The US insurance storm continues

Mayhem persists among the US’s property and casualty insurers.

Auto-insurance businesses are still losing money. And a run of unusually destructive bad weather has brought additional losses for their property-insurance businesses.

Allstate reported a 2Q loss of $4.42 per diluted share earlier this week, with its stock down around 3 per cent since last Friday. (The stock is off nearly 20 per cent year to date.) Progressive’s stock has fared better after it eked out 57c of 2Q per-share profit, but that was because it cut spending on advertising; it still lost money on its underwriting businesses.

As we’ve covered previously, the US’s auto insurance rates have soared 24 per cent over the past two years (v BLS data). Yet the insurers are still losing money on their auto businesses, going by Progressive and Allstate’s latest quarterly reports. It seems to have been caused by the same drivers we’ve been covering and recently discussed with our pals at Unhedged: Repair costs, litigation and accident severity.

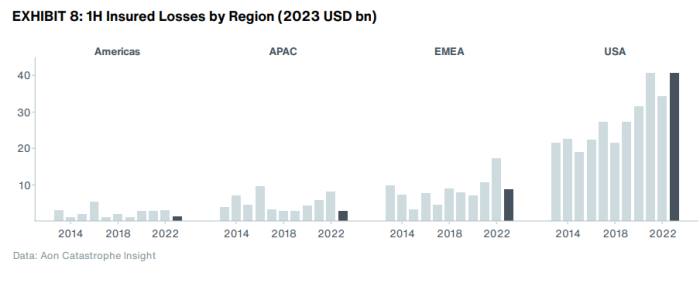

What’s new is that weather is dealing a bigger blow to insurers’ profits. Severe thunderstorms and tornadoes caused lots of damage and multiple deaths this spring; the US had $40bn of insured catastrophe losses in the first half of this year, the third-highest on record after 2011 and 2021, according to Aon, an Illinois consulting firm and reinsurance broker:

The main takeaway so far is that Allstate could be at risk for downgrades from ratings firms, say CreditSights analysts, who called it a “brutal” quarter for the insurer:

With ongoing quarterly losses pushing leverage higher [and] regulatory capital/ratios lower, we’re looking at [an] increasingly financially constrained insurer at least in the near term . . .

At some point, implemented premium rate increases in the personal auto business will be more fully reflected in earned premiums and loss cost trends will eventually stabilize, but for the time being the operating environment remains highly unfavorable . . .

If we were going to hunt for bright spots, we’d point to a homeowners’ underlying combined ratio that still looks strong (but what good is that if weather events continue contributing to enormous CAT losses[?]) and higher net investment income given the positive impact of rising interest rates on fixed maturity investment yields.

Fitch downgraded Allstate’s holding-company credit to BBB+ from A- earlier this year, citing “sharp underwriting result deterioration”.

Ratings have a significant effect on interest rates for borrowers who don’t print their own currency / run the world / etc, so additional downgrades from S&P Global or Moody’s would presumably matter a bit more than a US credit-rating downgrade.

This story originally appeared on: Financial Times - Author:Alexandra Scaggs