Have you unknowingly had Consumer Credit Insurance added to your policy? We check your policies and get back what you are owed.

When applying for a personal loan, a credit card, or a mortgage, you might be offered an optional product called Consumer Credit Insurance or Loan Protection Insurance. Its job is to cover you in the event you are unable to make the payments to your loan due to circumstances out of your control. There are different types of cover and policies available, and no two polices are the same! But they generally cover situations like death, unemployment, disability, and illness or injury that is preventing you from earning an income. It is also important to understand that sometimes CCI may not cover all of the debt that you owe, and potentially it might only pay out a percentage of the outstanding debt, if the claim isn’t denied or withdrawn. Now this would depend on your exact policy inclusions and exclusions, which should have been explained to you. Including any pre-existing health conditions that could have an affect on the policy paying you. Can be so confusing!

Consumer Credit Insurance is bought with the intention of providing cover in the event that the consumer cannot make credit repayments due to death, unemployment, disability, illness, or injury. It should be sold as a precautionary product, but is often marketed as a necessity for all, and as protection for something that is likely, and almost surely going to happen. After a few risky stories later…. you may find yourself scared not to have it! If the insurance conversation was even had in the first place of course.

Selling the insurance to someone who might already be covered by another policy – potentially through their employment contracts or through Life, Income, and Home insurance that you may have already purchased

Unfortunately, one of the most deceitful forms of mis-sold insurance comes from lenders discreetly including it into your original loan documentation and paperwork without you knowing about it or having agreed to it. It is Australian Law that before you buy insurance you are provided the product disclosure document to read and understand. This will help you make a decision if the Insurance is right for you by choice.

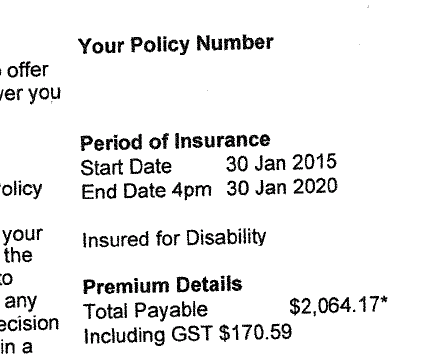

Most consumers were never given these documents to risk highlighting the insurance they had paid for. If you were lucky enough to be given your Certificate of Insurance this should have an itemised listing of the insurance products you have purchased, along with important information such as: