Top FAQs for Health Insurance Premium Cost Calculator

People also ask - Health Insurance Premium Cost Calculator FAQs

Are the premiums paid towards health insurance tax deductible?

Yes, according to the section 80D of the Income Tax Act, you are eligible to claim for tax deductions on premium amount payable towards a health in...Read more

How much time do I require to spend online for calculation of insurance premium?

The best attribute of a health insurance premium calculator is that it is pretty fast and simple. If you use InsuranceDekho’s premium calculator, t...Read more

What is the benefit of using an online medical insuance premium calculator?

The benefits of using an online premium calculator are many. The free premium calculation, simplification of complex calculations, time-saving solu...Read more

Can I reduce my health insurance premium?

Yes. You can reduce the health insurance premium of the selected health insurance policy in the following ways: Purchasing the policy at a young ag...Read more

Does the premium for health insurance policies vary with different health insurance companies?

Yes. The premium for health insurance policies vary with different health insurance companies. For further information about the premium calculator...Read more

What is a health insurance premium calculator?

Health insurance premium calculator is an online tool that gives you an estimate of the health insurance premium that you are required to pay for a...Read more

How to use a health insurance premium calculator?

To use health insurance premium calculator online at InsuranceDekho, you are required to follow the simple steps given below: Visit insurancedekho....Read more

What is the advantage of using an online health insurance premium calculator?

The advantage of using a health insurance premium calculator online is that it not just helps you in saving time but it is also a very cost effecti...Read more

What are the tips to reduce health insurance premiums?

You can use InsuranceDekho’s health insurance premium calculator not only to get an estimate for health insurance premiums, but also to compare hea...Read more

What all details do I need to provide while using the health insurance premium calculator?

You are required to provide information such as your gender, marital status, date of birth, annual income, etc, while using the health insurance pr...Read more

Do you have to pay GST on Health Insurance Premium?

Yes. When buying a health insurance policy, you have to pay the health insurance premium and GST charges at a rate of 18%. For example, the premium...Read more

Does the premium for health insurance policies vary from one insurance provider to another?

Yes. The premium cost for health policies varies from one insurance provider to another. Every insurance company has its guidelines and follows the...Read more

What factors affect health insurance costs?

Several factors affect the healthcare premium rates. Some of them include family medical history, age of the insured person(s), lifestyle, health r...Read more

How can I get medical insurance quotes?

To get quotes for medical insurance policies offered by Care Health Insurance, visit our official website, where you would find various policies as...Read more

How to calculate the medical insurance premium for parents?

To calculate your parent's health insurance premium, access a mediclaim policy premium calculator on CHI's website. Enter the details regarding you...Read more

How to calculate family health insurance premium?

You can use our Family Health Insurance Premium Calculator to know the premium cost of your family medical insurance plan. Use the tool and enter t...Read more

How to compare health insurance premium?

You can compare premium amounts by getting quotations for different health insurance policies with CHI's premium calculator. If you opt for a famil...Read more

How to calculate your health insurance policy premium?

To use the free tool, you are required to follow the simple steps given below:

- Visit InsuranceDekho and click on the Health tab.

- Enter your personal details such as name, age, gender, members to be insured, mobile number, city, email ID, etc.

- Then click on ‘View Instant Quote’.

- There will be several suitable health insurance policies displayed on your screen as per your requirement, along with the estimated premium amount.

More items...

How your health insurance premiums are calculated?

Sum insured is the amount of cover offered by a Health Insurance plan. In other words, medical expenses beyond this amount have to be borne by you. Premiums are directly proportional to the sum insured. The higher the sum insured, the higher the premium amount. *

Is HSA better than PPO?

While the option of opening an HSA is attractive to many people, choosing a PPO plan may be the best option if you have significant medical expenses. Not facing high deductible payments makes it easier to receive the medical treatment you need, and your healthcare costs are more predictable. Unlike HSAs, PPO plans are not investment accounts.

How do you calculate health insurance?

- You should find this amount on your pay stub.

- If it's not on your pay stub, use gross income before taxes. ...

- Multiply federal taxable wages by the number of paychecks you expect in the tax year to estimate your income.

- See what other household income sources to include.

- Adjust all income amounts for expected changes during the year.

Health Insurance Premium Calculator - Calculate Mediclaim Premium Online

Category:

Health Insurance Premium

Health Insurance

Health Insurance Premium Calculator - Calculate health insurance premium online to choose the right medical insurance policy at an affordable cost. Calculate premium for family, senior citizen, arogya sanjeevani policy & more.

A health insurance premium calculator is an online tool that helps a potential health insurance buyer to get an estimate of the premium amount that he/she will be required to pay for a particular health insurance plan. With the rising medical expenses, calculating the premium becomes important.

A health insurance premium calculator is a free tool for calculating premiums for various health insurance plans, as well as comparing and examine different medical insurance policies offered by popular insurance companies online. You can compare health insurance plans on the basis of several factors that include age, gender, profession, number of members covered under a policy, etc. One can also customize their health insurance policies and notice a change in the health insurance premium. This way, using a health insurance premium calculator helps in making a better buying decision.

A health insurance premium is a pre-determined sum of money that a policyholder is required to pay to their respective health insurance company in order to avail coverage and benefits offered under a health insurance plan. To use the health insurance premium calculator and have it calculate the amount of premium that must be paid, a policyholder must provide the necessary information. The information includes sum insured, age, pre-existing illness (if any), number of members that need to be covered under the plan, etc. This information provided by the policyholder acts as a parameter depending upon which the amount of premium would get calculated. If there is an unexpected healthcare emergency or a diagnosis of a specific illness, the respective insurance company will pay all of the benefits and coverage listed in the insurance plan, according to the terms and conditions specified in your health plan.

With a health insurance premium calculator, you can calculate the health insurance premium of your policy by entering a few personal details like medical history, family members to be covered, etc. You will be able to get an estimate of the health insurance premium you will be expected to pay for your health insurance policy based on this information. InsuranceDekho has this tool that you can use to calculate premiums and compare different health insurance policies online, without paying anything for it.

Fill in your personal details as asked in the form displayed. You will have to share your Gender, Age, Members to be insured, City, Name, Mobile Number, and E-mail ID. Click on the ‘View Instant Quote’ option.

Health Insurance Premium Calculator: Mediclaim Premium Calculator

Category:

Calculate Health Insurance Premium

Calculate Health Insurance Premium: Learn more about the Mediclaim Insurance Premium Calculator in India & select the affordable health insurance plan for individuals and families. Click to know how to calculate the health insurance premium and its benefits.

Walk-in to the nearest Axis Bank branch to pay your Renewal Premium conveniently via Cheque/Demand Draft. Please ensure to keep the following in mind while opting for the same:

Please visit during banking hours and ask for ‘Easy Pay’ service counters at Axis Bank branch to deposit your premium.

Please mention your Policy(s)number and Contact number on the reverse of cheque. Instrument should be in favour of "Care Health Insurance Limited"

Make sure to collect the acknowledgement slip before leaving bank’s service counter for any future correspondence.

Postdated/ Outstation/ Third Party cheques are not allowed.

Please ensure the cheque amount is equal to the amount mentioned in renewal invite.

It is advisable to carry a copy of Renewal invite while visiting to Axis Bank branch.

Please ensure to deposit the cheque at least 7 Days prior to the due date. Instrument deposition is not allowed after the policy expiry date.

In case of any modifications in the policy details at the time of renewal, please contact our

branch and do not deposit the cheque in Axis Bank Branch.

Contact respective ‘Axis Bank branch manager’ in case of any difficulty/issue/clarification related to deposition of renewal premium. You may further contact our Customer Service team at 1800-102-4488/1800-102-6655

A mediclaim premium calculator is a user-friendly tool to a-sess the cost of your medical policy. The calculator simplifies complex policy calculations and improves your policy-buying decisions. This way, you need not chase insurers for a quote. Instead, get an initial idea of the estimated premium with just a few clicks! The calculator uses several factors, including:

What’s best is that a health insurance premium calculator helps you get a close to accurate premium cost from the comfort of your place without scheduling any agent visits or calls. The easy-to-understand steps and minimal required information helps you complete the premium calculation without any a-sistance. Should you still need some help, the customer support of Care Health Insurance is just one call away.

As much as health insurance is essential, it is also important to know how much investment you should make in health insurance. As a policyholder, you would prefer to opt for a health plan that comes at an affordable cost and meets your medical needs.

At Care Health Insurance, we help you make an informed decision about your health and money management with our digital health insurance premium calculator. It helps you estimate the cost of securing your health under the desired insurance policy without getting into lengthy calls or visits. This way, you can select the plan with the suitable health benefits and plan your budget accordingly. Calculating health insurance premium is the primary step toward finding an affordable policy for yourself & your family. Read more about how you can calculate health insurance premium through Care Insurance digital portal.

Health Insurance Premium Calculator - Policybazaar

Category:

Health Insurance Premium Calculator

The mortality rate is nothing but the

cost an

insurance company has to bear in a case of an eventuality to a customer. ... Use

health insurance premium calculator to figure out how much …

Types of Health Insurance Costs \u0026 How to Compare Them

13:33 - 3 years ago

Types of Health Insurance Costs & How to Compare Them?- Call us at iHealthBrokers today at 888-410-0344. Our services are ...

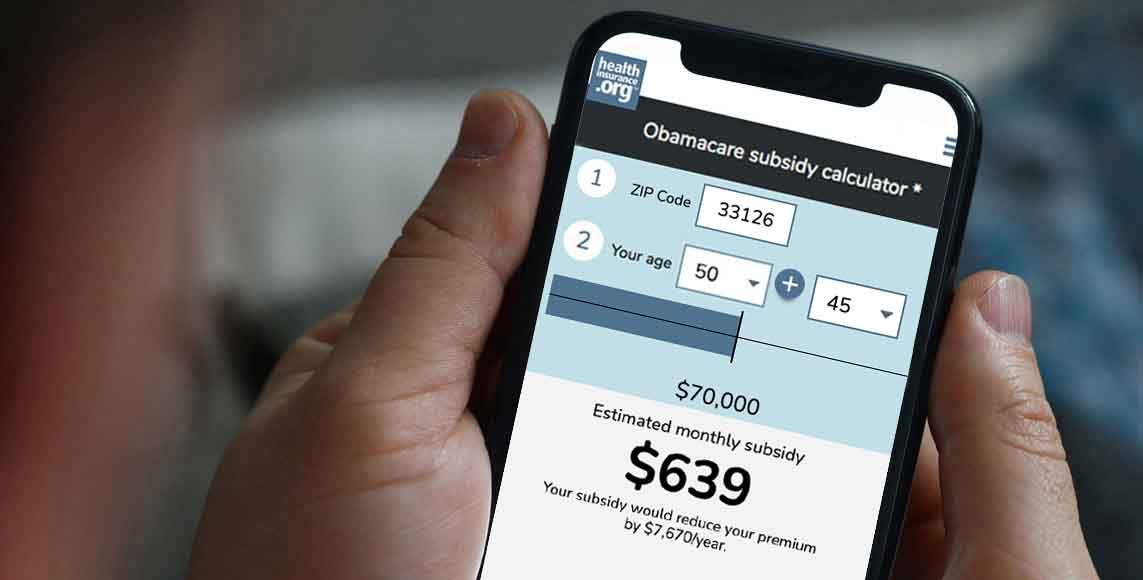

Health Insurance Marketplace Calculator | KFF

The Health Insurance Marketplace Calculator, updated with 2023 premium data, provides estimates of health insurance premiums and subsidies for people purchasing insurance on their own in health insurance exchanges (or “Marketplaces”) created by the Affordable Care Act (ACA).

The Health Insurance Marketplace Calculator provides estimates of health insurance premiums and subsidies for people purchasing insurance on their own in health insurance exchanges (or “Marketplaces”) created by the Affordable Care Act (ACA). With this calculator, you can enter your income, age, and family size to estimate your eligibility for subsidies and how much you could spend on health insurance. You can also use this tool to estimate your eligibility for Medicaid. As eligibility requirements may vary by state, please contact your state’s Medicaid office or Marketplace with enrollment questions. We encourage other organizations to feature the calculator on their websites using the embed instructions.

US Average

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

District Of Columbia

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming

The Health Insurance Marketplace Calculator is based on the Affordable Care Act (ACA) as signed into law in 2010, and subsequent regulations issued by Health and Human Services (HHS) and the Internal Revenue Service (IRS). The calculator includes subsidy increases for 2023 in the Inflation Reduction Act.

Premiums displayed in the calculator’s results are based on actual exchange premiums in 2023 dollars. Premiums were obtained through data published by HHS, data received directly from state exchanges or insurance departments, and data collected from state-based exchanges by KFF researchers. The silver premium is the second-lowest cost silver premium available in the county of the entered zip code and the bronze premium shown is the lowest-cost bronze plan in the county of the entered zip code. Not all plans are available in all parts of the county, so actual premiums may vary depending on plan availability. Premiums shown are the premium portion used for Essential Health Benefits. Actual premiums may be higher if plans include "non-essential benefits" such as dental or vision care.

The premium is adjusted for family size and age of the user. Premiums in the calculator vary by age within the three to one limit specified in the law, using age factors from proposed regulations issued by HHS (or, state specific age factors where states have adopted them). The calculator does not display a tobacco surcharge. However, in most states, insurers can charge a tobacco surcharge of up to 50% of your total premium, and tax credits do not apply to the surcharge. Actual tobacco surcharges will vary by plan and some states do not permit insurers to vary premiums by tobacco status.

How Much Does Health Insurance Cost? – Forbes Advisor

Category:

Health Insurance

Here's a breakdown on health insurance costs, including guidance on how to save money and find a better plan.

Best Credit Cards 2023

Best Travel Credit Cards

Best Airline Credit Cards

Best Rewards Credit Cards

Best 0% APR Credit Cards

Best Cash Back Credit Cards

Best Student Credit Cards

Best Secured Credit Cards

Best First Credit Cards

Best Balance Transfer Credit Cards

Best Gas Credit Cards

Best Credit Cards For No Credit

Amex Gold Vs. Chase Sapphire Preferred

Amex Platinum Vs. Chase Sapphire Reserve

Chase Sapphire Preferred Vs. Reserve

Amex Gold Vs. Platinum

Chase Freedom Unlimited Vs. Flex

Chase Sapphire Preferred Vs. Venture X

Capital One Venture X Vs. Chase Sapphire Reserve

Personal Loan Rates

Best Personal Loans

Best Debt Consolidation Loans

Best Low-Interest Personal Loans

Best Personal Loans For Fair Credit

Best Bad Credit Loans

Best Joint Personal Loans

Easiest Personal Loans

Best Wedding Loans

Best Personal Loans For Veterans

Compare Personal Loans

Best Student Loan Refinance Lenders

Best Student Loans

Best Parent Loan For College

Best Low-Interest Student Loans

Best Graduate Student Loans

Best Medical School Loans

Lenders To Refinance Parent PLUS Loans

Student Loan Forgiveness Calculator

Student Loan Forgiveness Programs

Student Loan Calculator

Student Loan Refinance Calculator

Best Business Loans

Best Business Lines Of Credit

Best Working Capital Loans

Best Unsecured Business Loans

Best Same-Day Business Loans

Best Startup Business Loans

Best Business Loans For Women

Best Business Loans For Bad Credit

Fast Approval Business Loans

Best LLC Loans

Business Loan Calculator

Health Insurance Premium Cost Calculator

Category:

Health Insurance

discover Health Insurance Premium Cost Calculator. Find articles on fitness, diet, nutrition, health news headlines, medicine, diseases

(6 days ago) A health insurance premium is a pre-determined sum of money that a policyholder is required to pay to their respective health insurance company in order to avail …

(1 days ago) Here’s how we calculate health insurance premium: Suppose the sum insured is Rs 5 lakh for a policy term of 1 year. The premium includes 18% GST. Age (in years) Premium for …

(7 days ago) Here’s how you can go about using one -. To use SMC’s Health Insurance Premium Calculator, visit our website and click on ‘Health Insurance’. Select the members you want to insure and …

(Just Now) In return for the premium, the insurance company is liable to pay for medical costs and hospitalization expenses if a medical emergency arises or an illness is diagnosed. A health …

(4 days ago) The average monthly premiums for a Bronze ACA health insurance plan is $928. The average monthly costs increase to $1,217 for a Silver plan and $1,336 for a Gold plan. …

Health Insurance Plan Comparison Calculator

Category:

Health Insurance

2. If you let this sit for a while, the server will clear your entries. So if you have to walk away, you should grab a screen shot first, print, or download the data so you can pull it into a spreadsheet.

This calculator’s especially good at helping you rule out the bad deals and focus on the better ones. Enter premiums (after subsidies) and other values for the plans you’re considering, then roll over the lines in the graph to see your total outlays.

An example of how to use this: Why would anyone buy the purple plan here for an extra thousand dollars a year, instead of the green plan, which offers the same or better financial protection? Turn off the blue and orange checkboxes to see that comparison clearly, and zoom the X axis to get a close-up look at how more-typical healthy years will play out.

A note on zero-percent coinsurance. If you enter zero for the coinsurance percentage (the share you pay after you’ve spent the deductible limit, until you hit the out-of-pocket limit), the graph will show you never paying more than the deductible — never getting to the OOP. But some things in your plan probably aren’t 0% coinsurance. You will pay more, even after your deductible. So: If your plan has 0% coinsurance, still, enter some percentage — 10% or whatever — in this field to see your actual annual out-of-pocket exposure on the graph.

Many plans have fixed (generally low) co-pay amounts instead of percentage “co-insurance” for many services, even before you reach your deductible. There’s no way to display that without you entering how many visits, lab tests, etc. you might have. (Gets way too complicated.) Enter your plan’s percent coinsurance, and figure your outlays will be somewhat lower than what you see above because of the low fixed copays for office visits etc.

Marketplace health insurance plans and prices | HealthCare.gov

Category:

Health Insurance

null

Preview health plans and price quotes in your area. See your Obamacare health insurance coverage options now, apply & save.

A federal government website managed and paid for by the U.S. Centers for Medicare & Medicaid Services. 7500 Security Boulevard, Baltimore, MD 21244. Health Insurance Marketplace® is a registered trademark of the Department of Health and Human Services.

2023 Obamacare subsidy calculator | healthinsurance.org

Category:

Health Insurance Premiums

Our ACA subsidy calculator estimates your premium subsidy based on your income, age and household size. 89% of exchange enrollees for 2022 received premium subsidies.

Your age

Age

18 years19 years20 years21 years22 years23 years24 years25 years26 years27 years28 years29 years30 years31 years32 years33 years34 years35 years36 years37 years38 years39 years40 years41 years42 years43 years44 years45 years46 years47 years48 years49 years50 years51 years52 years53 years54 years55 years56 years57 years58 years59 years60 years61 years62 years63 years64 years

If you’re worried about the cost of health insurance premiums in the exchange/marketplace, it might help to know that – thanks to the Affordable Care Act’s generous subsidies, which have been temporarily enhanced under the American Rescue Plan and Inflation Reduction Act – your premiums could end up a lot lower than you expect.

Exchange / marketplace enrollment hit a record high in 2022, and more people are eligible for subsidies now that the American Rescue Plan has temporarily eliminated the “subsidy cliff.” Of the 14.5 million people who enrolled in private coverage through the exchanges during the open enrollment period for 2022, 89% were receiving premium subsidies.

Yet about two-thirds of uninsured Americans aren’t aware of the financial a-sistance that’s available for health insurance coverage. If you haven’t shopped for health coverage lately, it’s important to compare the available options during the open enrollment period for 2023 coverage. You might be surprised at how large your subsidy is, and how affordable your after-subsidy premium ends up being.

The subsidies are tax credits, which means you can opt to pay full price for your coverage (purchased through the exchange in your state) each month, and then get your tax credit when you file your tax return. But unlike other tax credits, the subsidies can be taken throughout the year, paid directly to your health insurer to offset the cost of your coverage.

Your total costs for health care: Premium, deductible, and out-of-pocket costs | HealthCare.gov

Get tips on comparing & choosing a health plan that make the process simpler

When choosing a plan, it’s a good idea to think about your total health care costs, not just the bill (the premium”) you pay to your insurance company every month.

When choosing a plan, it’s a good idea to think about your total health care costs (including the premium, deductible, and copayment/coinsurance amounts), the health and drug services you'll use, the health plan category that works best for you, and plans with easy pricing.

The amount you pay for your health insurance every month. In addition to your premium, you usually have to pay other costs for your health care, including a deductible, copayments, and coinsurance. If you have a Marketplace health plan, you may be able to lower your costs with a premium tax credit.

The Marketplace has 4 health plan categories to help you compare plans: Bronze, Silver, Gold, and Platinum. They’re based on how you and the plan share the costs for care you get.

Generally, categories with higher premiums (Gold, Platinum) pay more of your total costs of health care. Categories with lower premiums (Bronze, Silver) pay less of your total costs. (But see the exception about Silver plans below.)

If you don’t expect to use regular medical services and don’t take regular prescriptions: You may want a Bronze plan. These plans can have very low monthly premiums, but have high deductibles and pay less of your costs when you need care.

Eligibility & Premium Calculator | Medicare

Estimate my

Medicare eligibility &

premium. Get an estimate of when you're eligible for

Medicare and your

premium amount. If you don't see your situation, contact Social Security (or the …

Health Insurance Premium Calculator - Calculate Mediclaim Premium Online

Category:

Health Insurance Premium

Calculate health insurance premium online to buy the right medical insurance policy at an affordable cost. Calculate your mediclaim premium instantly from leading health insurance companies in india.

1 Lakh

1.5 Lakh

2 Lakh

2.5 Lakh

3 Lakh

3.5 Lakh

4 Lakh

4.5 Lakh

5 Lakh

5.5 Lakh

6 Lakh

6.5 Lakh

7 Lakh

7.5 Lakh

10 Lakh

15 Lakh

20 Lakh

25 Lakh

30 Lakh

40 Lakh

50 Lakh

60 Lakh

75 Lakh

1 Crore

0-17 Years

18 Years

19 Years

20 Years

21 Years

22 Years

23 Years

24 Years

25 Years

26 Years

27 Years

28 Years

29 Years

30 Years

31 Years

32 Years

33 Years

34 Years

35 Years

36 Years

37 Years

38 Years

39 Years

40 Years

41 Years

42 Years

43 Years

44 Years

45 Years

46 Years

47 Years

48 Years

49 Years

50 Years

51 Years

52 Years

53 Years

54 Years

55 Years

56 Years

57 Years

58 Years

59 Years

60 Years

61 Years

62 Years

63 Years

64 Years

65 Years

66 Years

67 Years

68 Years

69 Years

70 Years

71 Years

72 Years

73 Years

74 Years

75 Years

76 Years

77 Years

78 Years

79 Years

80 Years

81 Years

82 Years

83 Years

84 Years

85 Years

86 Years

87 Years

88 Years

89 Years

90 Years

91 Years

92 Years

93 Years

94 Years

95 Years

96 Years

97 Years

98 Years

99 Years

100 Years

- Select Age -

18 Years

19 Years

20 Years

21 Years

22 Years

23 Years

24 Years

25 Years

26 Years

27 Years

28 Years

29 Years

30 Years

31 Years

32 Years

33 Years

34 Years

35 Years

36 Years

37 Years

38 Years

39 Years

40 Years

41 Years

42 Years

43 Years

44 Years

45 Years

46 Years

47 Years

48 Years

49 Years

50 Years

51 Years

52 Years

53 Years

54 Years

55 Years

56 Years

57 Years

58 Years

59 Years

60 Years

61 Years

62 Years

63 Years

64 Years

65 Years

66 Years

67 Years

68 Years

69 Years

70 Years

71 Years

72 Years

73 Years

74 Years

75 Years

76 Years

77 Years

78 Years

79 Years

80 Years

81 Years

82 Years

83 Years

84 Years

85 Years

86 Years

87 Years

88 Years

89 Years

90 Years

91 Years

92 Years

93 Years

94 Years

95 Years

96 Years

97 Years

98 Years

99 Years

- Select Age -

<1 Year

1 Years

2 Years

3 Years

4 Years

5 Years

6 Years

7 Years

8 Years

9 Years

10 Years

11 Years

12 Years

13 Years

14 Years

15 Years

16 Years

17 Years

18 Years

19 Years

20 Years

21 Years

22 Years

23 Years

24 Years

25 Years

- Select Age -

<1 Year

1 Years

2 Years

3 Years

4 Years

5 Years

6 Years

7 Years

8 Years

9 Years

10 Years

11 Years

12 Years

13 Years

14 Years

15 Years

16 Years

17 Years

18 Years

19 Years

20 Years

21 Years

22 Years

23 Years

24 Years

25 Years

Reliance Health Insurance Premium Calculator Online

Category:

Health Insurance Calculator

Reliance health insurance premium calculator- Calculate your Reliance health insurance policy premium online, features, how to use, tax exemption & more.

Reliance health insurance calculator is a unique online tool which will render service to calculate the estimated health insurance premium. The premium has to be paid during the purchase of the policy or during the renewal time, as per your budget and overall requirements.

You may always go through various health insurance plans and compare them as per your affordability using the health insurance premium calculator, which will only guide you with an estimate of the premium. This could help you in the calculation of premiums absolutely easily, online mode during the purchase of your customised health insurance plan. The Reliance health insurance calculator gives you the estimated amount, but it can work out the exact premium applicable to a particular policy if you provide your own policy coverage details.

Reliance health mediclaim premium calculator will help you to analyse and calculate all health insurance plans in one portfolio when you would purchase a new policy or customise the one already purchased in time of renewal. You can always have a check and balance on the estimated premium amount. The plan can be easily edited online and any alteration in the plan can be done as per your requirements.

You can use the Reliance health calculator multiple times to calculate different coverages which will help you to select your perfect policy plan if you have not chosen the correct one as per your affordability, you can always modify it without any complications.

Reliance health insurance premium calculator helps you to analyse the estimated amount by comparing the health insurance plans of different policies online, and it also helps you to buy the affordable plan as per your requirement. You can acquire the coverage just by following some online simple steps and providing the required information to the company.

Health Insurance Premium Calculator Online - Calculate Mediclaim Premium | Kotak General Insurance

Category:

Health Insurance Calculator

Health Insurance Premium Calculator - Calculate health insurance premium online to choose the right medical insurance policy at an affordable cost. Calculate premium for individual, family, and senior citizen policy & more with Kotak General Insurance

Are you planning to buy Kotak Health Insurance policy? Using this health insurance premium calculator tool, you can simplify your concerns about premium costs and find a health policy that fits your need budget. The Health Insurance Calculator is an online, free tool that estimates the premium payable for a health insurance plan. This will help you buy the best health insurance plan based on factors such as age, profession, gender, and family members, including medical history covered, among others. If you choose any add-on cover to enhance your existing health insurance, you can readily know the cost of the premium in an instant.

Choosing the best health insurance policy in India can be very easy if you have the proper guidance right from the start. Using the online health insurance calculator is one of the mediums to make the entire policy buying process hassle-free,

especially when it comes to a-sessing the premium cost. So, below are some of the benefits of a health insurance calculator:

The health insurance premium calculator tool helps you determine the exact premium cost you would incur for a health plan so that you can plan your finances in a better way.

You will be required to provide complete health records when applying for a health insurance policy. If you have any pre-existing medical condition such as diabetes or high blood pressure, the premium will be higher.

The BMI will determine the premium for an applicant. Individuals with a high BMI will have a higher premium rate because a higher BMI may lead to a number of medical conditions and illnesses.

Will you save? Do a quick check | HealthCare.gov

When you apply for Marketplace coverage, you may be eligible for premium tax credits and other savings on a private insurance plan.

Check if you might save on Marketplace premiums, or qualify for Medicaid or Children's Health Insurance Program (CHIP), based on your income. Or, find out who to include in your household and how to estimate income before you apply.

You can probably start with your household’s adjusted gross income and update it for expected changes. (Savings are based on your income estimate for the year you want coverage, not last year.)

A federal government website managed and paid for by the U.S. Centers for Medicare & Medicaid Services. 7500 Security Boulevard, Baltimore, MD 21244. Health Insurance Marketplace® is a registered trademark of the Department of Health and Human Services.

HHS.gov

A federal government website managed and paid for by the U.S. Centers for Medicare & Medicaid Services. 7500 Security Boulevard, Baltimore, MD 21244. Health Insurance Marketplace® is a registered trademark of the Department of Health and Human Services.

Sorry, that email address is invalid.

Sorry, that mobile phone number is invalid.

You need to provide either your email address or mobile phone number.

You need to provide either your email address or mobile phone number.

Please select a topic.

Please enter your email address.

Premium Contribution Calculator - SHBP/SEHBP

How much will your health coverage cost for 2022? Horizon BCBSNJ’s premium contribution calculator can help you manage your health care premium costs. This tool can help you estimate your annual contribution toward the cost of your health plan. After you see your estimated cost you can select up to three plans to view a side by side comparison of each plans benefits.

This calculator is for informational purposes only. All calculations are estimates and may differ from the actual amounts deducted from payroll. Estimates of cost are only valid for the plan year indicated and all plan rates are subject to change each plan year (January - December)

Please be aware you have clicked on a link to a visit another site operated by a third party. Horizon Blue Cross Blue Shield provides such links for your convenience and reference only. Horizon Blue Cross Blue Shield, and its subsidiary companies do not control these sites, and are not responsible for their content or the products and services offered therein.

Please be aware when you travel from the Horizon Blue Cross Blue Shield site to another site, whether through links we provide or otherwise, you will be subject to the privacy policies (or lack thereof) of those sites. Horizon Blue Cross Blue Shield cautions you to use good judgment and to determine the privacy policy of such sites before you provide any personal information.

Health Insurance Premium Calculator Online | HDFC ERGO

Category:

Health Insurance Premium Calculator

Calculate Health Insurance Premium

Health Insurance Premium Calculator - Calculate health insurance premium online to choose the right medical insurance policy at an affordable cost. Calculate premium for individual, family, senior citizen policy & more.

Health Insurance Plans are designed to offer wider health coverage to reduce the burden on finances at the time of medical emergency. Before buying a

health insurance

policy online, it’s advisable to read the list of coverages, exclusions and waiting periods. Similarly, calculating the premium amount is equally important. Health Insurance premium calculator helps you compare between

various plans based upon your requirements. Though, premium shouldn’t be the only factor in choosing health insurance plans. It helps you know the quotes to pick the right plan.

Calculating health insurance premium with HDFC ERGO is simple, easy and convenient. Simply click on the “Calculate My Health Insurance Premium” and generate health insurance premium effortlessly. By entering your personal details and insured and their age you can calculate your premium easily.

Trust redefines relations at HDFC ERGO. We consistently strive to make insurance easier, more affordable and more dependable. Here promises are kept, claims are fulfilled and lives are nurtured with utmost commitment.

We understand that in times of distress, instant help is the need of the hour. With our 24x7 customer care and dedicated claims approval team, we ensure to be your constant support system in times of need.

We go beyond health insurance, caring for your body as well as mind. my:health services application will help you embrace a healthy lifestyle. Get your health card, track your calorie intake, monitor your physical activity and enjoy well-being

at its best.

Health Insurance Premium Calculator: Calculate Mediclaim Policy Premium Online

Category:

Health Insurance Premium Calculator

Health Insurance

Health Insurance Premium Calculator: Calculate Policy Premium online to choose the right medical insurance plan at an affordable cost. Calculate health insurance premiums for family, senior citizens & more.

Comprehensive policy for the whole family. Comes with exclusive benefits like no room rent capping, no co-payment, OPD cover & lifelong renewability. Coverage starts from ₹5 lakh for a monthly premium

as low as ₹542*.

The monthly premium mentioned for ICICI Lombard Complete Health Insurance is the policy base premium calculated based on a persona of an individual with age of 21 years.

A health insurance policy is imperative to protect yourself and your family members against the hefty healthcare costs a-sociated with a medical emergency. However, before buying any health policy, it’s crucial to consider several factors, including sum insured, policy inclusions and exclusions, waiting period etc.

Likewise, calculating and comparing the premiums you need to pay for the policy is also very important. A health insurance premium calculator is an online tool that helps you to get an estimate of the premium amount you are required to pay for a particular health insurance policy.

To use this calculator, all you need to do is enter a few basic details such as your age, number of members you want to include in the policy, add-ons you want to buy, and pre-existing ailments. Along with that, you will also be asked to choose your preferred sum insured and duration for the policy.

Health insurance premium is an amount you need to pay to the insurance provider at definite intervals to keep your health insurance policy active. In return, the insurer is liable to pay for hospital bills and other healthcare expenses incurred by you in the event of a medical emergency or diagnosis of an ailment covered by the policy.

Health Insurance Premium Calculator Online| RenewBuy

Category:

Health Insurance Premium Calculator

Health Insurance Premium

Our Health Insurance Premium Calculator helps you to calculate the health insurance premium of different policies according to your coverage needs.

Health Insurance Premium Calculator helps you to determine the premium to be paid for purchasing or renewing your insurance policy. In the modern era, even the most complex calculations can be done with the help of computers. Health Insurance Premium Calculator is an online tool that takes various inputs and information from the policyholders and allows them to calculate the exact amount to be paid. But, before we discuss the health insurance premium calculator, let us refresh your memory about insurance premiums.

The health insurance premium is the amount you pay to the health insurance company to avail coverage benefits and ensure that the medical insurance policy remains active. In return for the premium, the insurance company is liable to pay for medical costs and hospitalization expenses if a medical emergency arises or an illness is diagnosed. A health insurance calculator helps you calculate your health insurance premium amount per your coverage needs.

An individual can buy a health insurance plan for a specified period in exchange for paying monthly or annual premiums. During this period, if an insured person is involved in an accident or is diagnosed with an illness, the health insurance company will cover the cost of any medical care required, subject to certain exclusions mentioned in the policy. The health insurance premium is the amount you are expected to pay regularly to keep your health insurance plan active.

Health Insurance Premium Calculator not only helps you calculate your premium but also helps you save money by making the right choice. Here are some reasons why you should opt for a Health Insurance Calculator:

It simplifies the calculation and gives you the exact amount you will need to pay as the premium for your health insurance policy. Hence, you can plan your finances accordingly and invest in the policy that suits your budget.

Star Health Insurance Premium Calculator, Online Chart 2022

Videos of Health Insurance Premium Cost Calculator

How Much You Pay For Health Insurance In F.I.R.E Will Shock You!

6:24 - 3 years ago

Health insurance costs have risen dramatically over the years and many potential early retirees are worried that they won't be ...

HOW TO USE LIFE INSURANCE CALCULATOR

5:14 - 3 years ago

Health insurance is a contract that requires an insurer to pay some or all of a person's healthcare costs in exchange for a premium ...

2023 Medicare Costs: Medicare AEP

30:19 - 3 years ago

Costs have finally been released for Original Medicare in 2022. Call us at iHealthBrokers at 888-410-0344. Our services are ...

What Insurance You Need

5:52 - 3 years ago

Description: This video introduces the 4 common types of insurances for individuals. For those looking to secure their families in ...

You may also like

-

Anna Kepner’s younger stepbrother—a suspect in her murder—was reportedly obsessed with the Florida cheerleader and once even climbed onto her while she slept, according to the father of her slain 18-year-old ex-boyfriend.

-

A teenage apprentice at a woodshop in Turkey has died after coworkers forced a high-pressure air hose into his rectum in a brutal so-called ‘prank’ — the latest case in which this reckless misuse of an air compressor has ended a young man’s life by causing catastrophic internal injuries.

-

Florida cheerleader Anna Kepner’s killing has taken a dark turn, as court documents reveal her 16-year-old stepbrother is now considered an FBI suspect — all while unsettling new allegations surface about the family behind closed doors.

-

One of Jeffrey Epstein’s victims has revealed that the convicted pedophile had an ‘extremely deformed’ penis, oddly shaped like a lemon.

-

Federal investigators may be zeroing in on the stepsibling of a Florida high school cheerleader whose body was discovered wrapped in a blanket and hidden under a bed aboard a Carnival cruise ship, according to a startling new court filing.

-

A Florida high school cheerleader who died aboard a Carnival Cruise ship was reportedly discovered by a cabin steward—wrapped in a blanket and hidden under a bed.

-

An Illinois teenager was discovered dead in an RV behind her home just hours after she was reported missing on Friday — and now a suspect with a troubling criminal past has been charged with killing the promising young wrestler.

-

New York Jets cornerback Kris Boyd was shot and critically injured in Midtown early Sunday morning and is now fighting for his life at Bellevue Hospital, authorities and team officials said.

-

President Trump says the proposed $2,000 ‘tariff dividend’ checks are on the way — but the official payout date is still up in the air.

-

John Neal won’t even get to start at AIG—his tenure ended before it ever began.