The easiest way to save money on your auto insurance bill is to compare quotes from multiple companies. Find out how with our latest guide.

At Compare.com, it’s our mission to find simple ways to help our customers save money on the things they need. While we partner with some of the companies and brands we talk about in our articles, all of our content is written and reviewed by our independent editorial team and never influenced by our partnerships. Learn about how we make money, review our editorial standards, and reference our data methodology to learn more about why you can trust Compare.com.

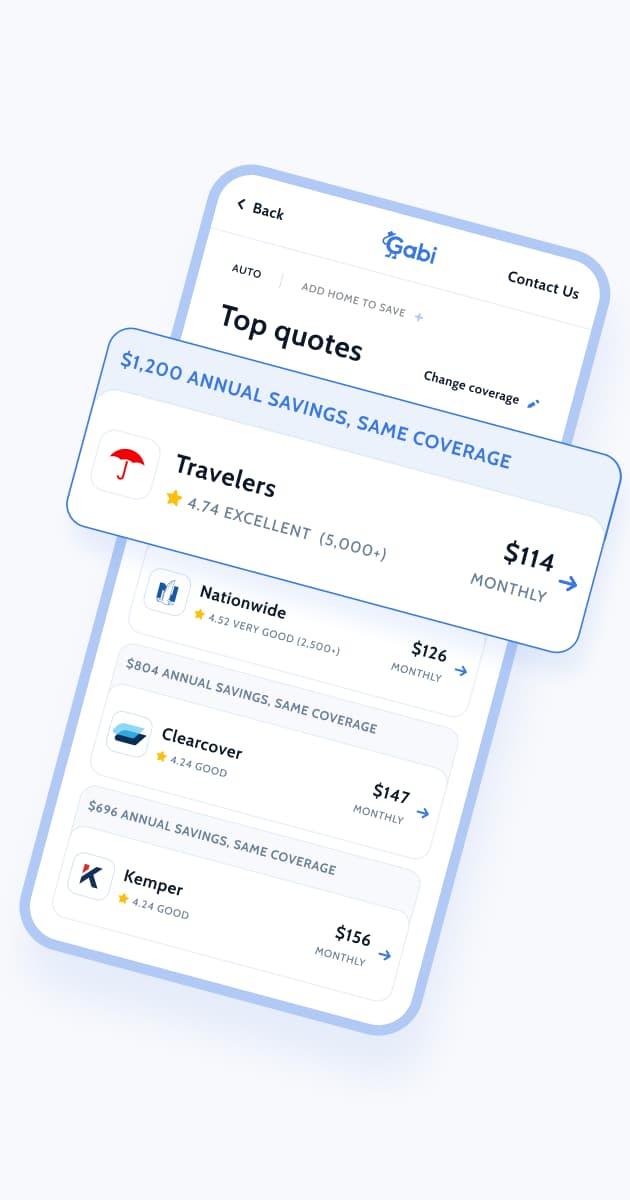

If you want to save money on your car insurance bill every month, there’s only one fast, easy, and free way to do it — getting quotes from multiple companies and comparing the rates they offer head-to-head. But with hundreds of car insurance companies out there, where do you even start? In our comprehensive guide below, we’ve broken down average rates from some of the country’s top insurance carriers and put together a list of everything you’ll need to know to start saving today.

Just about every auto insurance company out there has advertisements on TV or online about saving you money on car insurance, but how are you supposed to know which one really offers the cheapest rates? While rates can vary quite a bit from driver to driver, the same can be said for insurance companies.

As you can see, rates can vary wildly from one company to the next. Companies like American Family, Erie Insurance, and State Farm have some of the cheapest average rates, while other companies’ prices can be over twice as expensive. That’s why it’s so important to compare auto insurance rates.

But just looking at the national averages doesn’t necessarily paint the whole picture. Car insurance pricing can vary drastically from person to person, and since no two drivers are the same, just because one company has the cheapest average rates, it doesn’t mean they’ll necessarily be the cheapest for you.

![Compare the Best Car Insurance Rates [September 2022] | Compare.com](https://www.compare.com/wp-content/uploads/2020/09/keenan-constance-ywWkgJ6M0vs-unsplash-scaled.jpg)

![Compare Car Insurance Quotes and Rates [Updated 2022] - Insurance.com](https://www.insurance.com/images/icom-default-twittercard.fw.jpg)