Top FAQs for Best Group Health Insurance

People also ask - Best Group Health Insurance FAQs

When is open enrollment for health insurance?

Open Enrollment for 2022 starts Monday, Nov. 1, 2021, and ends Saturday, Jan. 15, 2022. If you want your coverage to begin Jan. 1, 2022, you need t...Read more

Why is health insurance so expensive?

“The driving factor for why health insurance is so expensive is that health care is so expensive,” says Louise Norris, a licensed health insurance...Read more

Does health insurance cover dental?

If you’re signed up for an ACA-compliant plan, it will cover pediatric oral care. “But no, it will not necessarily always include adult dental,” sa...Read more

Is it illegal to not have health insurance?

No, it is not illegal not to have health insurance, says Turner.Read more

What company has the best health insurance?

The two top-rated health insurance companies are Kaiser Permanente and Blue Cross Blue Shield, according to available state data from the National Committee for Quality Assurance (NCQA). Mid-tier insurers include Humana, Anthem, UnitedHealthcare and Aetna.

How to select the best health insurance?

There are numerous factors to take into consideration when you're shopping for health insurance

- Consider provider networks and covered drug lists. ...

- Determine your worst-case scenario. ...

- Back-of-the-envelope comparison. ...

- But don’t focus entirely on the cost of claims. ...

- If your plan has tiered networks, pay attention to out-of-pocket costs. ...

- Silver plans’ cost-sharing subsidies. ...

- Gold plans: a better value in some areas. ...

- Consider Quality Ratings. ...

More items...

What are the advantages of a group health insurance?

Understand The 6 Major Benefits Of A Group Health Insurance Plan

- It helps to save money. As highlighted in the introduction, group health insurance plans cut down costs to the policyholders.

- A significant risk pool leading to lower costs. Group health insurance involves a large number of people. ...

- A better working environment and satisfied employees. ...

- Tax incentives for offering employees this insurance plan. ...

More items...

Who is eligible for group health insurance?

Recently, a business owner was explaining how angry she was because her individual health insurance plan ... In most states, businesses with two or more people are eligible to purchase group insurance. Why is this important? Because, in many states ...

Best Health Insurance Companies Of November 2022 – Forbes Advisor

Here are the best health insurance companies, based on coverage area, provider networks, starting rates, benefits offered and various industry rankings.

Best Credit Cards 2022

Best Travel Credit Cards

Best Airline Credit Cards

Best Rewards Credit Cards

Best 0% APR Credit Cards

Best Cash Back Credit Cards

Best Student Credit Cards

Best Secured Credit Cards

Best First Credit Cards

Best Balance Transfer Credit Cards

Best Gas Credit Cards

Amex Gold Vs. Chase Sapphire Preferred

Amex Platinum Vs. Chase Sapphire Reserve

Chase Sapphire Preferred Vs. Reserve

Amex Gold Vs. Platinum

Chase Freedom Unlimited Vs. Flex

Chase Sapphire Preferred Vs. Venture X

Capital One Venture X Vs. Chase Sapphire Reserve

Personal Loan Rates

Best Personal Loans

Best Debt Consolidation Loans

Best Low-Interest Personal Loans

Best Personal Loans For Fair Credit

Best Bad Credit Loans

Best Joint Personal Loans

Easiest Personal Loans

Best Wedding Loans

Best Personal Loans For Veterans

Best Student Loan Refinance Lenders

Best Student Loans

Best Parent Loan For College

Best Low-Interest Student Loans

Best Graduate Student Loans

Best Medical School Loans

Lenders To Refinance Parent PLUS Loans

Student Loan Forgiveness Programs

Student Loan Forgiveness Calculator

Student Loan Calculator

Student Loan Refinance Calculator

Best Business Loans

Best Business Lines Of Credit

Best Working Capital Loans

Best Unsecured Business Loans

Best Same-Day Business Loans

Best Startup Business Loans

Best Business Loans For Women

Best Business Loans For Bad Credit

Best LLC Loans

Business Loan Calculator

Best Health Insurance Companies of 2022

Finding the best health insurance company for your lifestyle can be hard — find the best plan for your circumstances with some of our top picks.

The Affordable Care Act (ACA) of 2010 requires most U.S. adults to purchase health insurance. Health insurance is important because it can cover the costs of an unexpected accident, illness, or any routine medical care. And if more people decide to stay uninsured, the overall cost of health insurance will rise.

For some, health insurance might seem like a luxury. Plans can be expensive and difficult to understand. To help you find the best health insurance company to choose this year, we’ve analyzed some of the top networks in the United States.

Affordability. The cost of a monthly premium will vary based on your location, plan, and whether you’re covered by your employer. We still tried to find options that can fit every budget, though.

Marketplace plans. Depending on what’s available in your area, you may find bronze, silver, gold, and platinum marketplace plans. These levels are broken down by how much you pay versus how much your network pays. Some of these can include:

Health Maintenance Organization (HMO). An HMO usually limits coverage to care from doctors who work for or contract with the HMO. It generally won’t cover out of network, except in an emergency. The plan may require you to live or work in its service area to be eligible for coverage.

Best Health Insurance Companies of 2023

We rated the best health insurance companies based on features including plan types, availability, dental coverage, and physician copays.

David J. Rubin is a fact checker for The Balance with more than 30 years in editing and publishing. The majority of his experience lies within the legal and financial spaces. At legal publisher Matthew Bender & Co./LexisNexis, he was a manager of R&D, programmer analyst, and senior copy editor.

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

Shopping for individual insurance can feel overwhelming. The Affordable Care Act (ACA) standardized certain health insurance features, but there can still be variations in quality and value. To help you find the best health insurance company, we compared some of the largest providers on the federal and state health insurance exchanges. We examined availability across states, National Committee for Quality A-surance (NCQA) and healthcare.gov ratings, types of plans available, plan benefits, dental insurance options, and cost, including premiums, copays, and deductibles.

If you’re looking for the best health insurance company overall, Blue Cross Blue Shield (BCBS) is our top recommendation. BCBS plans are generally well-rated by the NCQA, averaging 3.74 out of 5 points. That’s the second-highest score among the companies we evaluated.

The company offers a wide selection of health insurance plans, including health maintenance organization (HMO), preferred provider organization (PPO), exclusive provider organization (EPO), and point-of-service (POS) plans, as well as dental coverage for kids and adults. It offers bronze, silver, gold, platinum, and catastrophic plans in the Health Insurance Marketplace and on state exchanges.

Kotak Health Insurance Plans 2022 | Kotak Group Health Care | Kotak Health Insurance Policy Review

2:43 - 3 years ago

Kotak health insurance plans : The basic of Kotak group health insurance plan is that a policy is issued against a single premium ...

What is the best group health insurance plan? - Health Insurance Providers

Category:

Group Health Insurance

The best group health insurance plan is really going to depend on your personal health needs and budget. In addition, your employer is the one who usually chooses the insurance plan. However, there are companies that have received accolades for being rated as the best insurance companies. You can compare health insurance quotes now by […]

The best group health insurance plan is really going to depend on your personal health needs and budget. In addition, your employer is the one who usually chooses the insurance plan. However, there are companies that have received accolades for being rated as the best insurance companies.

You may or may not have a choice in the group health insurance plan your employer offers you, but if you do have a choice, you can be sure you are getting the best plan by the awards given to the following companies in the article below. The following article discusses the best group health insurance plans according to:

Consumer Reports in conjunction with the National Committee for Quality A-surance (NCQA), rated PPO plans based on customer service and treatment and care of the plan. The highest ranking went to Tufts Health Plan followed by the Harvard Pilgrim Health Care.

When rating HMO plans, Consumer Reports and the NCQA rated these based on customer service, treatment, and care of the plan. The highest ranking went to Harvard Pilgrim Health Care followed by Tufts A-sociated Health Maintenance Organization and Capital Health Plan.

U.S. News also rates group health insurance plans. However, there ratings are simply based on the size of the insurance company, not necessarily the service that is provided to its policyholders. The list at http://health.usnews.com/health-plans/national-insurance-companies rates:

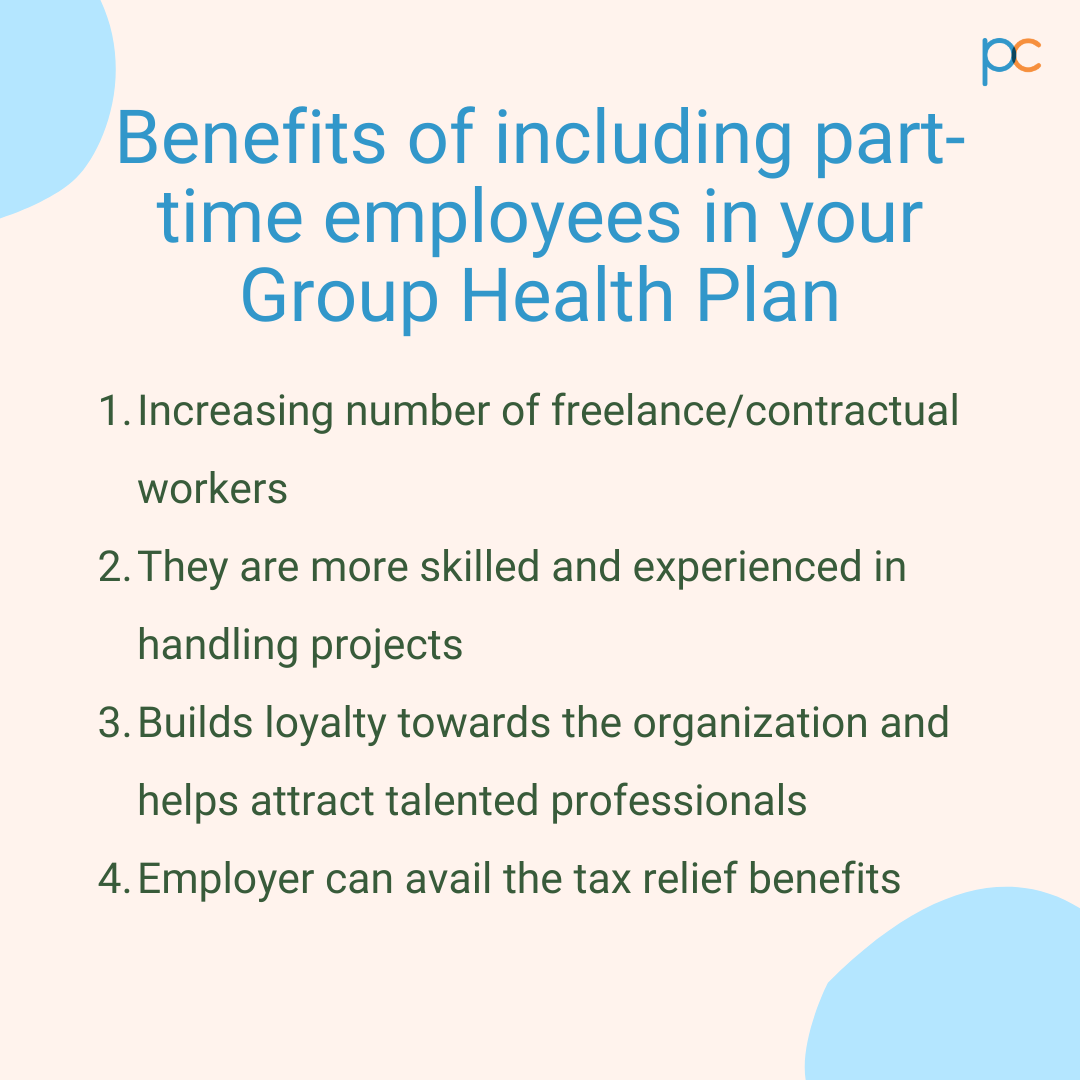

Best Group Health Insurance Plans For Part-Time Employees - PlanCover - Small Business Insurance

Category:

Best Group Health Insurance

Best Group Health Insurance Plans For Part-Time Employees - With so many medical insurance plans from distinct insurance companies, the selection can be

Employer health insurance plans or group healthcare plans are currently among the mandatory service concessions in India. Post Covid-19, the government has set rules for the compulsory offering of employer medical insurance for the employees working in an organization. Any startup or business with an employee strength of seven can apply for the policyThe legal document issued to the policyholder that outlines the conditions and terms of the insurance; also called the ‘policy purchase. Many are unaware that the same rule is valid for part-time works as well. In an organization, if there are both part-time and full-time employees working under the same employer, then all of them can qualify for group healthcare benefits.

The way the employer healthcare insurance works is valuable in more than one way. It has advantageous factors for both employees and the employer providing it. After the lockdown in 2020, most organizations are purchasing the group medical policies for the government mandate. If you consider it from a long-term perspective, the group plan is equally beneficial for both parties.

For employees: The benefits for the employees are plain and simple. The group mediclaim covers the medical expenses incurred for valid medical treatment. The employer pays the premium for which there is no added pressure on the employee to continue the plan benefits. They can enjoy the plan coverage till the last day of their service and, port the insurance into an individual plan if they want to continue it after switching the job. Few organizations also offer part-time employees comprehensive medical insurance where the dependent family members (spouse, children, parents) can also enjoy the treatment coverage. Thus, it is always beneficial for a part-time employee if their employer offers such medical plans.

For employers: Employers are the ones to bear the responsibility of the group healthcare plan. Then how is it beneficial for them? The employers can also gain through the group healthcare schemes. The employees grow loyal to the organization for such plan benefits, increasing employee retention. Secondly, for payment of premium on behalf of the organization’s employees (part-time and full-time), the employer can enjoy tax relief. There are legal norms that qualify an employer to get a tax deduction on producing valid certifications of premium payment.

With so many medical insurance plans from distinct insurance companies, the selection can be confusing. An organization having both part-timers and full-timers needs a distinct approach while buying the policies. The employer has to find the right balance of features that satisfies the requirements of the part-time and full-time employees. But if the majority of the workers are part-timers, you may cut on certain added benefits from the plan. Going for a moderately serving plan for part-time employees serves both the interests of the employer and employee.

What You Need To Know About Group Health Insurance – Forbes Advisor

Nearly 50% of insured Americans receive health insurance coverage through group plans. Here’s a guide to the ins and outs of group health insurance.

Best Credit Cards 2022

Best Travel Credit Cards

Best Airline Credit Cards

Best Rewards Credit Cards

Best 0% APR Credit Cards

Best Cash Back Credit Cards

Best Student Credit Cards

Best Secured Credit Cards

Best First Credit Cards

Best Balance Transfer Credit Cards

Best Gas Credit Cards

Amex Gold Vs. Chase Sapphire Preferred

Amex Platinum Vs. Chase Sapphire Reserve

Chase Sapphire Preferred Vs. Reserve

Amex Gold Vs. Platinum

Chase Freedom Unlimited Vs. Flex

Chase Sapphire Preferred Vs. Venture X

Capital One Venture X Vs. Chase Sapphire Reserve

Personal Loan Rates

Best Personal Loans

Best Debt Consolidation Loans

Best Low-Interest Personal Loans

Best Personal Loans For Fair Credit

Best Bad Credit Loans

Best Joint Personal Loans

Easiest Personal Loans

Best Wedding Loans

Best Personal Loans For Veterans

Best Student Loan Refinance Lenders

Best Student Loans

Best Parent Loan For College

Best Low-Interest Student Loans

Best Graduate Student Loans

Best Medical School Loans

Lenders To Refinance Parent PLUS Loans

Student Loan Forgiveness Programs

Student Loan Forgiveness Calculator

Student Loan Calculator

Student Loan Refinance Calculator

Best Business Loans

Best Business Lines Of Credit

Best Working Capital Loans

Best Unsecured Business Loans

Best Same-Day Business Loans

Best Startup Business Loans

Best Business Loans For Women

Best Business Loans For Bad Credit

Best LLC Loans

Business Loan Calculator

Best Health Insurance Companies of 2022 | Insure.com

Kaiser Permanente, Humana, Blue Cross Blue Shield of Michigan, Health Care Service and other top health insurers are ranked by customer satisfaction and financial stability to help consumers pick the right provider for their needs.

Bob Haegele is a personal finance writer. He covers car insurance, health insurance and life insurance. While working in the corporate world he started a personal finance blog. He later left his corporate job and began freelance writing full-time. Since then, he has made it his mission to help people master their money. His work has been featured in Business Insider, Forbes Advisor, Bankrate, FinanceBuzz and others.

John is the editorial director for CarInsurance.com, Insurance.com and Insure.com. Before joining QuinStreet, John was a deputy editor at The Wall Street Journal and had been an editor and reporter at a number of other media outlets where he covered insurance, personal finance, and technology.

At Insure.com, we are committed to providing honest and reliable information so that you can make the best financial decisions for you and your family. All of our content is written and reviewed by industry professionals and insurance experts. We maintain strict editorial independence from insurance companies to maintain our editorial integrity, so our recommendations are unbiased and are based on a comprehensive list of criteria.

Finding the right health insurance company is an important decision. After all, there is arguably nothing more important than your health. But what are the best health insurance companies and what’s the right one for you?

To rank the top health insurers, the editors collected data on each company from several independent sources: J.D. Power’s U.S. Commercial Member Health Plan Study, which provides a gauge of customers’ perceptions of their insurer; the National Committee for Quality A-surance’s Health Plan Ratings, which, among other factors, evaluates health plans on the quality of patient care; and the National A-sociation of Insurance Commissioners’ complaint data, which ranks a company by the number of customer complaints it receives.

Best Health Insurance Companies 2022 | Top Ten Reviews

Looking for the best health insurance companies? Here we outline the best companies and plans that can meet a range of healthcare requirements.

The best health insurance companies can help cover the cost of any medical treatment that may be necessary, giving you peace of mind that your finances won’t be in jeopardy if an illness or accident left you with hefty medical bills. But how can you be sure that you’re getting the best health insurance plans for your needs?

There are several things you’ll need to consider, not least of which is the cost involved. While opting for affordable health insurance will always be important, you’ll want to strike the right balance between value and coverage, ensuring you’ve got the ideal plan to suit. However, there are some providers that specialize in offering affordable plans to certain demographics, such as seniors or low income families, with Humana or Aetna well worth considering in this regard.

Make sure that your focus on price doesn’t obstruct other considerations, such as the claims process and level of cover. A cheap health insurance plan could turn out to be more expensive in the long run if the cover is lacking or the claims process onerous. Keep in mind the service rating of your potential health insurance company too, together with its financial strength, not to mention its network of doctors and location, as where you live can play a part in the health insurance companies that are available to you.

Yet when it comes to choosing a health insurance policy (opens in new tab), the coverage is arguably the most important consideration of all. You’ll need to think about whether you want a full-service plan or something on the lighter end of the scale, which may depend on whether you’ve got separate vision insurance (opens in new tab) or dental insurance (opens in new tab) plans elsewhere. Or if you qualify for Medicare, make sure to read up on the best Medicare Part D plans (opens in new tab) as well.

While there are a lot of top-rated companies to choose from – Blue Cross Shield, Cigna and United Healthcare are just a few of the leading options currently available – each one will have different strengths that makes them perfect for certain individuals. This guide can help you narrow down the options depending on whether you want the best value, are looking for a short-term policy or have a number of other requirements, and we make sure to highlight the best health insurance company overall, too. And, if you want to streamline things even further, we’ve also linked to FirstQuoteHealth beside each provider so you can compare the best health insurance companies with ease.

Best Group Health Insurance Plans for Small Business - MPB Health

MPB.Health offers comprehensive group health plans, an affordable alternative to health insurance, through medical cost sharing and much more!

✔ No network restrictions, you choose the doctor and facility.✔ Medical Costs Incurred outside the U.S. are eligible for sharing.✔ No enrollment period restrictions, enroll anytime!✔ A fraction of the cost of traditional health insurance.

A tax-advantaged medical savings account that can be used to pay for medical expenses with before-tax dollar is available to taxpayers in the United States who are enrolled in MPB Secure

Members may access our primary, pediatric, women’s health, and behavioral health board-certified physicians on their own time. Through a convenient web and mobile experience, members are free to text directly with our providers to get the answers they need, including access to additional support. This solution will be accessible via secure text (with image share, phone, and video available) 24/7 and 365 days per year in all 50 states.

If you or your family are experiencing a difficult time in areas of stress, anxiety, depression, family-related issues, substance abuse, or any other problems we are here to help you through it.

The concierge team at MPB Health is here to help you make the most out of your membership. Traditional healthcare can be difficult to understand, at MPB Health it doesn’t have to be! We’re here to help you navigate all your benefits. We’ll work with you to ensure that you have the support you need and that you’re getting the most out of your healthcare plan.

Videos of Best Group Health Insurance

Compare Health Insurance Plans and Choose The Best Medical Plan for Your Family in 2023

12:24 - 3 years ago

#healthcare #healthinsurance #coveredca #medical please subscribe to our channel for more videos!

The Real TRUTH About An HSA - Health Savings Account Insane Benefits

20:42 - 3 years ago

Welcome to the guide on how an HSA can change your financial life forever. In this video, we're going to go over everything you ...

Health Insurance Shopper's Guide: The 5 Types of Plans

10:15 - 3 years ago

For 7 years, I was a very successful health insurance agent. I've retired from the insurance business and become a tech ...

My Business Is Struggling. Is Group Health Insurance for My Employees Worth It?

4:52 - 3 years ago

Keeping employees happy isn't easy at the moment. Between the COVID-19 pandemic's ongoing danger, public health ...

You may also like

-

She survived a Hollywood monster—only to die a hero. The cop raped by producer David Pearce was killed saving crash victims days before he got life in prison.

-

Tragically, a father-to-be was killed by a single punch in an Arizona bar brawl, just weeks away from welcoming his baby, authorities report.

-

Johnson & Johnson is under fire again: New cancer lawsuits tied to its famous baby powder have jumped 17% after the company’s latest attempt at a global settlement collapsed in court.

-

American International Group is making a bold move — the insurance giant has struck a definitive deal to acquire the renewal rights to Everest Group’s $2 billion retail commercial business.

-

The son of legendary mobster 'Quack Quack' won’t be walking free — a judge denied his bail in the explosive NBA gambling scandal, fearing he’d fall right back into witness-tampering.

-

A shocking new report claims that dozens of President Joe Biden’s executive actions ‘cannot all be deemed his own.’ According to insiders, his closest aides went to extraordinary lengths to prop up the 46th president as he faced serious physical and cognitive challenges in office.

-

Barack Obama wasn’t exactly thrilled when Nancy Pelosi rushed to back Kamala Harris — and he didn’t keep his feelings to himself. According to a new book, the former president picked up the phone and let the former House speaker know just how unhappy he was.

-

Remember Zohran Mamdani’s 'aunt' who was too afraid to wear her hijab on the subway after 9/11? Turns out, she’s actually his dad’s cousin.

-

Authorities say a college financial aid advisor allegedly strangled his girlfriend and then set fire to their upstate New York home, trapping her and their newborn baby inside.

-

President Trump said Monday he has no plans to join Vice President JD Vance on a ticket to sidestep the Constitution’s two-term limit — but hinted he’s far from done with politics, teasing a possible 2028 showdown with Rep. Alexandria Ocasio-Cortez.

:max_bytes(150000):strip_icc()/best-health-insurance-companies-4174511-Final-1f8530aaf0594ee79c9d545ed66627d0.png)