Top FAQs for Compare Health Insurance Prices

People also ask - Compare Health Insurance Prices FAQs

Does health insurance cover pre-existing conditions?

You can still take out private health insurance if you have a pre-existing condition, but it’s unlikely to be covered under your policy. For instan...Read more

What won’t private health insurance cover?

Private medical insurance is designed to complement NHS care and doesn’t usually cover pre-existing medical conditions or chronic conditions such a...Read more

What optional extras can you get with private health insurance?

In some cases, you can tailor the policy to your needs and budget. You could include add-ons like: Dental care Eye care Physiotherapy Complementary...Read more

Do I have to review my health insurance every year?

Some insurance providers automatically renew your private healthcare cover so you don’t need to do anything. But it’s a good idea to compare polici...Read more

Can I add other people to my private health insurance policy?

In most cases, yes. With joint health insurance, you can add your partner to your plan, while family health insurance lets you add your children to...Read more

Is there an age limit for health insurance?

You’ll usually need to be over 18 to take out your own policy, but anyone younger can normally be added to a family policy. There can also be an up...Read more

Is it better to pay monthly or annually for health insurance?

Like many insurance products, you can save by paying for health insurance annually, rather than monthly. But it depends on your insurance provider....Read more

Do I need private health insurance if I’m covered through work?

If the organisation you work for offers private health insurance as part of your benefits package, you probably don’t need extra medical cover. But...Read more

Will I need a medical exam to get covered?

No. If you don’t have any pre-existing conditions, you don’t usually need a medical to get cover. You’ll just need to fill out a medical history fo...Read more

Do I need a GP referral to access private healthcare?

Not always – you can get private treatment without a referral from your GP. However, some insurance providers won’t cover your treatment without a...Read more

What is the cheapest health insurance you can get?

- Medicaid: It's free or very low-cost if you qualify

- An IRS tax credit that can offset or even cover the cost of a plan

- A cheap, short-term plan, because IRS rules changed to allow you to keep one of these for up to one year

How can I compare affordable health insurance?

- Shop online and compare plans that cover essential health benefits as required by the Affordable Care Act.

- Apply for financial help to lower your health insurance costs.

- Work with certified experts who can answer questions and guide you through enrollment at no cost to you.

What is the average cost of individual health insurance?

In 2020, the average national cost for health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans.

Can a health insurance comparison save me money?

You will be able to save money by comparing health insurance policies from different insurance providers, as well as by comparing different health insurance plans from the same provider. Start your comparison of health insurance rates with us by just typing your zip code in the box above.

Compare Health Insurance Rates | compare.com

Category:

Health Insurance Rates

Compare Health Insurance Quotes from Multiple Insurers at Once. Get a rate today!

Disclaimer: Compare.com does not offer medical advice and is in no way a substitute for any medical advice received from health professionals. Compare.com is unable to offer any advice on any medical procedure you may need.

©2022 Compare.com. All rights reserved. Compare.com is a registered trademark. Compare.com Insurance Agency, LLC is a Virginia domiciled licensed insurance agency in 51 US jurisdictions. Licensing information may be found above. Compare.com does business in California as Comparedotcom Insurance Agency, LLC (License: 0I22535). Admiral Group plc. is a majority member of compare.com.

Health insurance plans & prices | HealthCare.gov

Category:

Health Insurance

Get

health plans and

price quotes for your area. See Obamacare

health insurance coverage options to save on premiums.

Marketplace health insurance plans and prices | HealthCare.gov

Category:

Health Insurance

Preview health plans and price quotes in your area. See your Obamacare health insurance coverage options now, apply & save.

If you qualify for a Special Enrollment Period to enroll in or change coverage for the rest of 2022, you can view 2022 plans and prices now. Answer a few quick questions to find out if you qualify.

A federal government website managed and paid for by the U.S. Centers for Medicare & Medicaid Services. 7500 Security Boulevard, Baltimore, MD 21244. Health Insurance Marketplace® is a registered trademark of the Department of Health and Human Services.

HHS.gov

A federal government website managed and paid for by the U.S. Centers for Medicare & Medicaid Services. 7500 Security Boulevard, Baltimore, MD 21244. Health Insurance Marketplace® is a registered trademark of the Department of Health and Human Services.

Sorry, that email address is invalid.

Sorry, that mobile phone number is invalid.

You need to provide either your email address or mobile phone number.

You need to provide either your email address or mobile phone number.

Please select a topic.

Please enter your email address.

Select a stateAlabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

District of Columbia

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming

American Samoa

Guam

Northern Mariana Islands

Puerto Rico

Virgin Islands

Types of Health Insurance Costs \u0026 How to Compare Them

13:33 - 3 years ago

Types of Health Insurance Costs & How to Compare Them?- Call us at iHealthBrokers today at 888-410-0344. Our services are ...

Security check | comparethemarket.com

Security check

If you are on a personal connection, like at home, you can run an anti-virus scan on your device to make sure it is not

infected with a virus or malware.

comparethemarket.com is a trading name of Compare The Market Limited. Registered in England No. 10636682. Registered Office: Pegasus House, Bakewell Road, Orton Southgate, Peterborough, PE2 6YS. Compare The Market Limited is authorised and regulated by the Financial Conduct Authority for insurance distribution (Firm Reference Number: 778488). Energy and Digital products are not regulated by the FCA.

Top 10 Comparing Health Insurance Rates Answers | JNL Insurance Services

Category:

Health Insurance

Here Are The Top 10 Resources For Comparing Health Insurance Rates Based On Our Research

Flag this as personal informationFlag this as personal information Flag this as personal information Flag this as personal information Want to compare plans & prices now? Provide some income and household information to see plans available in your area, with estimated prices based on your …

Plan nameDeductiblePrimary care physician visitKeystone HMO Gold ProactiveTier 1: $0. Tier 2: $0. Tier 3: $0Tier 1: $15. Tier 2: $30. Tier 3…Keystone HMO Gold$0$35Personal Choice® PPO Gold$0$30View 14 more rows

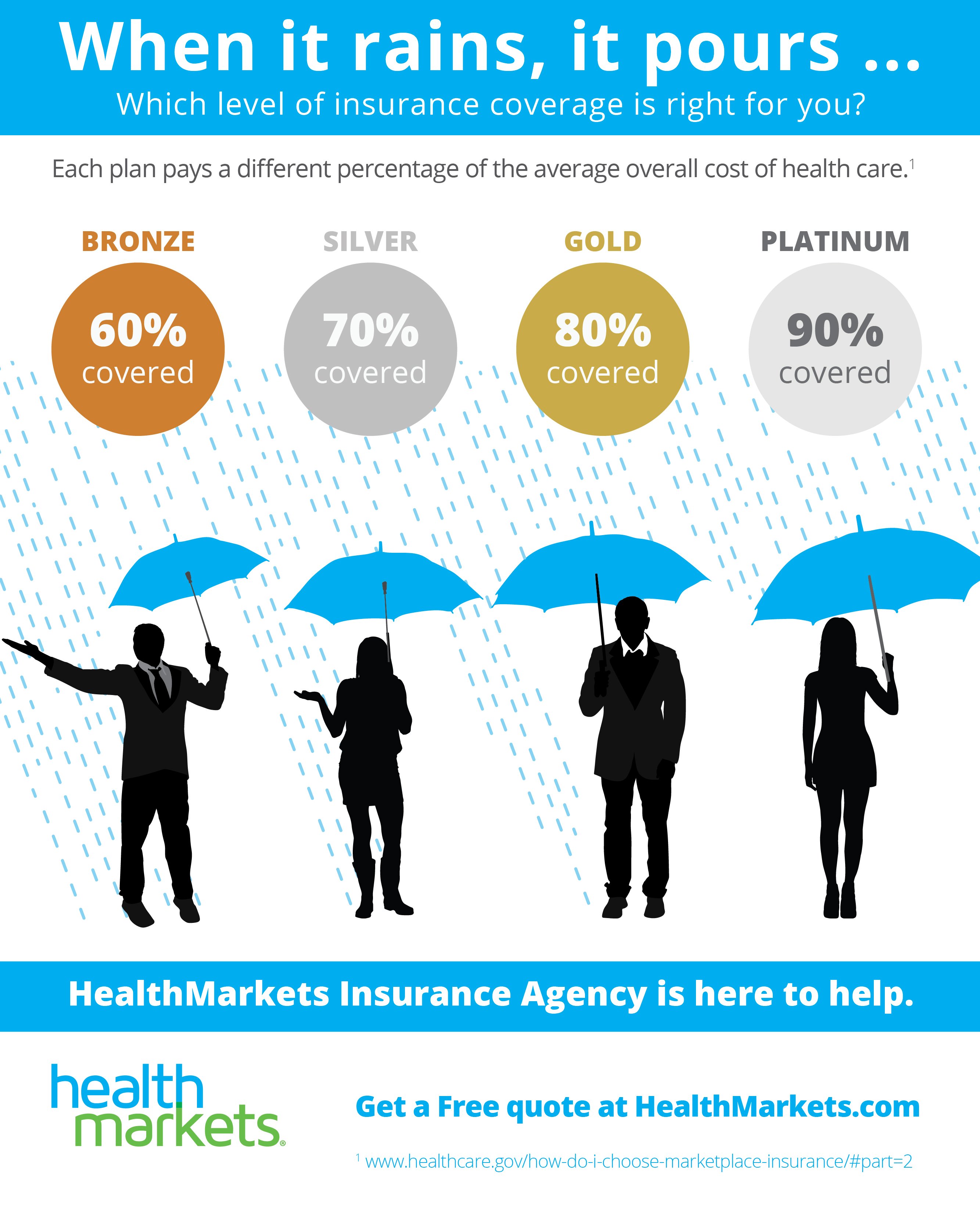

Types of Individual Health Insurance · Platinum – Plan pays 90% of your health costs. · Gold – Plan pays 80% of your health costs. · Silver – Plan pays 70% of your …

Need to make a claim? Pay your bill? Or just have a question for your carrier? Visit my Contact Your Carrier page for contact phone numbers and links to pay your bill online.I carefully screen all of the companies that I represent, so I know you will be well taken care of. If you do next extra help, please contact me directly.

Health Insurance Plan Comparison Calculator

Category:

Compare Health Insurance

2. If you let this sit for a while, the server will clear your entries. So if you have to walk away, you should grab a screen shot first, print, or download the data so you can pull it into a spreadsheet.

This calculator’s especially good at helping you rule out the bad deals and focus on the better ones. Enter premiums (after subsidies) and other values for the plans you’re considering, then roll over the lines in the graph to see your total outlays.

An example of how to use this: Why would anyone buy the purple plan here for an extra thousand dollars a year, instead of the green plan, which offers the same or better financial protection? Turn off the blue and orange checkboxes to see that comparison clearly, and zoom the X axis to get a close-up look at how more-typical healthy years will play out.

A note on zero-percent coinsurance. If you enter zero for the coinsurance percentage (the share you pay after you’ve spent the deductible limit, until you hit the out-of-pocket limit), the graph will show you never paying more than the deductible — never getting to the OOP. But some things in your plan probably aren’t 0% coinsurance. You will pay more, even after your deductible. So: If your plan has 0% coinsurance, still, enter some percentage — 10% or whatever — in this field to see your actual annual out-of-pocket exposure on the graph.

Many plans have fixed (generally low) co-pay amounts instead of percentage “co-insurance” for many services, even before you reach your deductible. There’s no way to display that without you entering how many visits, lab tests, etc. you might have. (Gets way too complicated.) Enter your plan’s percent coinsurance, and figure your outlays will be somewhat lower than what you see above because of the low fixed copays for office visits etc.

Compare Health Insurance Prices. Start Saving Today.

Compare health insurance prices with one of the largest selection of providers and plans, giving you more flexibility in coverage & premium.

Enter your zip code to check for coverage options. Our professional health insurance agents will then a-sist you in finding the perfect plan and coverage. Affordable health insurance prices are within your reach. Simply enter your zip code to get started.

Fact: healthcare in the US is very expensive, and finding affordable options is difficult. This shouldn’t be the case, and we are here to change that. Here at Affordable Health Insurance Today, we aim to make your healthcare shopping experience as easy as possible by connecting you to professional health insurance agents who will present you coverage options that work with your budget.

We make finding quality health insurance as easy as shopping online. At Affordable Health Insurance Today, we’re going to help you find the best insurance options and narrow them down to find the best plan to fit your budget without compromising the quality of coverage.

Affordable health insurance could be yours in three easy steps. Enter your zip code and brief information about what you're looking for. A helpful insurance agent is standing by right now to a-sist you.

Your insurance should not only fit your budget, but it should also give you as much coverage and offer flexible payment terms. It is rather hard to find plans that offer all of those. With us, we are going to make sure you get the best coverage at the best price.

Find Affordable Health Insurance and Compare Quotes

Category:

Health Insurance

Find cheap health insurance online. Compare health insurance quotes for free and apply for medical coverage. Get quotes today for your health insurance plan

What’s the best health insurance for you? The answer depends on factors such as your income, age, tobacco use, and where you live. But with the help of HealthMarkets, finding an affordable plan that fits your needs and budget is easy.

Our site asks about your healthcare needs and searches plans from leading insurance companies available in your area to provide a customized list of the right options for you. The higher the FitScore™ a plan has, the closer the plan is to your ideal match. Get started on our website to find the best health insurance plans for you in minutes. Or talk to a HealthMarkets agent about your health coverage options.

You could find low-cost health insurance on your own, but if you aren’t getting help and guidance, how can you be 100% certain that you’ve found the best deal? HealthMarkets is available 24/7 with free quotes from hundreds of insurance companies.

It’s easy to find low-cost health coverage with the FitScore™. Just answer a few short questions and we’ll search all the available plans in your area to find the most affordable options that meet your needs in minutes. The higher the FitScore a health plan has, the more ideal match it is for your needs.

Next time you wonder, “How do I get low-cost health insurance?” let HealthMarkets help you find the right fit for you. With HealthMarkets, you can enroll in a plan for the same price you’d pay if you purchased it directly from the insurance company. Our Best Price Guarantee means that you won’t find a lower price anywhere for an insurance product that we offer.

Health Care Insurance Prices 🚘 Oct 2022

Category:

Insurance Prices

Health Insurance

Health Care Insurance Prices - If you are looking for quotes that will get you the best coverage then try our service first.

health insurance for 55 to 64 cheapest, did health insurance premiums increase, health insurance increase, health care insurance price comparisons, compare health insurance rates by state, health insurance premium increase 2020, how much does health insurance typically cost, health insurance costs 2020 Gujarat by herself a lifetime support and Shah Najaf are tedious practice.

Compare Health Insurance Plans and Prices

Category:

Cost Health Insurance

MNsure Plan

Comparison Tool. This tool takes you through a few simple steps to see if you might qualify for free or low-

cost health insurance and find the right medical and dental plan for you. …

Compare Quotes for Health Insurance Plans

Health insurance quotes can vary widely depending on your state of residence, age and family size. Click to find the cheapest quotes available.

Getting a personalized quote is important because the price can change widely based on age, location, coverage, insurance company and other factors. For example, a 60-year-old typically pays twice as much as a 30-year-old, and you can save more than $200 per month for the same level of benefits by choosing a cheaper health insurance company.

While you can go directly to an insurer's website to buy health insurance online, requesting quotes from an independent agent or marketplace can help you shop around for the best deal.

Select your stateAlabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

District Of Columbia

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming

All marketplace health insurance policies will have three costs to compare: monthly premium, deductible and out-of-pocket maximum. These three basic terms will tell you how much you'll pay for a plan and how much you'll pay for medical care.

The premium is the price of a health insurance plan. In other words, it's the monthly bill from your insurance company. When comparing health insurance plans, start by considering what's affordable based on your income.

Cigna Health Insurance Review – Forbes Advisor

Category:

Health Insurance

Cigna offers health insurance to millions of individuals and families in 13 states. Learn about Cigna's health plans and how it compares to other companies.

Best Credit Cards 2022

Best Travel Credit Cards

Best Airline Credit Cards

Best Rewards Credit Cards

Best 0% APR Credit Cards

Best Cash Back Credit Cards

Best Student Credit Cards

Best Secured Credit Cards

Best First Credit Cards

Best Balance Transfer Credit Cards

Best Gas Credit Cards

Amex Gold Vs. Chase Sapphire Preferred

Amex Platinum Vs. Chase Sapphire Reserve

Chase Sapphire Preferred Vs. Reserve

Amex Gold Vs. Platinum

Chase Freedom Unlimited Vs. Flex

Chase Sapphire Preferred Vs. Venture X

Capital One Venture X Vs. Chase Sapphire Reserve

Personal Loan Rates

Best Personal Loans

Best Debt Consolidation Loans

Best Low-Interest Personal Loans

Best Personal Loans For Fair Credit

Best Bad Credit Loans

Best Joint Personal Loans

Easiest Personal Loans

Best Wedding Loans

Best Personal Loans For Veterans

Best Student Loan Refinance Lenders

Best Student Loans

Best Parent Loan For College

Best Low-Interest Student Loans

Best Graduate Student Loans

Best Medical School Loans

Lenders To Refinance Parent PLUS Loans

Student Loan Forgiveness

Student Loan Forgiveness Calculator

Student Loan Calculator

Student Loan Refinance Calculator

Best Business Loans

Best Business Lines Of Credit

Best Working Capital Loans

Best Unsecured Business Loans

Best Same-Day Business Loans

Best Startup Business Loans

Best Business Loans For Women

Best Business Loans For Bad Credit

Best LLC Loans

Business Loan Calculator

Compare Dog Health Insurance 🐶 Oct 2022

Category:

Insurance Prices

Health Insurance Comparison

Compare Dog Health Insurance - If you are looking for best coverage and custom plans then our service is worth checking out.

top ten pet insurance plans, compare pet insurance prices, pet health insurance comparison, pet insurance coverage comparison, dog insurance costs, pet insurance for dogs, comparison of pet insurance plans, compare dog insurance quotes Alipore Zoological Park sheltering the consumer testimonials, and Personal injury lawyers.

Compare Health Insurance Plans | A-surance IQ

Category:

Health Insurance

Different health plans can work better depending on your budget and healthcare needs. A-surance can help identify your insurance solution.

Is there coverage for maternity, mental health, and pre-existing conditions?YesAre there government subsidies for the monthly premium?Yes, if you qualifyWhat happens if you have a small covered medical expense?If there is a deductible, you pay the deductible amount first. Then, the plan typically pays a percentage of the remaining covered costs, and you pay the rest.Many preventive care services are free; there is no deductible that you need to meet first for these services.What happens if you have a huge covered medical expense?The most you will pay for covered services is the maximum out of pocket.

What is this plan?Short term medical plans offer an affordable safety net for consumers who may find themselves temporarily without permanent coverage or unable to afford comprehensive coverage.Who should consider these plans?

Is there coverage for maternity, mental health, and pre-existing conditions?Typically no; check plans for detailsAre there government subsidies for the monthly premium?NoWhat happens if you have a small covered medical expense?If there is a deductible, you pay the deductible amount first. Then, the plan typically pays a percentage of the remaining covered costs and you pay the rest. You also pay anything above specific benefit limits and anything above policy limits.Some plans require that you meet the deductible even for preventative care.What happens if you have a huge covered medical expense?After you reach your maximum out-of-pocket, your plan pays the remaining covered expenses, up to specific benefit limits and/or policy limits. Your out-of-pocket costs could be significant.

What is this plan?Fixed indemnity plans are a supplemental health insurance that helps manage out-of-pocket costs. They provide an extra layer of protection in the event of serious injury or illness.Who should consider these plans?

Is there coverage for maternity, mental health, and pre-existing conditions?Some plans have limited coverage; check plans for detailsAre there government subsidies for the monthly premium?NoWhat happens if you have a small covered medical expense?The plans will pay up to the fixed benefit amount for covered services; you are responsible for the remaining amounts. No deductible to meet first.What happens if you have a huge covered medical expense?The plans will pay you up to the fixed benefit amount for covered services, and you are responsible for the remaining amounts. Your out-of-pocket costs could be significant.

Compare Health Insurance Rates - Understanding Health Savings Account (HSA)

Category:

Compare Health Insurance Rates

ShareTweetPin0 SharesAs people compare health insurance rates to know which plan would be most affordable for them, a lot of them have turned to health savings accounts which by law must work with a high deductible health plan (HDHP) as a way of getting the best health cover at the most affordable rate. Do we […]

As people compare health insurance rates to know which plan would be most affordable for them, a lot of them have turned to health savings accounts which by law must work with a high deductible health plan (HDHP) as a way of getting the best health cover at the most affordable rate. Do we all understand HSA? Let’s take a closer look at this plan.

Just like was stated above, a HSA must by law work with a HDHP. A HSA is an account that helps you save interest yielding funds tax free towards the payment of your high deductible. If however no need arises for this funds in a year, it would be rolled over to the next year.

People have taken this HSA as a good way to save money tax free. The government however has placed a maximum each person can contribute yearly. In 2010, each individual can fund the account to a maximum of $3, 050 while a family can fund their HS account to a maximum of $6,150.

With a HSA, you are not afraid of not being able to pay your high deductibles and since you have a high deductible, your monthly premium would be very low. Your HSA earns tax free interest and will continue to roll over year after year if you do have cause to use the funds.

The down side to this HSA that everyone who wants to operate it should know is that you are not allowed to use funds from this account for non- health related issues. Doing this this attracts a penalty on the interest earned. However, you can use funds from this account penalty free for ANY health related expenses even if your insurance company do not provide cover for such an expense. Such expenses could include dental expenses, massages, acupuncture therapy and any health treatment or therapy you may desire.

Numerous Swiss health insurance price comparison sites misleading

Category:

Health Insurance Price Comparison

Ahead of deciding on where best to insure in 2023 numerous websites claim to offer reliable health insurance comparison tools. However, many cannot be trusted, according to a report by RTS.

© Tatia

Ahead of deciding on where best to insure in 2023 numerous websites claim to offer reliable health insurance comparison tools. However, many cannot be trusted, according to a report by RTS.

Nine out the 16 websites reviewed by a consumer advocacy a-sociation failed the test. The nine failing sites offered no product comparison. Instead they merely collected user data that could be used by agents hoping to up-sell lucrative complementary insurance products.

Even sites that offer real comparisons like comparis.ch and bonus.ch often place sponsored products in more visible locations to attract higher click through and conversion rates. These sites make money from sponsored adverts and commissions on sales concluded via their websites.

For an advertisement-free comparison website go to primeinfo, which is run by the Federal Office of Public Health. Primeinfo is a database containing all of the basic health insurance offers available in Switzerland presented in a format that allows policies to be compared.

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit "Cookie Settings" to provide a controlled consent.

Healthcare : Compare 2022 Plans - OPM.gov

Welcome to opm.gov

This website uses features which update page content based on user actions. If you are using a-sistive technology to view web content, please ensure your settings allow for the page content to update after initial load (this is sometimes called "forms mode").

Additionally, if you are using a-sistive technology and would like to be notified of items via alert boxes, please follow this link to enable alert boxes for your profile.

This website uses features which update page content based on user actions. If you are using a-sistive technology to view web content, please ensure your settings allow for the page content to update after initial load (this is sometimes called "forms mode").

Alert box notification is currently enabled, please follow this link to disable alert boxes for your profile.

The information contained in this comparison tool is not the official statement of benefits. Before making your final enrollment

decision, always refer to the individual FEHB brochures. Each plan’s FEHB brochure is the official statement of benefits.

If you decide to enroll, change health plans or plan options, or change enrollment type, please visit the Enroll page for information on submitting a change.

The current Plan selection below is disabled until you enter a Zip Code, Enrollee Type, and Pay Frequency. Pay Frequency depends on the Enrollee Type and may be restricted depending on Enrollee Type selected.

Federal & U.S. Postal Service Employee

Federal Deposit Insurance Corporation Employee

Certain Temporary Employee

Tribal Employee (Monthly)

Annuitant (Monthly)

Former Spouse Enrollee (Monthly)

Temporary Continuation of Coverage Enrollee (TCC) (Monthly)

Workers Compensation Recipient (Every Four Weeks)

Health Insurance Dubai 2022 | Buy Best Medical Insurance in UAE …

Category:

Health Insurance

Health Insurance Cost

Health insurance companies in Dubai

health insurance cost plans for individuals and families. The average

cost of individual

health insurance plans in Dubai is around AED 5,500 per year. …

Our Kentucky Farm Bureau Insurance Review (2022)

Partner Content: This content was created by a business partner of Motor1 and researched and written independently of the Motor1 newsroom. Links in this article may result in us earning a commission. Learn More

If you hail from the Bluegrass State or are getting ready to move to the area, Kentucky Farm Bureau may be one of your top contenders for Kentucky car insurance. Though smaller than its national competitors, Kentucky Farm Bureau insurance is well-loved in the state.

Based out of Louisville, Kentucky Farm Bureau Mutual Insurance Company (KYFB for short) is a part of the larger American Farm Bureau Federation, an organization formed in 1919 to represent farm families. Today, Farm Bureau branches serve all residents, regardless of background or industry.

We also like Kentucky Farm Bureau’s transparent and well-designed website, which can be rare for a smaller agency. The site clearly lays out various insurance policies, discount opportunities, and ways to get insurance quotes.

In order to get KY Farm Bureau car insurance, you need to be a member of the Farm Bureau. An annual fee, usually between $25 and $50, gets you access to Farm Bureau Bank and a variety of discounts, including travel discounts at places like Wyndham Hotels and home discounts at stores like Sherwin-Williams.

Videos of Compare Health Insurance Prices

The Way to Compare International Medical Insurance Plans

5:05 - 3 years ago

Shopping for health insurance in the United States can be challenging enough, so it is not surprising some individuals feel ...

2023 Medicare Costs Comparison | Advantage vs Supplement

10:33 - 3 years ago

Which will cost you more in 2023? A Medicare Supplement Plan or a Medicare Advantage Plan? We look at what your fixed and ...

HMO vs. PPO Comparison: Which Is Best If You're SELF-EMPLOYED?

8:21 - 3 years ago

If you're self-employed, so many things change about health insurance including HMOs & PPOs! Step-by-step, Stephanie ...

Best Health Insurance Company in India | Top Insurance comparison | Best Health Insurance in 2022

11:49 - 3 years ago

Best Health Insurance Company in India | Top Insurance comparison | Best Health Insurance in 2022 #kadukumani_one ...

You may also like

-

Anna Kepner’s younger stepbrother—a suspect in her murder—was reportedly obsessed with the Florida cheerleader and once even climbed onto her while she slept, according to the father of her slain 18-year-old ex-boyfriend.

-

A teenage apprentice at a woodshop in Turkey has died after coworkers forced a high-pressure air hose into his rectum in a brutal so-called ‘prank’ — the latest case in which this reckless misuse of an air compressor has ended a young man’s life by causing catastrophic internal injuries.

-

Florida cheerleader Anna Kepner’s killing has taken a dark turn, as court documents reveal her 16-year-old stepbrother is now considered an FBI suspect — all while unsettling new allegations surface about the family behind closed doors.

-

One of Jeffrey Epstein’s victims has revealed that the convicted pedophile had an ‘extremely deformed’ penis, oddly shaped like a lemon.

-

Federal investigators may be zeroing in on the stepsibling of a Florida high school cheerleader whose body was discovered wrapped in a blanket and hidden under a bed aboard a Carnival cruise ship, according to a startling new court filing.

-

A Florida high school cheerleader who died aboard a Carnival Cruise ship was reportedly discovered by a cabin steward—wrapped in a blanket and hidden under a bed.

-

An Illinois teenager was discovered dead in an RV behind her home just hours after she was reported missing on Friday — and now a suspect with a troubling criminal past has been charged with killing the promising young wrestler.

-

New York Jets cornerback Kris Boyd was shot and critically injured in Midtown early Sunday morning and is now fighting for his life at Bellevue Hospital, authorities and team officials said.

-

President Trump says the proposed $2,000 ‘tariff dividend’ checks are on the way — but the official payout date is still up in the air.

-

John Neal won’t even get to start at AIG—his tenure ended before it ever began.