Learn how to read a car insurance declaration page, the summary page that outlines the key components of your auto policy.

The car insurance declaration page is arguably the most important part of your auto insurance policy, as it summarizes the coverage available to you.

While important, insurance policies are confusing and intimidating to read. They are filled with unfamiliar legal and financial jargon, and are written in as specific a manner as possible. These documents seem long, tedious and overly complex. Your auto insurance policy is a legal contract, which mandates the insurance company to take specific action under specific circumstances for a specifically agreed-upon price.

Even though you may be tempted to quickly gloss over this document, it is important that you fully understand your coverage. Doing so can help you avoid gaps in coverage, or the frustrating feeling that your insurance company is taking advantage of you.

It is quite likely that if you are reading this article, you are either considering a new insurance policy, or you have recently been involved in an accident and are trying to determine your level of coverage.

The information in this article will help you understand your car insurance declaration page in detail. However, if you have been in an accident, please consult with our car accident attorneys before you engage your insurance company, or the insurance company of the other party. Consultations are absolutely free!

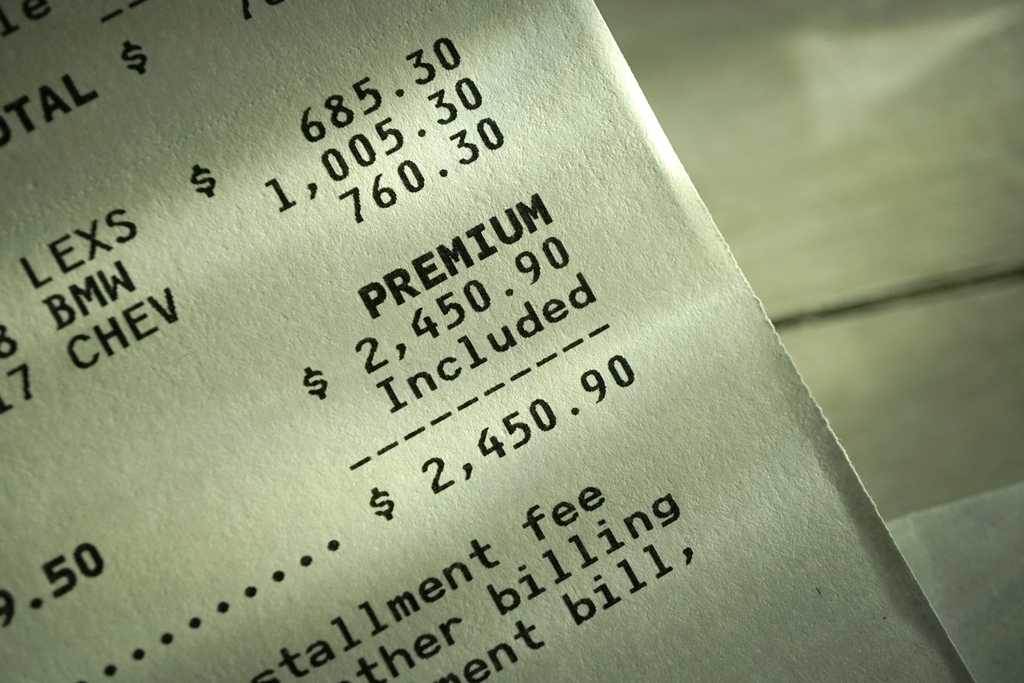

As the name suggests, your car insurance declaration page states the types of coverage you have chosen on your auto insurance policy, and which ones you have elected not to purchase. It also includes vital information about levels of coverage, deductibles, the drivers covered under the policy and the premium, or price, you are paying for the policy.

The declaration page is almost always the very first page of the packet you will receive from your insurer. It should be clearly labeled as the “declarations page” or “your policy declarations.” Often, you don’t have to wait for a hard copy of your policy to arrive in the mail. With many auto insurance companies, you can log in and view your entire policy online as soon as you purchase it.

The length of the declaration page section of an insurer’s auto policy may run, confusingly enough, to more than a page. So, be sure to read it fully. Information that is contained in a car insurance declaration page includes:

A list or schedule of coverage, limits, deductibles, and the price for each type of coverage. This will be further broken down by vehicle if you have several vehicles listed under your policy. If a certain type of coverage is not named under this section, you probably do not have it.

Be sure to review the declarations page after you renew or make any changes to your auto insurance policy. If you don’t receive a hard copy of the updated document within one week, contact your agent or insurance company to confirm that the policy changes were made and are in effect. Ask that they send you a fresh declarations page. It is imperative to carefully read and review this page after each renewal and modification, to confirm all the information is accurate.

Here are the critical elements of the declaration page that need your attention: