002.jpg)

/GettyImages-646915426-19fde68419434602a0936cfa89298ed9.jpg)

/GettyImages-1176846967-f5caca8369844478a4d7eeb8572b7e94-2478f74a8c854aed8908eb145a6b2c0b.jpg)