How a Swedish start-up reignited the search for an Alzheimer’s drug But then a new treatment showed promise

Gunilla Osswald speaks quietly as she describes her last act at AstraZeneca. After 28 years of trying to create treatments for patients with brain disorders, in 2012 she was handed the “sad” task of closing a large Swedish research and development site and making 1,300 people redundant.

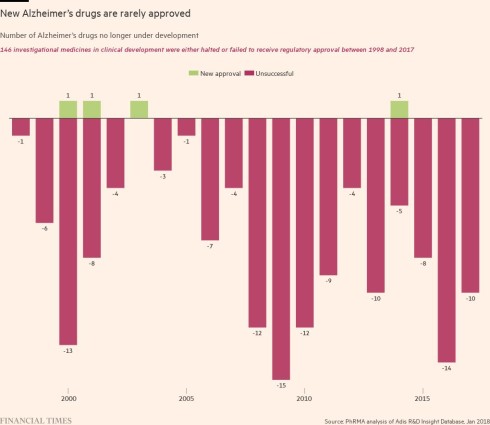

A decade ago, the Anglo-Swedish drugmaker was cutting its investment in neuroscience. It was not the only one. GSK, Pfizer and Bristol Myers Squibb were among other big pharmaceutical companies that stopped trying to find treatments for some of humanity’s most inscrutable diseases. At the time, Alzheimer’s research was considered a costly, hopeless cause and investors preferred companies to chase larger rewards in areas such as cancer.

Peering over a conference table in Stockholm, Osswald admits neuroscience is risky for drugmakers. “It’s a difficult area. But the benefit can be so huge when you have something which is successful,” she says.

After AstraZeneca closed its site, Osswald did not give up. Instead, she became the leader of a start-up of just 20 people devoted to tackling Alzheimer’s, called BioArctic, and brought in others from AstraZeneca. Their aim was to create a drug that would become the first to significantly slow the progression of the disease.

On that front, they have made progress. This week, the Food and Drug Administration, the US regulator, will decide whether to fully approve BioArctic’s first commercially available drug candidate, lecanemab, created with the Japanese drugmaker Eisai and US biotech Biogen.

The FDA already granted emergency approval in January, based on data that showed lecanemab slowed the rate of cognitive decline in early-stage Alzheimer’s patients by 27 per cent, a moderate but statistically significant result. Full approval should vastly increase the number of patients able to access the drug in the months ahead; it is the first time people with Alzheimer’s will be able to take something to slow the progression of their disease.

“It is really a big step forward,” says Osswald, explaining that before this, drugs could only alleviate some symptoms, not tackle the causes of the condition.

Not everyone agrees. Some researchers and clinicians are concerned that the reduction in the rate of cognitive decline seen during the late-stage drug trial is not “clinically meaningful” because many patients would not feel much of an impact.

They worry that the benefits do not outweigh the risks: the trial showed the drug can cause swelling and bleeding in the brain. Patients will have to be carefully monitored when they first take the drug, which is administered intravenously. Since the trial of 1,795 ended, at least three Alzheimer’s patients have died from brain bleeds after taking lecanemab, including two people who were also taking blood-thinning medicines. Eisai said the drug could not be directly linked to the deaths.

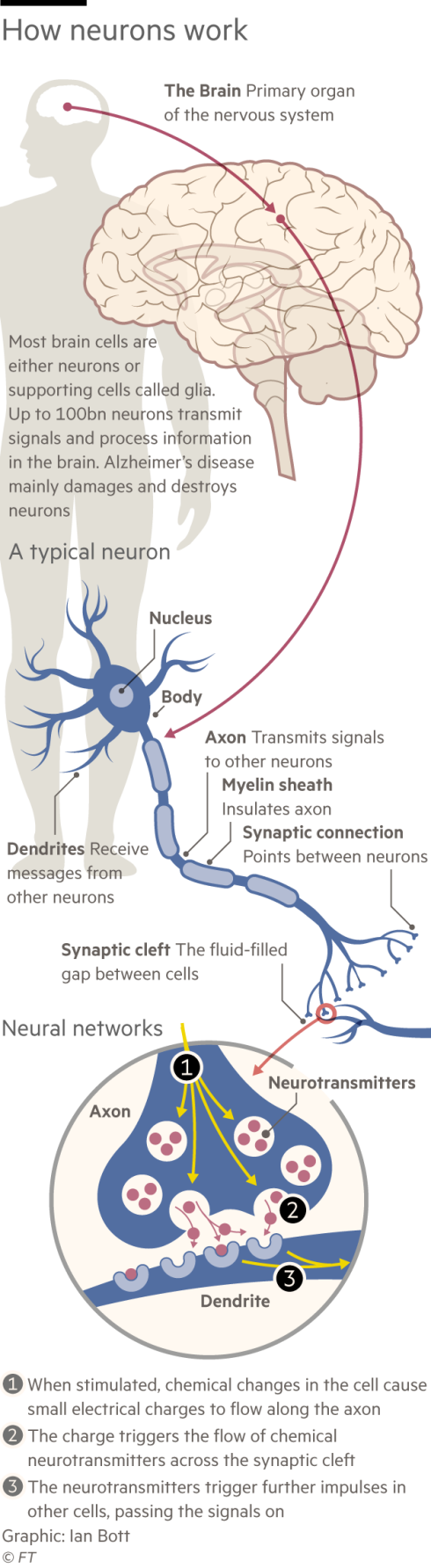

About 55mn people worldwide have dementia, of which up to 70 per cent suffer from Alzheimer’s — a disease that erases memories and the ability to communicate and live independently. In the UK, the Alzheimer’s Association estimates it already costs the government £25bn a year. The disease is distressing for patients and their families, and expensive for overstretched health systems in countries with ageing populations.

Osswald weighs her words carefully, wary of overpromising to desperate patients. “It’s not a cure. But it hopefully can help them to get a longer time when they are fairly healthy,” she says.

Lecanemab is not the only new Alzheimer’s drug with potential. BioArctic’s results last autumn were rapidly followed by those from another promising trial for a drug, donanemab, from Eli Lilly.

If they are both approved, the drugs may eventually save on healthcare costs by keeping people healthier for longer. But they will create huge upfront bills. Lecanemab will have an official US price of $26,500 a year, though insurers will negotiate rebates that make it cheaper. Medicare, the US government-backed insurance for seniors, has pledged to pay for it if approved. In Europe, the regulator is expected to make a decision in the first quarter of next year.

Lecanemab has given hope to large pharmaceutical companies, such as Bristol Myers Squibb and GSK, which are piling back into neuroscience, partnering with start-ups, or looking to see if they can revive failed drug candidates.

There are now more clinical trials for Alzheimer’s drugs than ever before, with drugmakers increasing the number they sponsor by almost 8 per cent in the past year, according to research from the University of Nevada. AstraZeneca says it still has a small neuroscience group with a number of products in trials, including one for Alzheimer’s in an early study.

After a transformation in oncology treatments over the past decade — mortality rates are falling across many types of cancer — scientists are speculating that Alzheimer’s could also be tackled with medicines targeted to sub groups of patients.

While it is far from a perfect drug, lecanemab is the culmination of decades of research and many failed candidates — a prolonged and frustrating process of trial and error that is beginning to bear fruit. John Hardy, a professor of neurology at University College London, says academics and companies finally understand what a potential drug has to do to tackle the disease. “We’re not operating in the dark anymore,” he says.

The ‘Arctic mutation’

BioArctic’s co-founder, a doctor-turned-scientist called Lars Lannfelt, travelled to the end of the earth to find the clue that led to his drug breakthrough.

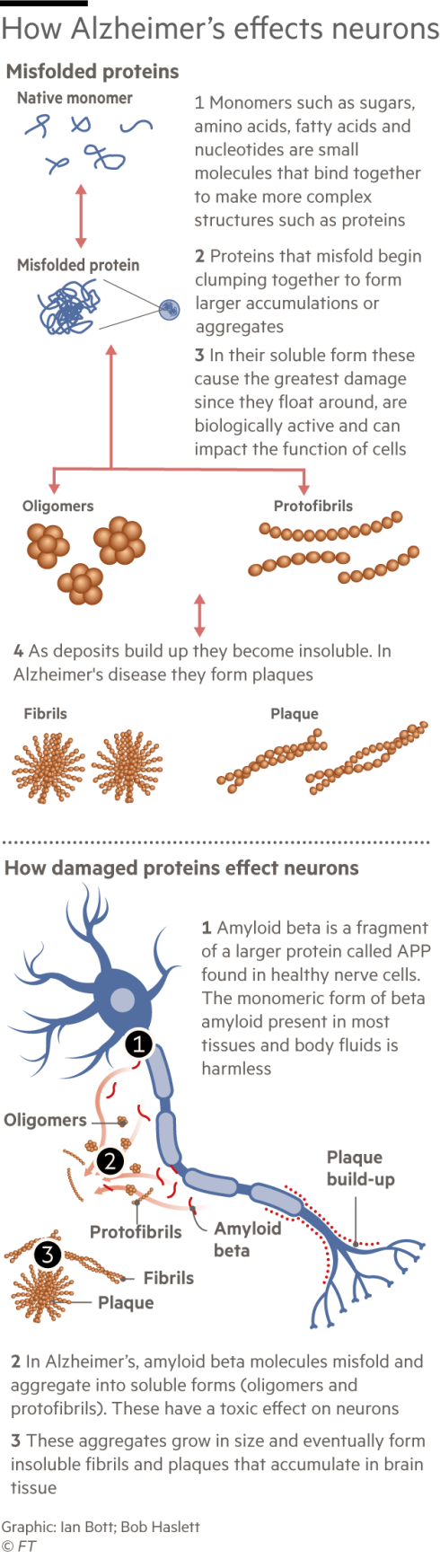

In the 1990s Lannfelt made a name for himself in dementia research when he discovered in Alzheimer’s patients a mutation in the gene that produces a protein called amyloid beta. A build-up of amyloid in the form of sticky plaques in the brain is generally considered to be the cause of Alzheimer’s. (Not all researchers agree with the “amyloid hypothesis”. Numerous therapies aimed at reducing plaques in patients’ brains have failed in trials, sowing doubts and entrenching division.)

Lannfelt made his discovery — christened “the Swedish mutation” — after long and slippery drives to faraway communities in his Volvo, which, he laments, lacked power steering.

In his search for a drug to treat the disease, he went even further, flying to Umeå in Northern Sweden and driving a rental car to a remote community of people who, due to their own genetic mutation, were suffering disproportionately from Alzheimer’s. They experienced “exaggerated forms of the disease” — developing symptoms at a younger age than average and experience a faster decline. It was therefore easier to witness what was happening in the brain using blood tests and scans.

“My idea was, if we don’t understand the mutation cases, we will never understand the more common forms. You start off with what is simple,” Lannfelt says.

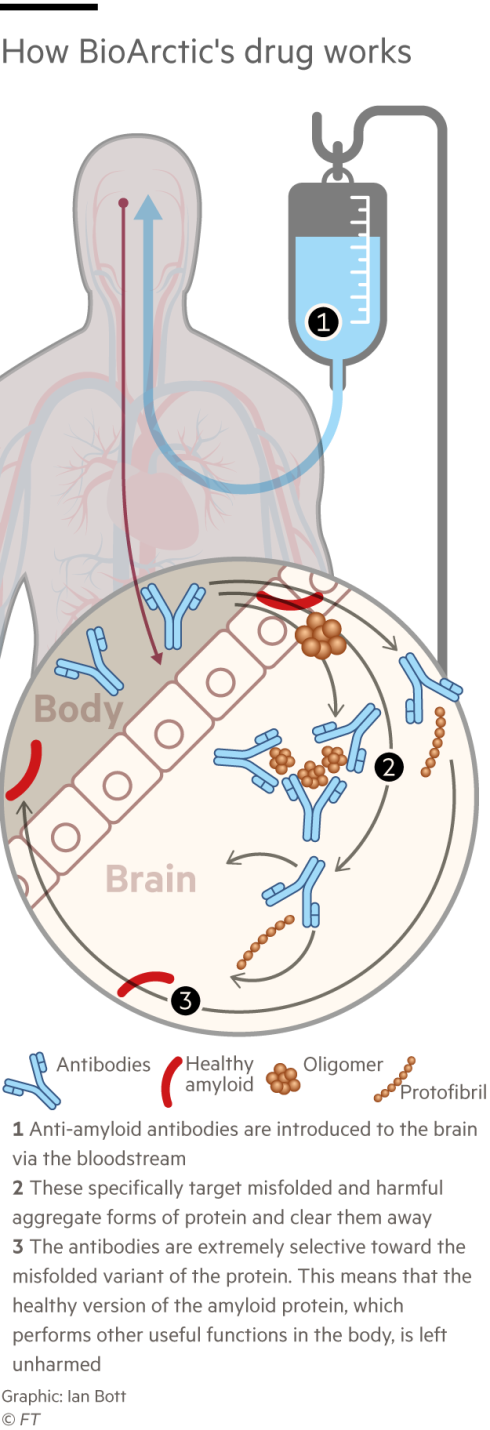

Lannfelt discovered that patients in the Arctic community had the symptoms of Alzheimer’s but they didn’t have the sticky plaques in their brains. Rather, they had a build-up of amyloid beta in a soluble form called protofibrils. Lannfelt came to believe that it was the protofibrils that initially cause the disease. Unlike the plaques, soluble protofibrils can move around the brain, gumming up neurons and eventually causing the cells to die.

Protofibrils, he thought, would also be a safer target for a drug. Amyloid beta exists in many forms in the body. Protofibrils are only in the brain. Drugs designed to target amyloid beta generally could therefore latch on in unintended places, causing severe side effects.

In 2003, Lannfelt and his BioArctic colleagues first approached Eisai, a much bigger company with experience in clinical trials with Alzheimer’s patients. Unlike many pharmaceutical companies at the time, Eisai was similarly determined to find a drug for the disease. Haruo Naito, chief executive, was leading the company’s discovery lab when Eisai developed its first therapy for symptoms of Alzheimer’s, and he stayed in contact with patients and their families. Alexander Scott, executive vice-president of integrity, says Naito understood the “tremendous unmet need” for patients.

In 2007, the Japanese drugmaker took the license for lecanemab and in 2014 Eisai signed up Biogen to jointly develop and commercialise the drug.

Lannfelt, now 74, has been studying Alzheimer’s since 1992. He was convinced BioArctic’s new approach would work, yet it worked better than he expected. In the study, the patients taking the drug declined 27 per cent more slowly than those who received a placebo, as measured on a cognitive and functional scale. Study participants, considered early-stage, had probably had the amyloid building up in their brains for 20 to 25 years. But scans showed a significant removal in just 18 months.

“I was surprised the effect was so strong,” Lannfelt says.

Investors were also surprised. BioArctic’s stock shot up more than 240 per cent on the day the initial results were published. When approved, analysts at Swedish bank Carnegie forecast sales will peak at $13bn in 2035, giving BioArctic a $1.1bn royalty that year. In total, it stands to receive billions, much of which it plans to invest in the hunt for more effective drugs.

This is a marked difference from the last Alzheimer’s drug heralded as a breakthrough. Medicare refused to pay for Biogen and Eisai’s aduhelm, after a controversial US accelerated approval in 2021. Aduhelm did not work as well, and scientists debated the validity of its trials, after one failed. It was initially priced far higher, at $56,000 a year, though it was later cut to $26,500.

Now there are two drugs with more solid prospects. An exception to Big Pharma’s initial exodus from neuroscience was Indianapolis-based Eli Lilly, which persisted despite having other Alzheimer’s drugs fail. Ron DeMattos, senior vice-president and chief scientific officer of neurobiologics at Lilly, says the decision to pursue an amyloid-reducing drug was a “leap of faith”.

Unlike BioArctic, Lilly targeted the solid form of amyloid beta, the plaques. Its molecule proved successful: donanemab slowed the progression of the disease by 35 per cent in 1,182 patients — a narrower group than in the lecanemab trials. The trial also showed side effects of brain swelling and bleeding. But its full trial results have not yet been published.

“I believe the field can now move past all this back and forth, amyloid hypothesis, or not amyloid hypothesis,” DeMattos says. “The real question is how do we drive further benefit for patients? How do we continue on this line of success to improve those margins that make patients better over time.”

Hardy, the neurology professor at UCL, says the real problem with the previous drugs targeting beta amyloid was that they didn’t remove enough of it. “To me, the two [new] drugs look pretty similar, they both remove amyloid, and they both have similar clinical effects,” he says.

But at the same institution, Rob Howard, a professor of old age psychiatry, disagrees. He accepts amyloid beta is connected with Alzheimer’s, but doubts if it drives its progression. He believes there was poor correlation between how much amyloid was cleared and how much clinical benefit there was in patients in the lecanemab trial.

A new golden era?

Since the successful trial results of lecanemab and donanemab, there has been a real uptick in interest from Big Pharma looking to acquire neuroscience biotechs, says Philip Scheltens, who leads the €260mn LSP Dementia Fund. “We are now in an interesting position because Big Pharma suddenly gains interest again, but doesn’t have a pipeline,” he says.

Dementia is still far less understood than cancer, despite having a similar number of patients, partly because it receives less funding, Scheltens says. Some 4.8mn papers about cancer have been published on the online database PubMed, compared to 264,000 on dementia.

Aware that global Big Pharma is now paying attention to the tiny company in Stockholm, Osswald is tight-lipped about what else BioArctic is working on for Alzheimer’s. But the company is inspired by a transformation in oncology. Anders Martin-Löf, chief financial officer, says oncology was the “big thing” of the past 10 years, with more targeted drugs, often combined for better impact.

“We’re at the starting point now in neuro. And I think we’re looking for a golden era that is about to start,” he says.

Even if amyloid build-up is the first sign of Alzheimer’s, there are other targets to tackle, like the tangles of proteins called tau that accumulate in patients’ brains. Eisai is already testing lecanemab combined with a drug to target tau.

As tests become more accurate and we understand more about what is happening inside individuals, drugs may become targeted to specific groups, like in cancer where many tumours are sequenced to discover which mutations are driving them, and then specific drugs are prescribed. Some believe Alzheimer’s may not even end up being a single disease.

BioArctic is also looking at ways to target beta amyloid more effectively. Its moonshot project is a “brain transporter” designed to get more drug into the brain. At the moment, only about 1 per cent of a drug can cross the strict blood-brain barrier, so patients must receive large doses and risk side effects. By hijacking the system that delivers iron into the brain, it hopes that it can access the 600km of blood vessels inside the organ.

Zoe Karamanoli, an analyst at RBC Capital Markets, who covers BioArctic, says brain transporter has “huge potential” — but is still really risky at this stage. She says BioArctic’s cash windfall from the lecanemab royalties will help the company — but it is not enough to guarantee a second success. “Definitely having something that has worked and is approved in such a difficult field helps them. But don’t get carried away and assume everything will work,” she warns.

Lecanemab is already in phase 3 trials for a population with less amyloid in their brains and who do not yet have symptoms.

Other companies are also looking to go earlier. Last week AC Immune received an FDA breakthrough designation — a fast track through the regulatory process — for an “Alzheimer’s vaccine”, which it hopes will stimulate the immune system to tackle the build-up of proteins itself.

In a fortunate coincidence, in 2020 Swedish scientists created a blood test that can detect the early stages of build-ups in the brain, before anyone would seek treatment. The test can detect the disease five to 10 years before patients show a clear impairment.

Some experts believe the current drugs have too serious side effects to treat asymptomatic people, though others hope that with less amyloid stuck to blood vessels, there could be fewer side effects.

Eisai’s Scott, whose own parents died from Alzheimer’s, compared taking drugs to prevent the disease to the “pretty radical procedures” that some are prepared to undertake to reduce the risk of cancer. “People will get double mastectomies, if they have a family history, as Angelina Jolie showed us,” he says.

If lecanemab is used preventively, BioArctic could make billions more. Osswald has ambitions to grow BioArctic into a standalone pharma company, which conducts large trials and sells its own drugs globally.

But she does not want it to be the next AstraZeneca which, she found, could get bogged down in bureaucracy. BioArctic has just 85 staff in an office and labs spread over a couple of floors in Stockholm.

Nor is she wary of competition as other Big Pharma companies rejoin the race for better treatments for Alzheimer’s. “We’re not afraid of competition. I think that is helpful for patients,” she says. “The market is enormous.”

Graphic illustration by Ian Bott and Bob Haslett

This story originally appeared on: Financial Times - Author:Jamie Smyth